Swissquote releases new version of mobile trading app for iOS gadgets

The app now offers shortcuts to derivative quotes and improved Credit Cards user interface.

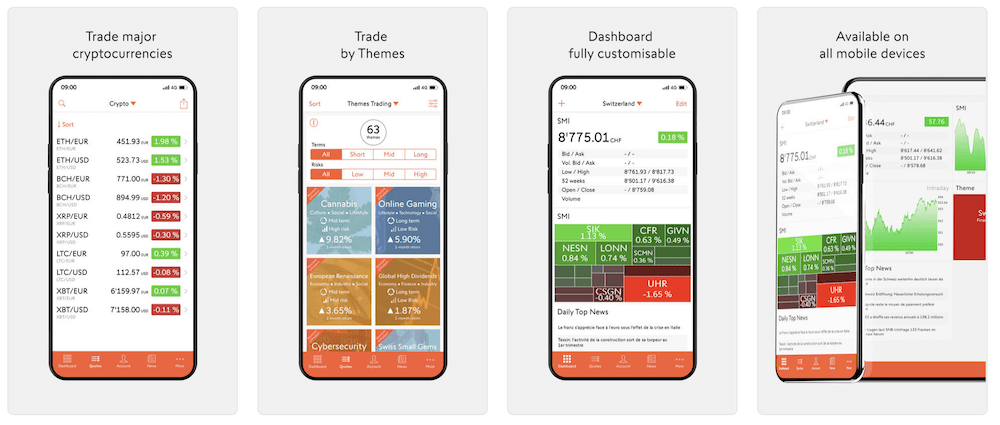

Swiss provider of online financial and trading services Swissquote Group Holding SA (SWX:SQN) has just released a new version of the Swissquote Mobile app for iOS-based devices, with the enhancements ranging from the use of credit cards to support for the latest iOS version.

The latest release of Swissquote Trading sees the addition of shortcuts to derivatives quotes, as well as improved Credit Cards UI. Crypto-currencies disclaimer acceptance has been added to the solution. The app is now also compatible with iOS 12.

Furthermore, uses of the app will notice the changed “Robo-Advisor” menu.

Talking of “Robo-Advisor”, let’s recall that Swissquote has recently upgraded its digital wealth management service, including the corresponding mobile app. Swissquote ePrivate Banking mobile application for iOS-based devices has changed its name and is now known as Swissquote Robo-Advisor.

The company mentioned the upgrade to its robo-advisory platform in the end of July when it reported its results for the first half of 2018. Back then, Swissquote said that the Robo-Advisory platform has been completely overhauled, and that it sports a new, client-friendly design. In the near future, Swissquote promised, cryptocurrencies will be added to the investment universe of Swissquote’s Robo-Advisory as a new asset class, thereby underlining Swissquote’s determination to further expand its position in the Robo-Advisory market.

In September this year, Swissquote rolled out a new version of its mobile trading app for Android devices. The lineup of enhancements ranges from more convenient payments to improvements to the transactions history section. For instance, thanks to Ibiscan, traders got the ability to pay their bills easily with Scan & Pay. They can manage their payments from the “Account” section.