Special Administrators of LQD Markets (UK) request bar date for client claims

The Special Administrators indicate clients of the now-defunct brokerage will get 12 cents in a dollar.

RSM Restructuring Advisory LLP – the Special Administrators appointed at LQD Markets (UK) Ltd, a retail FX broker that went insolvent soon after the January 15, 2015 events, have just published their Seventh Progress Report.

The document is set to be detailing the work carried out by the administrators during the period from February 2, 2018 to August 1, 2018. Unfortunately, the version provided by the Administrators is apparently lacking at least one page (or even two). So, the whole section explaining the purpose of the report, as well as the beginning of the section about the actual progress being made are missing. Hence, there is no information on client claims and money at the moment of the publication of this article.

From what is available, one can see that the Special Administrators have instructed lawyers to commence with the application to Court to request a bar date is set for clients to submit claims and to commence the distribution process. The draft order and supporting witness statement is being reviewed by the Special Administrators. They expect the application will be made within the next four weeks.

During the reporting period the Joint Special Administrators have been reviewing and where appropriate agreeing clients’ claims, answering client queries and liaising with the Financial Services Compensation Scheme regarding the prospect of compensation for the clients. As previously advised, in August 2015 the FSCS confirmed that the investment products offered by the Company are covered by the Compensation Scheme.

Some clients’ claims have been rejected due to the fact that their claims are different from that stated in the Company records. The Joint Special Administrators have informed these clients and have advised them that, in line with legal advice obtained, each client’s client money entitlement is equal to the client’s account balance on January 28, 2015, and in order for claims to be agreed it needs to be supported by an up to date MT4 generated statement.

The FSCS have indicated that they will distribute funds in US$, but the Joint Special Administrators have not decided what currency they will distribute in as they are not yet in a position to make a distribution.

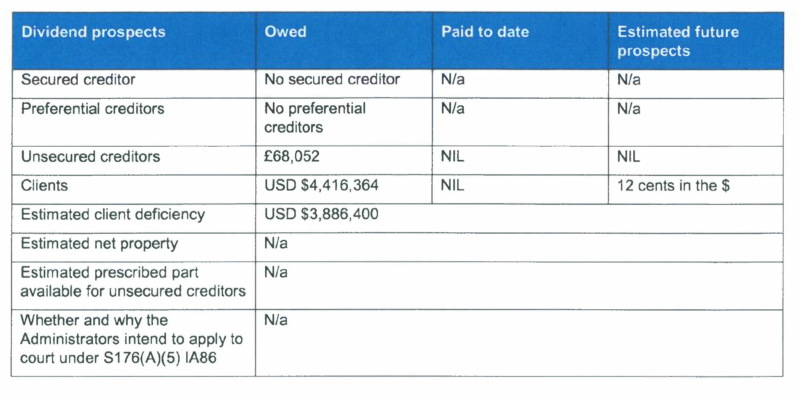

Let’s note that the client money deficit that emerged when the administrators started investigating LQD Markets (UK) books has hampered the distribution process. As per the Seventh Progress Report, this deficit amounts to approximately $3.9 million. According to the Sixth Report, the deficit was about $2.9 million.

There is not much left to distribute to clients of the now-defunct brokerage. The data (which is only indicative) in the Report points to estimated future prospects of 12 cents in the dollar ($) regarding client distributions.