Swissquote launches Robo-Advisor app for Android gadgets

The Robo-Advisor creates a personalised investment portfolio and monitors it 24 hours a day, continuously optimising it in order to maintain one’s chosen level of risk.

Swiss provider of online financial and trading services Swissquote Group Holding SA (SWX:SQN) has released a new mobile application for Android-based gadgets. Swissquote’s Robo-Advisory solution aims to offer easy and accessible digital asset management.

The Robo-Advisor creates a personalised investment portfolio for a user of the app and monitors this portfolio 24 hours a day, 7 days a week, continuously optimising it in order to maintain one’s chosen level of risk.

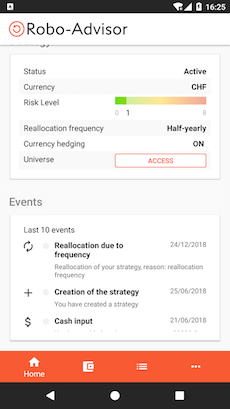

The app provides its users with direct access to their Robo-Advisor accounts. Traders can view account status and performance (including absolute return, TWR and CVaR).

Users of the solution can also access their current strategy and chosen level of risk, and the reallocation frequency and a range of securities.

The app also provides graphics for viewing changes in performance and display transactions that have been carried out, as well as important events.

Level 3 card is required only for one’s first login or if a user is switching accounts.

In August 2018, Swissquote ePrivate Banking mobile application for iOS-based devices changed its name to Swissquote Robo-Advisor.

The company mentioned the upgrade to its robo-advisory platform in the end of July when it reported its results for the first half of 2018. Back then, Swissquote said that the Robo-Advisory platform has been completely overhauled, and that it sports a new, client-friendly design.