Stockbrokers criticizing fashion? Whatever next?… A £180 million M&S share price fall, thats what!

Does familiarity breed contempt, or are those loyal Marks and Spencer Group Plc (LON:MKS) customers proof that good quality at reasonable prices is a good formula? One of the most widely recognized brands of food, clothing and finance in Britain, Marks & Spencer, has become the subject of scrutiny, this time not at the hands […]

Does familiarity breed contempt, or are those loyal Marks and Spencer Group Plc (LON:MKS) customers proof that good quality at reasonable prices is a good formula?

One of the most widely recognized brands of food, clothing and finance in Britain, Marks & Spencer, has become the subject of scrutiny, this time not at the hands of scathing criticism by fashionistas, but by stockbroking firm Peel Hunt, and multinational investment bank JPMorgan Chase & Co. (NYSE:JPM). As a youngster growing up in the United Kingdom, Marks & Spencer was always the darling of the middle classes; equally favored alongside a Labrador and the ubiquitous Volvo station wagon.

Both firms have now criticized Marks & Spencer’s clothing range, deeming it lackluster.

Peel Hunt stated that the once prestigious high street chain had been cutting back on the quality of its clothes – once the main selling point of the Marks & Spencer brand – in order to increase profits.

“We have anecdotally picked up from core shoppers that the product is slipping in quality terms: is M&S finding some of its gross margins gains by compromising the spec of the garments? It’s not impossible and if it is, then it will be a long road back in customers’ eyes” – Peel Hunt Stockbrokers

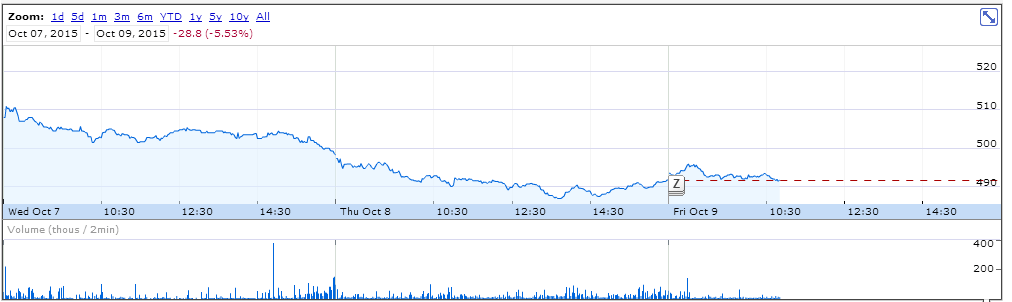

Immediately after these criticisms: A drop in stock value by over £180 million.

Peel Hunt also stated that Marks & Spencer needs to invest in renovation of its stores, but candidly stated that it had “zero confidence that things will pick up” in the following quarter.

JP Morgan’s attack was not so much leveled at Marks & Spencer’s clothing range, but more at its food division, about which the investment bank demonstrated concern over slowing growth.

It was always widely acknowledged that Marks & Spencer’s designs were conservative, but the quality of the products was outstanding and outlasted many more fashionable marques.

Attempts to revitalize the image of the product range have been numerous, however the company reported dwindling sales in almost every quarterly report for the last four years.

Peel Hunt went on to conclude that

“The ranges are simply not resonating with customers. We fear yet again that M&S has failed to read the script.’ They also said the retailer was ‘failing to keep up with the demands of its broad church of customers”

For those investing in corporate stock, it is worth bearing in mind what the analysts and brokers are saying, in order to make informed decisions, as clearly a criticism of a product range by a broker can dramatically influence stock prices.