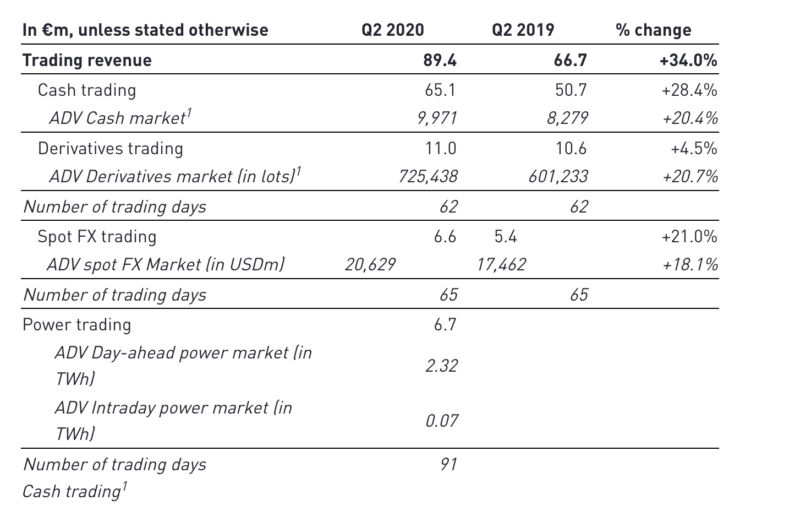

Spot FX trading generates revenues of €6.6m for Euronext in Q2 2020

This marks a rise of 21% from the revenues of €5.4 million generated by Euronext’s spot FX trading business in Q2 2019.

Euronext NV (EPA:ENX) today published its financial report for the second quarter of 2020, with revenues marking a strong rise from a year earlier.

Spot FX trading activity on the Euronext FX spot foreign exchange market recorded average daily volumes of $20.6 billion in the second quarter of 2020, up 18.1% compared to $17.5 billion in the same period in 2019, supported by a volatile environment through the quarter.

As a result, spot FX trading generated €6.6 million of revenue in the second quarter f 2020, up 21.0% compared to €5.4 million in the equivalent period in 2019. On a like-for-like and on a constant rate basis, spot FX trading revenue was up 18.5% compared to the second quarter of 2019.

Across all segments, revenue was €210.7 million, up 32.5% from a year earlier. Trading revenue increased to €89.4 million, marking a rise of 34.0% from the second quarter of 2019, with growth across all asset classes and €6.7 million contributed by Nord Pool power trading.

Recently launched single stock futures saw strong commercial traction and diluted derivatives overall trading yield.

Post-trade revenue increased to €36.1 million, up 64.5% from a year earlier, on the back of the consolidation of revenue from VPS, the Norwegian CSD, and higher clearing revenue.

Listing revenue increased to €36.1 million (+21.3%), driven by the consolidation of Oslo Børs VPS and the solid performance of Corporate Services at €7.9 million (+33.8% like-for-like).

Advanced data services revenue increased to €35.8 million (+16.0%), as a result of the consolidation of Oslo Børs VPS and Nord Pool, and the good performance of the core business.

EBITDA fo the second quarter of 2020 amounted to €125.4 million, up 27.8% from the equivalent period in 2019, with EBITDA margin at 59.5% (-2.2pts).

Euronext confirms its 2020 guidance for costs, excluding D&A, of mid-single digit growth in 2020, compared to the H2 2019 annualised cost base, to reflect expected costs in H2 2020 related to the integration of Oslo Børs VPS and implementation of the strategic plan projects.

Reported net income, share of the Group, amounted to €82.1 million in the second quarter of 2020, up 53.7% from a year earlier. Adjusted EPS were €1.23 (+33.1%).