Spotlight on Hargreaves Lansdown: We investigate the £6.9 billion firm that is attracting London’s finest FX industry talent

The retail FX industry that we know today has grown and evolved into such a sophisticated, global, all-encompassing, leading edge network of fintech innovators developing the next generation of trading systems, multi-billion dollar electronic brokerages, and knowledgeable traders with algorithmic methods that emulate the prop desks of Chicago and New York. Indeed, so global and […]

The retail FX industry that we know today has grown and evolved into such a sophisticated, global, all-encompassing, leading edge network of fintech innovators developing the next generation of trading systems, multi-billion dollar electronic brokerages, and knowledgeable traders with algorithmic methods that emulate the prop desks of Chicago and New York.

Indeed, so global and vast is our industry, that it is equally intertwined – therefore we all know each other, don’t we? …. Or do we?

Despite the level of sophistication and, in many cases, systems and practices that are paving the way for the entire financial services industry, the major firms in the FX business are still very much concentrated in certain areas, those being London for the interbank and institutional sector, Cyprus, Australia and Japan for the retail sector, and then there are the burgeoning IB networks of China.

But what about Bristol, an affluent city in the West of England?

Bristol is home to one of the largest companies in the retail financial services sector, Hargreaves Lansdown PLC (LON:HL). So large and prominent is Hargreaves Lansdown that it is attracting senior figures from London’s most well renowned companies, as exemplified by last week’s announcement that IG Group CFO Christopher Hill who left the London-based CFD and spread betting company recently in order to become CFO at Hargreaves Lansdown.

In order to investigate the raison d’etre of the company further, FinanceFeeds met with Hargreaves Lansdown’s Head of Communications at the company’s headquarters in Bristol yesterday.

Mr. Cox explained that the firm is an FTSE listed company which grew from small brokerage firm in the 1980s, into a large investment firm meeting needs of retail clients with small to large amounts, utilising market products.

£6.9 million market cap

The company’s market capitalization today is a substantial £6.9 billion, and it developed its own proprietary trading and execution system, under the name of Vantage.

Mr. Cox explained to FinanceFeeds reporter Richard McLeod that “In terms of the company’s method of providing products to retail customers, the majority of contracts are execution only which avoids the cost of financial advice, although advice is available from Hargreaves Lansdown should a customer require it. This direction is very cost effective, and is coupled with our in-house operating platform.”

What factors led a small, Bristol-based financial adviser on the path toward being a vast investment company?

Mr. Cox explained the company’s journey. “The decline of the investment bond market, which was usually from insurance companies, and is now down to a mere 10% volume since its heyday a few decades ago, helped the quick transition to modern day style of technological service provided by Hargreaves Lansdown.”

“The founders, Peter Hargreaves and Stephen Lansdown, sought to be the biggest and the best. Their combined talents and entrepreneurial skills led to a strong and trusted service with funds now at £54.7 billion from 760,000 clients.”

Proprietary trading technology

Hargeaves Lansdown’s self-developed Vantage service, in-house operation, offers customers a wide selection of option choices such as spread betting and CFDs, ISA’s, SIPPs as well as corporate and government bonds, ETF’s, Investment Trusts. The company considers its strong customer service and safety of client funds to be top priorities.

Trading in the instruments that the company provides are manageable via the Vantage system which holds different types of investments together in one place with one valuation and dealing service, and whilst CFDs and spread betting are very much part of the firm’s product range and are offered under the HL Markets brand, Hargreaves Lansdown has 14% of the UK’s market share in ISAs.

The company’s CEO is one of Bristol’s most successful commercial leaders. 43-year old Ian Gorham, whose salary is £500,000, superseded Mr. Hargreaves in 2010 and has maintained the company’s incredible financial strength.

Mr. Gorham is a family man who enjoys golf, however most certainly does not engage in some of the rapidly-depreciating lifestyle pursuits of some of his Square Mile-based peers, as despite his more than comfortable salary, he drives a Hyundai which fits in just anywhere and, in our opinion, makes a statement of responsibility.

Hargreaves Lansdown’s customer base is largely concentrated in Britain, and the company provides specific service level parameters with regard to its service. Mr. Cox explained that the company has a non-automated telephone menu, and a help desk at the company’s Bristol headquarters with response times in less than 10 seconds.

Bristol’s maritime prominence during the pre-industrial revolution merchant era led to the city being a longstanding insurance center, due to the need for marine reinsurance when the Bristol merchants used the city as an important port for global trade.

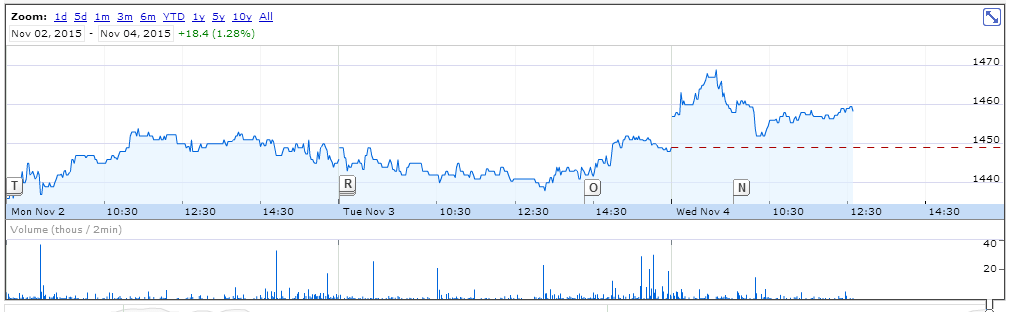

Today, electronic trading has taken over from the physical, and Bristol’s traditional insurance and retail banking origins are giving way to what is clearly more than a challenge for London’s largest, high tech investment houses, and Hargreaves Lansdown has risen to the top via that journey since its inauguration in 1981 by Yorkshire-born computer salesman Peter Hargreaves and Bristolian accountant and football enthusiast Stephen Lansdown, especially if the company’s rising share prices are an indication.

Photographs: Top Left; Hargreaves Lansdown’s plate glass headquarters in Bristol, England. Lower right; Hargreaves Lansdown develops its own proprietary trading system which handles multiple assets from one dealing platform.

Featured Image: FinanceFeeds reporter Richard McLeod meets Hargreaves Lansdown Head of Communications Danny Cox for a full informative tour of the company’s operations