That’s not me! – Guest editorial

If an early middle-aged pink faced English man can become the poster boy for an ICO, how can those of us who are more blessed professionally, reputationally and physically be sure that we are not the (un)official figure head of the next online scam, says Paul Orford as his identity is fraudulently abused

Paul Orford is a widely renowned FX industry executive, and is founder and Editor in Chief of GameChangers magazine, which details the professional lives of those who innovate and move the electronic trading business forward across all sectors globally.

That is really who he is!

I have always been one of those people who thought identity theft happens to someone else. Usually it’s the rich, beautiful and famous who have their face usurped and added to a fugazi outfit promoting real estate opportunities in Florida’s finest swamp land.

I remember a while back I saw a brokerage site, and unbeknownst to the designer, what they believed to be the generic image of smiling white middle-aged man, was actually the image of the former Australian Prime Minister Kevin Rudd.

With his name changed and giving a glowing reference for the brand as a happy and satisfied customer, along with why you should take advantage of their services with this life changing opportunity. I did not know what made me chuckle more, the designers lack of oversight or my random knowledge of Antipodean politics!

A couple of weeks back, when checking my Skype over breakfast and I had a message from a friend saying he did not know I was involved in an ICO. I am not the greatest morning person, so when processing the information, I was a touched confused.

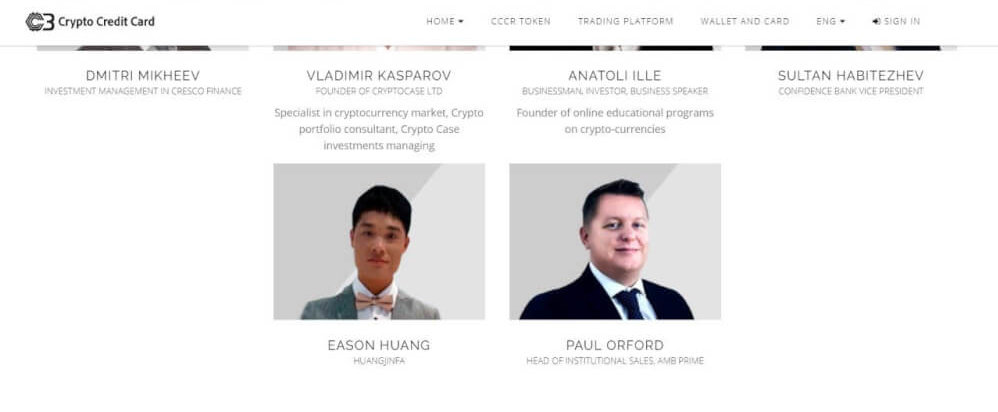

He then went on to show me the site, my image, name and former role being used as an advisor to this scheme. Just to get it out there, I am not involved in this project of which I have no idea if it is straight or not. However, trawling the website and the lack of response to my lawyer, I guess that it might not be the smartest thing to place your hard earned money into.

I think that the real thing that crushed me was not that my reputation was being trashed by being associated with this (I can do a great job of doing that myself!) it was that the picture they used. I can only describe the image as someone who had claimed diplomatic immunity at the all-day buffet!

This intrepid band of photo shoppers had morphed my body into the size of a large detached house, to which I could only laugh at when I saw it (inside I was crying). Moreover, after spending the past 6 months working off a large amount of stomach fudge, my ego was crushed. I am not sure if I can sue on the grounds of having my ego destroyed by unscrupulous photoshop methods, but I will certainly take a legal opinion on it!

It got me thinking about how can we stay on top of all this. If an early middle-aged pink faced English man can become the poster boy for an ICO, how can those of us who are more blessed professionally, reputationally and physically be sure that we are not the (un)official figure head of the next online scam.

In matters like this, I thought it was best to discuss with Charlotte Day, Creative Director at leading ICO content marketing agency Contentworks. I was intrigued about how can we protect our reputation and image from being used without permission.

“Online identity theft is a big issue and a real threat right now. A high profile example would be that of Hollywood actor Ryan Gosling, whose face and name were used in the fake Miroskii ICO.

Whilst seemingly amusing, many investors fell for the scam. If you’re a name in the industry then you need to protect your credibility and reputation. You should run regular Google searches on your name and company.

Sign up for Google alerts or meltwater if you’re subscribed. Run hashtag searches for your name and pay attention to any unusual account activity. Should you encounter a scam using your identity, you should contact the company immediately to remove it. If they refuse to do so, then it is a matter which can be escalated through legal channels, something a scam ICO will not want.

So based upon this tale of wrongful photoshopped gluttony and identity fraud, always get someone to do an audit on your online presence. It does not take that long to do, as unbeknownst to yourself you may be the unofficial spokesperson from everything from baked beans to a scam ICO.

The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff.