The Best Kept Secret in Today’s Volatile Crypto Markets

Following a $3 trillion market cap peak in November 2021, the crypto markets shed more than 50% of this value in the span of a few short weeks, leaving investors in a state of panic and pessimism for the future.

To say the crypto markets today are volatile will be a huge understatement.

Following a $3 trillion market cap peak in November 2021, the crypto markets shed more than 50% of this value in the span of a few short weeks, leaving investors in a state of panic and pessimism for the future. While Bitcoin and Ethereum have had their volatile days in the past, this new wave of selloffs has spread to a broader range of assets, that includes stablecoins like TerraUSD, which has been below its $1 peg for more than 24 hours, in addition to crypto-related equities like Marathon Digital.

The cause of the recent market panic can be attributed to a combination of inflation worries, the Russia/Ukraine war, supply shortages, Covid resurgence in China, and many other factors that are still being debated among policymakers, government institutions, and market participants. When it’s all over, reflection studies will be done to pinpoint the root cause of the current market sentiment and hopefully, there will be lots of lessons learned.

The Crypto Volatility Index (CVI)

Complex financial products have existed since the dawn of time.

In ancient times, emperors and kings relied on call/put options to ensure a steady supply of perishable commodities that included agricultural products like cocoa. Over the past few years, we have seen technology play a leading role in modern finance with the introduction of indexes, algorithmic trading, and other tools that have equipped financial traders to either gain an edge over their counterparts or protect themselves against potential losses. One key innovation that came about in the early 1990s was the CBOE Volatility Index, commonly referred to as the VIX. At its core, the VIX aims to provide an insight into the expected market volatility of the S&P 500 in the ensuing 30 days. Through the VIX, traders can get a sense of where the S&P 500 is heading in the coming weeks and take action based on this information.

The Crypto Volatility Index (CVI) has this same function for the crypto markets. Before the CVI’s inception in 2020, crypto market participants had no reliable benchmark to gauge expected volatility sentiment. As the TVL in crypto markets has increased and deepened across both retail and institutional investors, the CVI provides an oracle-like feature of accessing the crypto market’s sentiment on future volatility while giving traders an opportunity to place trades using the Crypto Volatility Token (CVOL) token based on this perceived sentiment. The CVI utilizes the BTC & ETH option prices to access the market sentiment for volatility and since its inception in 2020, the CVI has accurately timed all the major crypto market selloffs and reversals.

Let’s take a look at the charts from the past few days as an example:

Following a few weeks of uncertainty, the crypto markets reacted extremely volatile on May 8th with Bitcoin dropping and remaining below the $33,000 range for the first time in about 9 months, while Ethereum shed close to 20% of its value within this period. Following these market movements, the CVI saw a spike of about 32%, from its May 7th value of 65 to its 1-month peak value of 86.

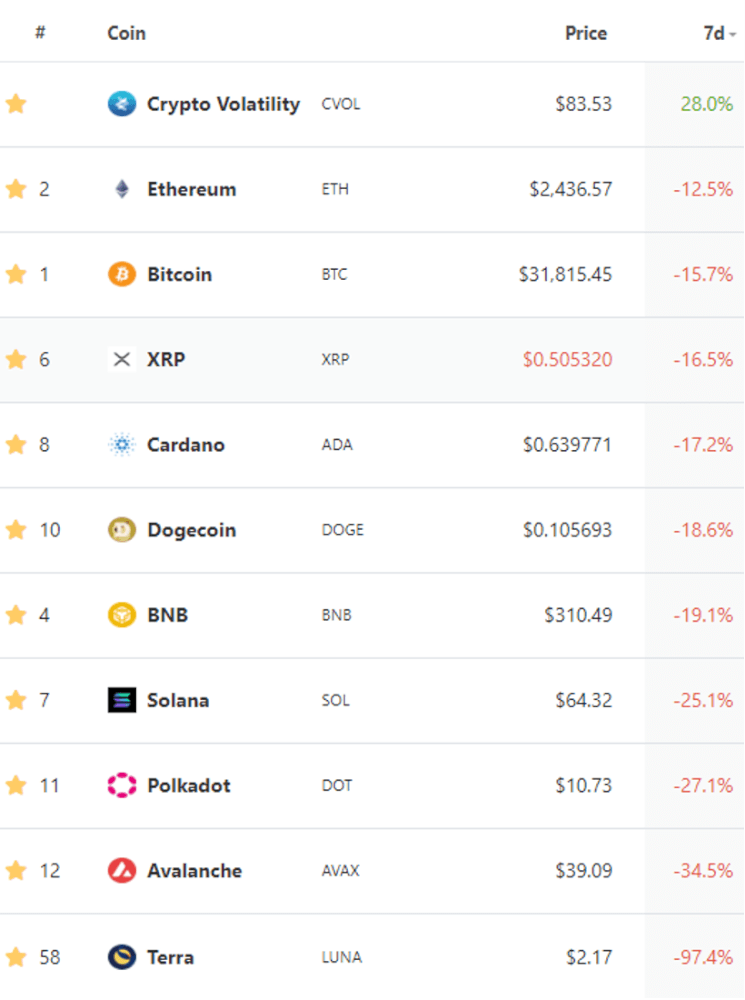

The trade is as simple as this: If the outlook for future volatility increases (like in today’s markets), you buy the CVOL. Taking a look at the top crypto charts during the past week, it is clear that the CVOL outperformed all the major crypto assets – while still being the perfect hedging mechanism for today’s markets.

Market movements like this are not new to us, and they will certainly not be the last. Against this backdrop, the Crypto Volatility Index (CVI) was created to provide a mechanism for crypto investors to access the market’s sentiment on future volatility. Given the huge correlation between the CVI and BTC & ETH option prices, retail and institutional investors alike are now equipped with an index that reflects when the markets are either more or less volatile.

The CVI provides the opportunity for traders to receive information about future volatility and hedge their portfolio while performing profitable short-term strategies using the CVOL.

Nir Arazi:

Nir Arazi:

CVI’s General Manager and COTI’s Chief Operations Officer.

Nir is a highly experienced manager in the fields of technology, finance, and strategic planning. Holding an MBA from Ben-Gurion University.