Swissquote discontinues Pulse communication platform

«Research», «Magazine» and «Insights», the three main platforms of Swissquote’s Newsroom, will remain available.

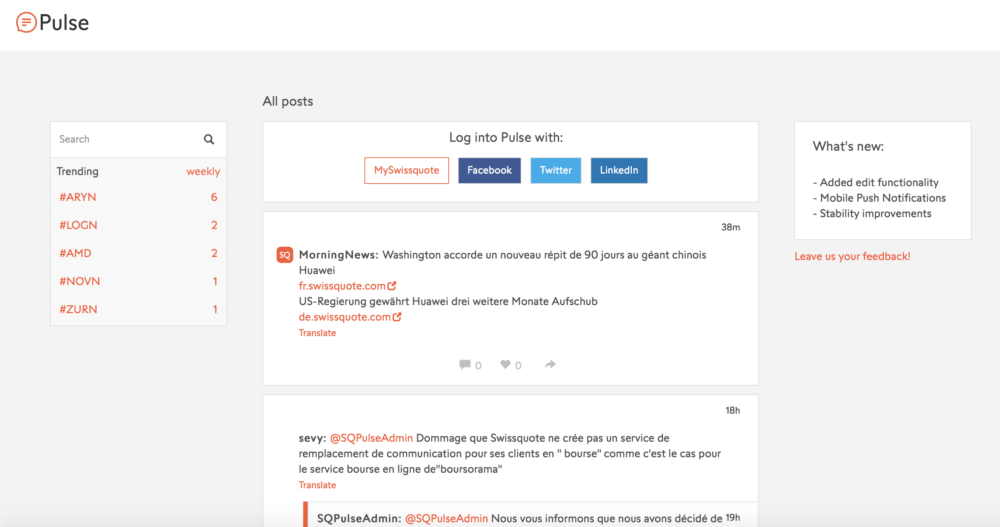

Swiss provider of online financial and trading services Swissquote Group Holding SA (SWX:SQN) is closing its social network for traders Pulse.

A Pulse administrator has published the following notice:

“We herewith inform you that we have decided to discontinue our communication platform Pulse after a service period of three years and to remove it from our Newsroom.

With «Research», «Magazine» and «Insights», the three main platforms of our Newsroom remain in service and continue to provide you with the latest information and analyses on current market events. To exchange with other traders, we invite you to visit our social media channels such as Twitter, which are becoming increasingly popular for this purpose.

We thank you for using the Pulse platform and look forward to welcoming you on our other interactive news platforms in the future”.

Pulse provides the trading community with an environment where one can share ideas, ask questions and may get to know the latest news about the market and the company.

In the summer of 2017, Swissquote’s Pulse grew out of its “beta” phase. The change happened about a year after the beta-launch of Pulse, which was humbly announced by Swissquote on its Facebook page in August 2016.

Apart from sharing ideas, traders often use the network to provide feedback about Swissquote’s services and to suggest improvements. Overall, the tone of communication on Pulse is friendly and suited those who’d like to get information from the company or other traders in a less formal way.

Pulse was made available in four languages – English, French, German, and Italian. It was open to those who do not have a trading account with Swissquote too as they could log in via Facebook, Twitter or LinkedIn. Now, these social media channels are effectively replacing Pulse.