Spotware releases cTrader Web 3.2 (beta), adding new Favourite Timeframes functionality

The latest version of the web platform also enables traders to get a full market picture with Standard DoM added to the ASP Order tab.

Fintech expert Spotware Systems has just announced the release of cTrader Web 3.2 (Beta) introducing a number of new features, ranging from new Favourite Timeframes with chart preferences to the addition of Standard DoM to the ASP Order tab.

Favourite Timeframes with chart preferences are now consolidated on the left side of the charts. Also, traders’ favorite periods for all tick- and time-based chart types have been made accessible directly from the chart title bar. This allows traders to tick the desired periods to add them to the Favourite Timeframes for quick access. Furthermore, traders can switch between them using the Up and Down keyboard arrows.

Favourite Timeframes with chart preferences are now consolidated on the left side of the charts. Also, traders’ favorite periods for all tick- and time-based chart types have been made accessible directly from the chart title bar. This allows traders to tick the desired periods to add them to the Favourite Timeframes for quick access. Furthermore, traders can switch between them using the Up and Down keyboard arrows.

To provide traders with a full market picture, the Standard DoM has been now added to the Active Symbol Panel’s Order tab. Users of the platform can also check it from the DoM tab of the ASP panel as before together with other types of DoM.

The symbol Finder has moved to a new tab next to Watchlists allowing traders to quickly switch between the two in the side menu.

The side menu can be collapsed vertically hiding less frequently used menu sections in the below submenu. It can also be resized to show in full longer symbols in one’s Watchlists or Finder. Traders can collapse it entirely by clicking the menu button.

The updated version of cTrader Web 3.2 also presents several updates to cTrader Copy which has recently become its native feature.

The updated version of cTrader Web 3.2 also presents several updates to cTrader Copy which has recently become its native feature.

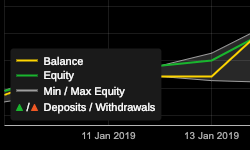

The Equity Chart in the strategy profile is now more comprehensive providing traders with information about deposit and withdrawal transactions. Finally, there is a new option “Show Positions To”, which allows strategy providers to choose who sees their open positions: everyone or only their copiers.