TD Ameritrade upgrades thinkorswim as retail traders go mobile

“Looking ahead to the new year and as our integration with Charles Schwab moves forward, we’ll continue to invest in the momentum of the thinkorswim platforms.”

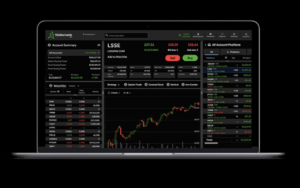

thinkorswim, TD Ameritrade’s retail trading platform, has been upgraded to feature a more personal, mobile-friendly experience as trading has gone mobile in 2021.

The year that is at an end saw mobile trading surpassing desktop devices for the first time on thinkorswim. The broker is only trying to address the demands from the new generation of retail traders that flocked toward the investment world since the pandemic started.

thinkorswim addresses novice traders’ needs

JJ Kinahan, chief market strategist, TD Ameritrade, commented: “Among the many things that made 2021 unique from a trading perspective is the fact that we’ve reached the mobile-first tipping point. We have always put a strong emphasis on our mobile capabilities, iterating and enhancing our offerings to deliver the full-featured but intuitive experience our trader clients have come to expect, regardless of the device they’re using. This year in particular, with so many novice traders engaging in the markets for the first time, it has also been critical to incorporate enhanced education about the strategies that may help them pursue their goals.”

“Looking ahead to the new year and as our integration with Charles Schwab moves forward, we’ll continue to invest in the momentum of the thinkorswim platforms. We remain fully committed to providing a best-in-class trading experience, now and in the future.”

Highlights of the recent thinkorswim enhancements include:

thinkorswim Desktop has gained more than 20 new charting strategies, studies and drawing tools in addition to a personalized news interface, news keyword search, and social activity watchlist.

thinkorswim Mobile is more customizable than ever, with a New Trader-driven account overview, redesigned core tools for easier onboarding, interactive in-app help, a new chat interface and support for Apple® M1™ chip.

thinkorswim Web now features a dedicated charts tab, eight new chart studies plus five new drawing tools, dozens of new pre-built watchlists, contingent orders, order rules and trailing stops, transaction history, and a personalized education experience.

In August 2020, Schwab announced plans to adopt thinkorswim and integrate its award-winning trading platforms, education, and tools into its trader offerings for clients. Traders can confidently take on the market knowing they’ll have uninterrupted access to the award-winning thinkorswim product suite—along with the innovation, education, and service they’ve come to expect. For more information on the thinkorswim, please visit www.thinkorswim.com.

thinkorswim enters Charles Schwab product suite

TD Ameritrade is a major U.S. retail trading brokerage, having been named #1 Overall Broker in the StockBrokers.com 2021 Online Broker Review (3 years in a row).

The brokerage firm was rated #1 in several categories, including “Platforms & Tools” (10 years in a row), “Education” (9 years in a row), “Beginner Investors” (9 years in a row), “Desktop Trading Platform: thinkorswim®” (9 years in a row), and “Active Trading”.

TD Ameritrade was recently acquired by Charles Schwab for $22 billion, a huge deal both in terms of the amounts and the impact on the trading landscape.

Charles Schwab said earlier this year that it plans to retain and integrate the former rival’s thinkorswim and thinkpipes trading platforms. At the time, the company anticipated the integration between the two largest publicly traded discount brokers to take up to three years following the close of Ameritrade takeover.

The merger creates an online brokerage behemoth with nearly $7 trillion in client assets and more than 30 million brokerage accounts. The process will also include the educational offerings and tools accompanying them, as well as TD Ameritrade’s institutional portfolio rebalancing solution iRebal.