Swissquote makes social network Pulse available on iOS gadgets

Underscoring its efforts to develop mobile fintech solutions and make trading experience more interactive, Swissquote takes Pulse to iOS devices.

Swissquote Group Holding SA (SWX:SQN) has remained true to its image of fintech development proponent and has taken one of its recently launched solutions – Swissquote Pulse, to iOS gadgets.

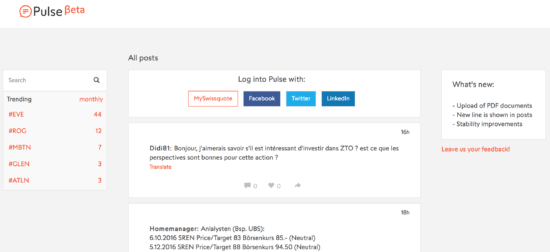

Swissquote Pulse is the company’s social network, with the company announcing its launch in August 2016. The message behind the launch, which appeared on Facebook, was simple: “Get ready to connect with other traders.” The interface of the network is rather clean – it has a forum-like appearance that enables fast communication with other traders. Of course, the sign that says “Pulse Beta” indicates that the service has yet to grow and develop.

The fact that this functionality appeared in the latest update (version 6.2.0) of the Swissquote mobile app for iOS devices is not surprising. That is because the company is usually fast in taking its products to the next, that is, mobile level. A short time span was witnessed with the “Themes Trading” service – it was initially launched in September 2015 and became available on iPhones in October 2015.

Swissquote has a solid track record of launching innovative mobile tech products for the financial services industry. In June 2015, Swissquote became the first Swiss bank to roll out an application for Apple Watch. Back then, it said that a growing percentage of its transactions was executed via mobile apps, thus underlining the business rationale for pushing further into mobile tech development.

The affinity for being a fintech pioneer, especially with regards to Apple products, was manifested about a year ago again. In January 2016, Swissquote was the first Swiss bank to launch an Apple TV application, providing continuous financial news coverage on television, displaying key indices, main currency pairs and important economic news.

Swissquote’s Pulse can also be accessed through your computer’s browser. Log-in is possible with a dedicated account or via Facebook, Twitter and LinkedIn.