Standard Chartered HK set to reopen more branches

Five of the branches closed due to Covid-19 will reopen on March 16, 2020.

Standard Chartered Bank (Hong Kong) Limited continues to reopen branches that were closed due to the outbreak of Covid-19.

The company today announces that five of its branches which have been temporarily closed due to developments in the coronavirus situation will resume operations on March 16, 2020 (Monday).

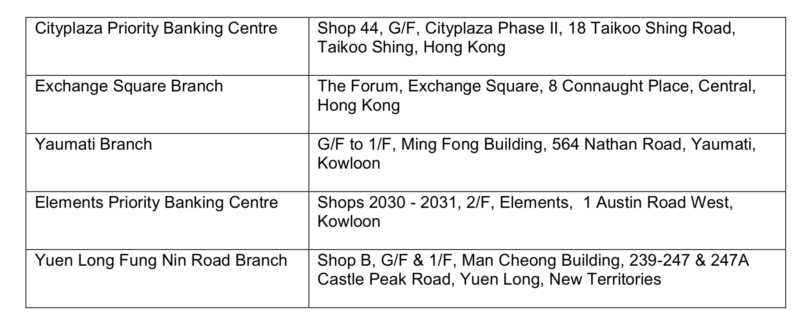

Branches that will reopen are:

Last week, the bank announced that three of its branches which were temporarily closed due to developments in the coronavirus situation would resume operations on March 9, 2020 (Monday).

As FinanceFeeds has reported, in early February, Standard Chartered Hong Kong said that, with consideration to ensuring the health and safety of clients and employees and maintaining the availability of its banking services, it would be suspending banking services at a number of its branches.

The bank has enhanced its cleaning and hygiene measures including deep cleaning and regular sanitisation of common areas and frequently touched facilities such as door handles and handrails. The bank has also reminded all employees to maintain personal hygiene and wear face masks.

Ten of Standard Chartered Hong Kong branches will remain closed until further notice.