Standard Chartered Bank (HK) responds to client data leakage allegations

The bank insists that given the results of a comprehensive internal investigation, which was reviewed by Deloitte, the allegations of client data leakage are unfounded.

Standard Chartered Bank (Hong Kong) Limited has earlier today posted its official response to recent allegations about client data leakage. The bank insists that given a comprehensive internal investigation, which was subsequently reviewed by Deloitte Advisory (Hong Kong) Limited, it is safe to conclude that the allegations of client data leakage are unfounded.

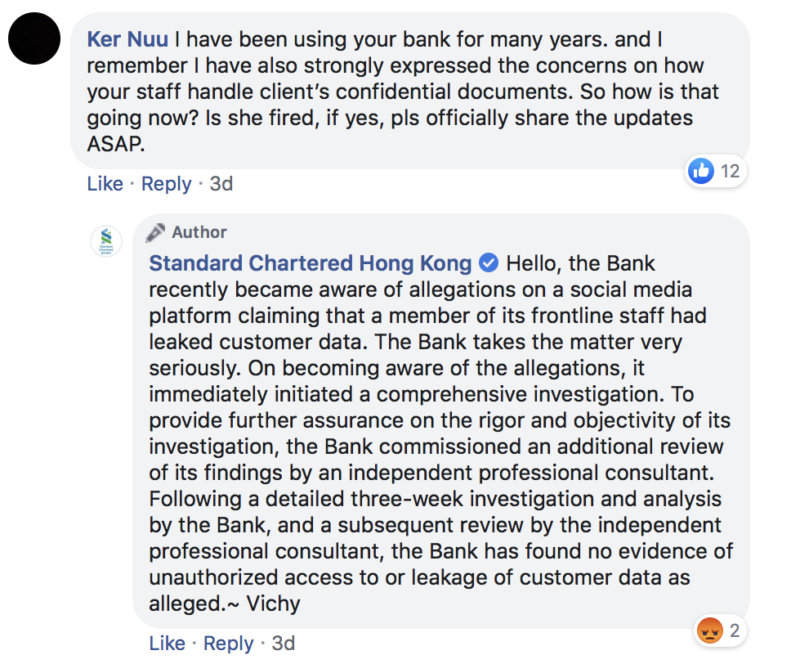

Standard Chartered also argues that recent comments made on social media about the investigation also lack a factual basis.

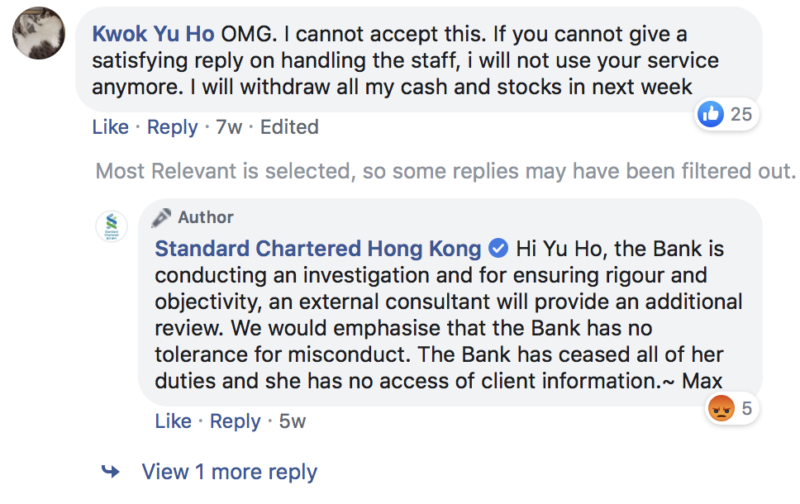

In October this year, the bank said on its Facebook page that it had terminated the contract of an employee alleged to have leaked customer data.

There have been numerous posts on social media over the alleged data leakage.

The internal investigation was conducted by an independent unit of the Bank. The investigation reviewed the Bank’s client data systems, communications (including emails), CCTV and other monitoring systems, and conducted interviews of staff. No evidence of leakage was found, Standard Chartered said today.

Given the potential seriousness of the matter, the Bank commissioned Deloitte to conduct a confidential and independent review. Through its review, Deloitte considered the methodology and conclusions of the Bank’s investigation unit. Deloitte leveraged its considerable forensic investigation experience, referenced its global investigation methodology and frameworks; and also referenced industry best investigative practices. Deloitte found the investigation undertaken and subsequent findings by the Bank to be reasonable and appropriate.

Standard Chartered says it is unable to disclose further details of the report as it contains personal data and information about the Bank’s internal systems that must be kept confidential to protect its clients.

The Bank notes that it has engaged with the Hong Kong Monetary Authority (HKMA) and other relevant authorities, and updated them on the results of its investigation.