Standard Chartered expects income to be lower in H2 2020

Profit fell 19% year-on-year in the second quarter of 2020.

Standard Chartered PLC (LON:STAN) today reported its financial results for the second quarter and first half of 2020, with credit impairment hitting earnings.

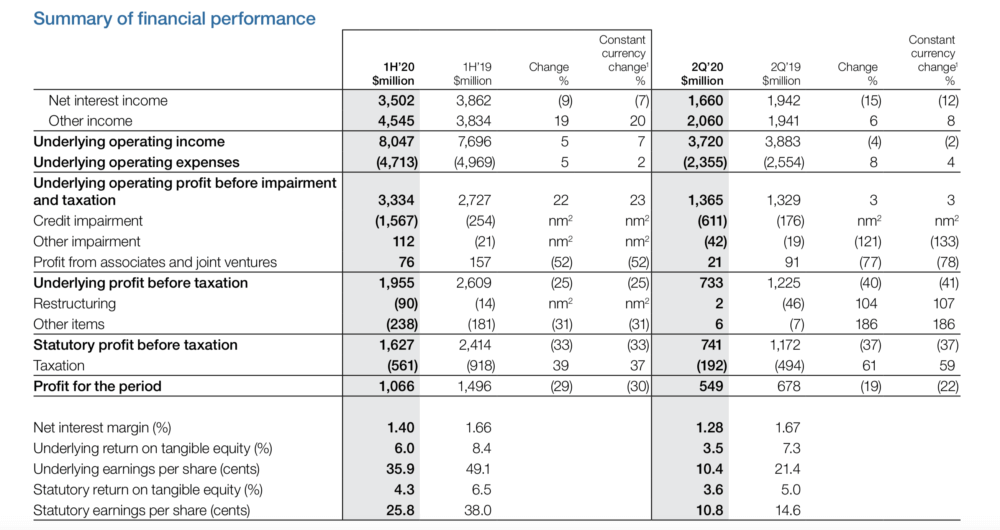

The company registered profits of $549 million in the second quarter of 2020, down 19% from the result of $678 million reported a year earlier.

Net interest income for the second quarter of 2020 was $1.660 billion, down 15% from $1.942 billion registered a year earlier. Other income was $2.060 billion, up 6% from the second quarter of 2019.

For the first half of 2020, the company reported income of $8 billion, up 5% from a year earlier. Net interest margin was down 26bps from 1H’19 to 1.40%.

Credit impairment was lower QoQ but up significantly YoY, driven primarily by the impact of COVID-19. Stage 1 and 2 impairment was up $586 million in the first half to $668 million. Stage 3 impairment was up $727 million in the first half to $899 million, with no significant new exposures in the second quarter of 2020.

In the first half of 2020, underlying profit before tax was down 25% to $2 billion due to higher credit impairment. Statutory profit before tax was down 33% to $1.6 billion, including $249 million goodwill impairment in India in the first quarter of 2020.

Earnings per share for the first half of 2020 were down 13.2c or 27% to 35.9c.

Let’s recall that Standard Chartered announced on March 31, 2020 that in response to a request from the Prudential Regulation Authority and as a consequence of the unprecedented challenges facing the world due to the COVID-19 pandemic, its board had decided after careful consideration to withdraw the recommendation to pay a final dividend for 2019 of 20 cents per ordinary share and to suspend the buy-back programme announced on 28 February 2020. Furthermore, no interim dividend on ordinary shares will be accrued, recommended or paid in 2020.

The Group had purchased 40 million ordinary shares for $242 million through the buy-back programme announced on 28 February 2020. These shares were subsequently cancelled reducing total issued share capital by 1.3%.

The Group’s minimum Common Equity Tier 1 (CET1) requirement has reduced from 10.2% to 10.0% reflecting the reductions in counter-cyclical buffer rates in the UK and Hong Kong.

The Group’s CET1 ratio of 14.3% was 50 basis points higher than as at 31 December 2019, over four percentage points above the Group’s latest regulatory minimum of 10.0% and above the top of the 13-14% medium-term target range.

In terms of outlook, the company continues to believe that some of its larger markets will start to drive the global economy out of recession over the coming quarters but expect economic activity across its footprint in that period to be volatile and uneven.

“Income is likely to be lower both half-on-half and year-on-year in the second half of 2020. The benefits of the early stage recovery in some of our markets and our geographic and product diversity are unlikely to be enough to offset the impact of low interest rates and the probability of less buoyant conditions for our Financial Markets business”, Standard Chartered forecasts.

Given the extreme economic pressures relating to the persistence of COVID-19, partially addressed through the efficacy of government support measures, it is not possible to reliably predict the quantum or timing of future impairments, the company says.

“However, if economic conditions in our markets do not materially deteriorate in the coming months then, given the substantial provisions we have taken already, we anticipate that impairments in the second half will be lower than those recorded in the first half”, Standard Chartered concludes.