The B2Broker B2Core REST API Is Now Live

B2Broker has announced the release of its new REST API, which lets customers use B2Broker’s solutions and services for business purposes.

B2Broker has announced the release of its new REST API, which lets customers use B2Broker’s solutions and services for business purposes. Customers can utilize HTTP methods to create, read, update, and delete resources using the REST API. This is a significant milestone for the firm since it provides more choices and options to its customers. B2Broker continues to blaze the trail in delivering cutting-edge solutions for the Forex market with this new release. We thank you for your support.

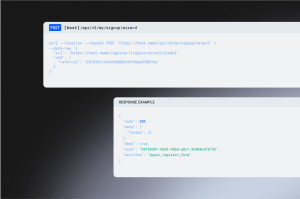

API for the Back Office

Clients may use the back office API methods to retrieve data about their users, accounts, and transactions for analytical or operational purposes. This will help companies greatly since they will have a complete understanding of their consumer base and can tailor their marketing efforts to them more precisely. The information acquired by this API will also help gain insight into how consumers use the company’s goods and services. Companies may utilize this information to fine-tune their products and offerings as needed. Overall, this will result in a more efficient and effective business operation.

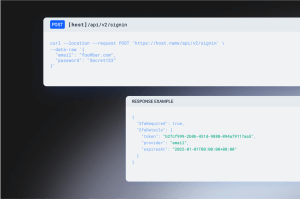

Front-Office API

The B2Core API methods support the end user by giving them the ability to work with the Trader’s Room (Front-Office API). With Front-Office APIs, you can authorize access, embed your products’ interface operation within other platforms, carry out transactions, and a lot more. Front-Office APIs allow you to supercharge your product and make it more appealing to your users. You may also use the Front-Office APIs to develop new capabilities and functions into your product and make it more interactive and user-friendly. If you are a broker who wants to offer your clients a more sophisticated trading experience, utilizing Front-Office APIs is the way to go.

Conclusion

We’re ecstatic to be able to release the B2Core API, and we’ll continue to add new features and capabilities. The bottom line is that the release of B2Broker’s new REST API provides more choices and options to customers and gives companies the ability to fine-tune their products and operations. We’re never satisfied here at B2Broker, which is why our first release—the B2Core API—is only the beginning. We are determined to keep working on developing this API so that your experience using it will be unparalleled. We want to make it easier for our users to enhance and develop new applications with this release. We believe this API will be extremely beneficial to Forex, CFD, crypto brokers, converters, crypto exchanges, and all the fintech industry.

We’re always on the lookout for possibilities to improve our products and services. You may go ahead and test the B2Core API! We’ve made it simple for you to get started. And if you run into any difficulties or have ideas for how we can make the API even better, please let us know.