Study: 62% of Australian retail investors hold on-exchange investments

Between 2012 and 2017 the proportion of investors aged between 18 and 24 years old that hold on-exchange investments has doubled to just over 20%, showing that young people invest more.

Australia has more than 11 million retail investors, but this number could be higher if companies consider trends in the Australian market and try to attract new clients accordingly. The latest changes to the Australian retail investment landscape have been highlighted by the ASX Australian Investor Study 2017.

Research Now was engaged to field the survey and collect data which was then analyzed by Deloitte Access Economics.The survey was in field during February and March 2017, with 4,000 responses received in total.

Around three-fifths (60%) of Australian adults directly hold investments of some sort outside of their institutional superannuation fund, the study shows. On-exchange investments represent the most commonly held investments – 62% of all investors (that is, of the 60% of Australian adults that invest in some way) hold them. This is followed by cash savings (56%) and investment property (37%).

Regarding the profile of the retail investor, the study shows that young Australians are investing more. Between 2012 and 2017 the proportion of investors aged between 18 and 24 years old that hold on-exchange investments has increased twofold to more than 20%, and there has been a 15 percentage point rise in the proportion of 25-34 year olds investing in on-exchange investments during the same period.

Interestingly, young investors are more risk averse than older investors, as 4 in 5 young investors prefer guaranteed or stable investment returns. This may provide a signal to the investment industry as to how to better tailor their products and advice to meet this requirement, for instance, by considering capital protected products and providing education on risk management.

The use of professional advice is widespread amid investors, as the study showed that around 60% of all investors use such advice – from a financial planner, full-service stockbroker, accountant, or lawyer.

However, investors are more reluctant to make use of robo advice. Amid young people (18-24 years old), around 15% said they would use robo advice, whereas 28% said they would not. Only 4% of retirees said they would use robo advice, while 41% said they would not.

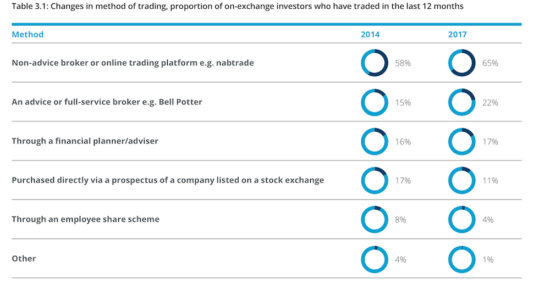

Non-advice brokers and/or online trading platforms remained the most common trading methods. Of young investors that have transacted in the past 12 months, 42% used a non-advice broker or online trading platform. The proportion is at 69% for retirees.