Swissquote makes it easier to open demo accounts via Advanced Trader Mobile app

Traders can now create a demo account simply with their Google or Facebook account.

Swiss provider of online financial and trading services Swissquote Group Holding SA (SWX:SQN) continues to boos the capabilities of its mobile trading solutions. The latest set of improvements concerns the Advanced Trader Mobile app.

The latest version of the solution for iOS- and Android-based gadgets allows easier opening of demo accounts. Traders can now create a demo account simply with their Google or Facebook account.

Let’s recall that the version of the application released in May this year made live prices, charts and webinars freely accessible – no account is required. Also, in one of the preceding versions of the solution, the Multi-Account Manager platform, the solution for Money Managers, has become available with many features, such as individual & group trading, various allocation methods & orders as well as reporting.

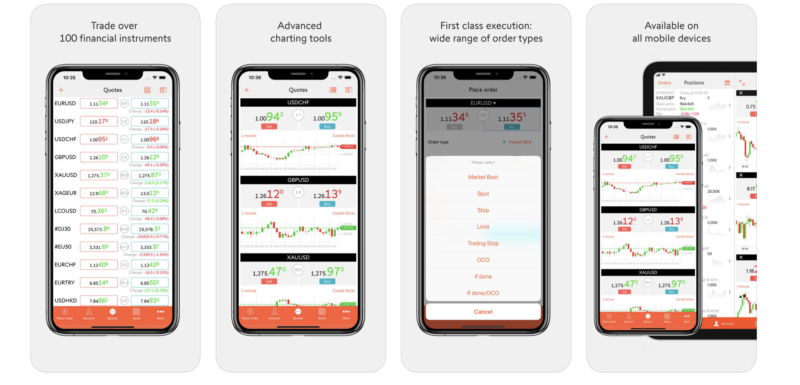

Advanced Trader Mobile enables traders to trade Forex & CFDs while on the go. The app integrates the sophisticated charting and analysis tools required by professional traders into an intuitive interface accessible to everyone.

The instruments available to trade include more than 80 currency pairs, a range of commodities (such as gold and silver), stock indices, and bonds. Traders can make use of a raft of charting tools, as well as daily and weekly Forex market reports on Swissquote Bank’s website.

Speaking of Swissquote’s mobile apps, let’s mention that Swissquote Mobile was updated earlier in July. A new “Notifications” menu in the “About” section allows traders to manage all the messages they receive from Swissquote. Further, traders can now also receive notifications related to the transactions on their Payment Cards. Users of the app for Android-based devices will likely notice that their Personal Lists are now available in the dedicated section of the left menu.