Spotware announces release of cTrader Copy

The new copy trading service functions as a flexible investment program and a fully integrated feature of cTrader Web 3.0.

The launch of cTrader Copy has been expected since fintech expert Spotware announced the launch of cTrader 3.0 some six months ago. Today, Spotware said it had released its new copy trading service, cTrader Copy, which now functions as a flexible investment program and a fully integrated feature of cTrader Web 3.0. The new service will soon replace cMirror.

The new copying model is based on Equity-to-Equity Ratio. The latter means that the volume to be copied is defined according to the Strategy Provider’s and Investor’s Equity. The system automatically recalculates the volume of Investor’s positions to adjust it to equity to equity ratio, taking into account any allocated amount changes due to the deposits and withdrawals of both parties. This results in position sizes of the Strategy Provider and Investor being relative to the resources which each party has or has allocated to the strategy.

In addition, each followed strategy is placed automatically in Separate Copy Trading Accounts. This provides investors with a clear view of each strategy performance making it fit for analysis and risk management. Furthermore, this feature enables investors to apply Equity Stop Loss per strategy rather than for the entire account, keeping profitable copying running. The same logic now applies and for fees, which are calculated for each copy trading account independently, making it more precise and fare.

Spotware notes that for the purpose of keeping the same trading as Strategy Provider, the existing positions of a strategy will be copied once the Investor starts copying, and the functionality of allowing Investors to change copied positions will be removed.

The list of changes implemented in cTrader Copy also includes the Investor’s ability to increase and decrease funds allocated to a particular strategy. This can be done without stopping the copying of the Strategy. Investors can increase their equity to potentially get higher returns, as well reduce their stake in the strategy or withdraw profits while keeping the initial amount allocated. This offers Investors additional controls to easily manage their funds.

In addition to the Volume Based Commissions, which was the only payment option in cMirror, cTrader Copy introduces two new types of fees – Performance fees and Management fees. All three methods can be combined or selected individually.

- Volume Based Commissions are based on the volume that the investors have traded while copying the strategy and charged for opening and closing of each position.

- Performance Fee payment method allows Strategy Provider to take a percentage of the investors’ profit using a High Water Mark which ensures that the Investor doesn’t get charged twice for the same or lower performance.

- Management Fee represents an annual percentage of Investors’ Equity which is calculated daily and paid end of each month.

Another new feature of cTrader Copy is the Minimum Investment Amount that allows Strategy Providers to have a meaningful return by setting an entry level for the Investors who wish to follow their strategy. This also means that Investors will not be able to withdraw from their copy trading accounts if Equity drops below this limit while they are actively following a strategy.

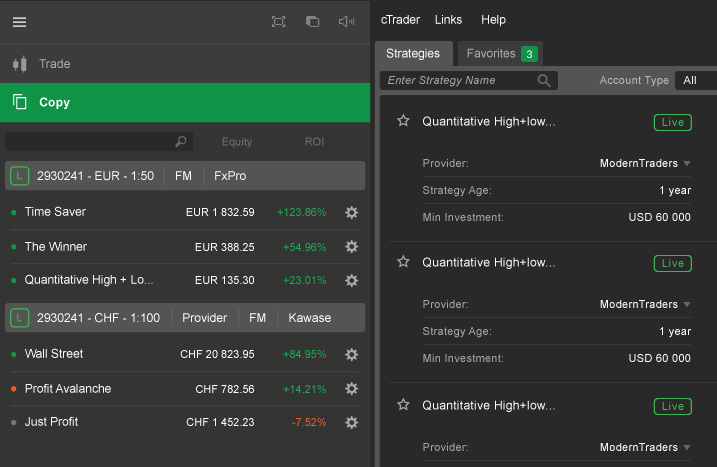

All the data is presented in a redesigned dashboard, which displays useful information previously hidden in the menu or tabs, extends its analytics and charts, and incorporates some useful functionality. From the dashboard, traders can see all their copy trading accounts with followed strategies, take fast actions and modify settings, and analyze the selected strategies, thus being equipped with the most advanced control panel for effective trading.

The Strategy Profile now features Advanced Analytics with more detailed statistics providing Investors with rich insights on the performance and behavior of each strategy. In addition to Time Weighted RoI, Balance vs. Equity and Breakdown of Traded Symbols charts, that are now all visible on a single page, traders can also see the History of Followers, a new chart that represents the growth of Investors over time.

Also, Investors can now bookmark Favorite Strategies to watch, monitor and come back to them later.

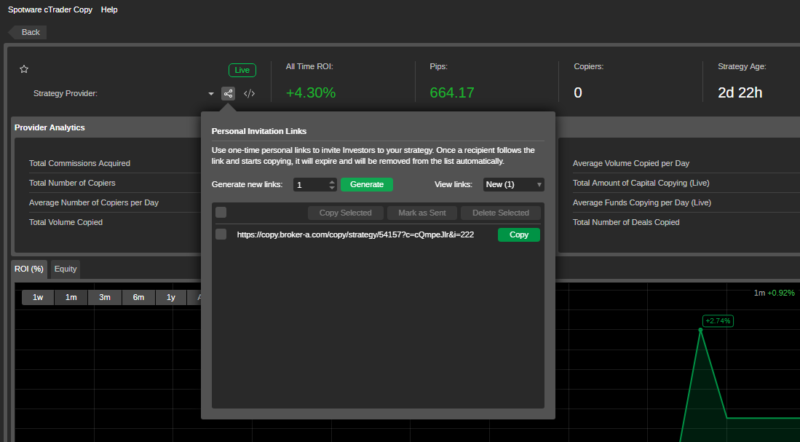

Finally, cTrader Copy offers more possibilities for Strategy Providers to promote their strategies by sharing their strategy profile with an embeddable code to external resources. The Embeddable Strategy Profile showcases the strategy in real time outside of the cTrader platform allowing Strategy Providers to attract new Investors.

Strategies can now be shared with the Investors in two ways – among all traders without any restrictions, or traders with invitation links only. In the last case, Strategy Providers can invite traders to follow the strategy via a direct private link. Such strategies cannot be searched and discovered from the Strategies list, they are hidden from anyone else except those who have unique invitation links.