Spain’s CNMV annual report highlights difficulties in resolving cross-border disputes

There are still no Cypriot members of FIN-NET, the network set to help solve cross-border disputes in the financial services sector.

The Spanish National Securities Market Commission (CNMV) has earlier today published its Annual Report on Investors’ Complaints and Enquiries for 2017, with the document highlighting the difficulties the regulator has experienced when addressing cross-border complaints.

Let’s note that there is a European network aimed at assisting in such cases – FIN-NET. FIN-NET is a network of national organisations responsible for settling consumers’ complaints in the area of financial services out of court.

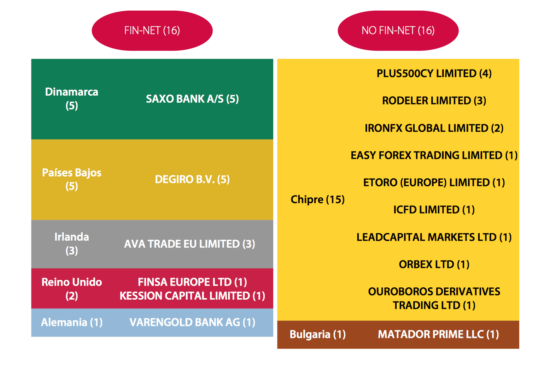

However, in 2017, CNMV received a number of complaints about companies located in countries where there are still no FIN-NET members. A notable example is Cyprus.

Let’s note that CNMV received 16 complaints about entities that were outside of the FIN-NET network and, hence, the Spanish regulator had to explain to investors that their claims could not be properly handled.

On the brighter side, the volume of investor complaints fell last year. In 2017, investors filed 998 complaints with CNMV, 17.18% fewer than in the previous year.

The main reason for complaints was problems arising from the information provided on financial products both before (20.3%) and after (21.7% of the total) they were purchased. The entities that received the greatest number of complaints were banks, with 84.9% of the total. Complaints related to investment firms accounted for 2% of the total.

With respect to the final result of the processing of complaints, 83.7% were closed with a final reasoned report. Of these, 54.2% were favourable for the complainant, while the remaining 45.8% were unfavourable. It should be noted that the percentage of cases in which the favourable report means that the entities accepted CNMV’s criteria or rectified their actions continued to increase.

In 2017, investors submitted 11,199 enquiries to CNMV in relation to the securities markets and how they function, which represents a 28.32% increase on the previous year.