Standard Chartered registers 37% Y/Y decrease in profit in Q1 2020

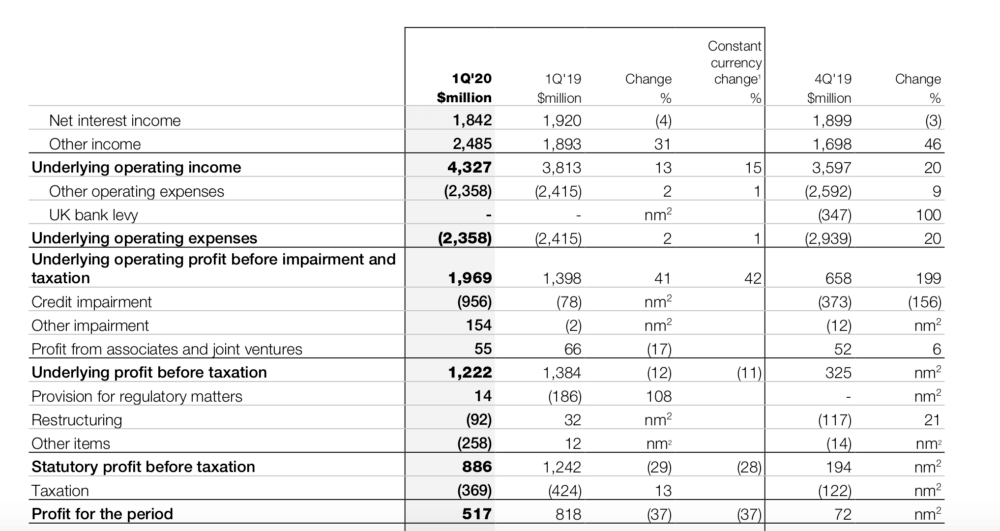

The profit for the first quarter of 2020 was $517 million, down 37% from $818 million a year earlier.

Standard Chartered PLC (LON:STAN) today released its financial report for the first quarter of 2020, with profits down from a year earlier.

The profit for the first quarter of 2020 was $517 million, down 37% from $818 million a year earlier. Underlying profit fell due to substantially higher credit impairment driven in part by the deteriorating macroeconomic outlook, Standard Chartered said.

On the brighter side, operating income grew 13% from the year-ago quarter including a $358 million positive movement in the DVA. Income was up 6% on a constant currency basis and excluding DVA.

Net interest income decreased 4% with increased volumes more than offset by a 14 basis point decrease in net interest margin. The decisions by the US Federal Reserve in March to drop its benchmark interest rate in total by 150 basis points along with actions undertaken by other central banks is estimated to have an impact of a further $600 million for the Group’s income in 2020.

Other income increased 31%, or 12% excluding the positive impact of movements in DVA, with a particularly strong underlying performance in Financial Markets.

Credit impairment increased by $878 million to $956 million. Stage 1 and 2 impairments increased by $388 million, of which around half was attributable to modelled outcomes with the rest due to a management overlay to reflect deterioration in the macroeconomic outlook not captured in the modelled outcome. Impairments of stage 3 assets increased $490 million with just under half the increase related to two Corporate & Institutional Banking clients in unconnected sectors.

Underlying profit before tax decreased 12% from the year-ago quarter. Charges relating to restructuring, provisions for regulatory matters and other items increased $194 million to $336 million, primarily relating to $249 million goodwill impairment in India due to a lower GDP growth outlook.

Let’s note that Financial Markets income grew 60% year-on-year (or 11% excluding DVA), on the back of heightened market volatility, wider spreads and increased hedging and investment activity by clients. There was strong double-digit growth in Rates and Foreign Exchange partly offset by declines in Credit and Capital Markets and in the Capital Structuring Distribution Group.

Across regions, Greater China & North Asia remained the largest regional contributor to the overall Group’s profit before tax, with profit down just 1% despite being the region most impacted by the effect of COVID-19 in the first quarter. Increased impairments were the primary drivers of the 6% lower profit in ASEAN & South Asia and the 83% profit decline in Africa & Middle East. Europe & Americas generated $101 million in profit, up from a $(32) million loss in the same period a year earloer, including a $190 million positive movement in DVA.

In terms of outlook, Standard Chartered expects a gradual recovery from the COVID-19 pandemic, with major contraction in economic growth rates across most of the world in the second quarter, before the global economy moves out of recession in the latter part of 2020, most likely led and driven by markets in Standard Chartered’s footprint.

“If we are wrong about the pace of recovery and the global economy gets back on its feet rapidly – and we are seeing encouraging early signs of that happening in China – then the actions we are taking now will make us leaner and fitter to take advantage of the opportunities that will bring”, says Standard Chartered.