The importance of today’s Fed rate hike – FX Industry View

Today marks a very important day in the fiscal calendar, and one of great significance for traders of all denominations including those in the retail segment, those at the interbank epicenter in London’s square mile, and the professional trading desks of Chicago and New York. Today is the day when Janet Yellen makes her decision on […]

Today marks a very important day in the fiscal calendar, and one of great significance for traders of all denominations including those in the retail segment, those at the interbank epicenter in London’s square mile, and the professional trading desks of Chicago and New York.

Today is the day when Janet Yellen makes her decision on US interest rates, and will announce her plans to an audience which is waiting with great anticipation.

The announcement during which the Federal Open Markets Committee (FOMC) will release its statement, will take place at 14.00 EST (New York) which is 19.00 in London.

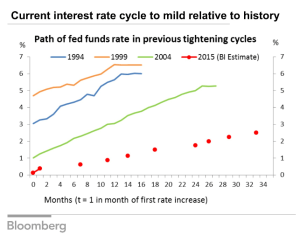

It has been generally considered by many market analysts in the advent of today’s forthcoming announcement that Ms. Yellen will indeed increase the interest rates once again, following a rate hike that already took place in September.

Who cares about interest rate changes? – Actually, pretty much everybody

A usually far from interesting subject, interest rate changes have become a moot point among traders. So important are US interest rates with regard to criteria that is used by large companies to measure market confidence that the September rate hike was actually part of the reason why less large companies looked to issue IPOs in oder to become publicly listed during 2015.

FinanceFeeds today spoke to Stephen Leahy, Chief Operating Officer at FXPRIMUS, who explained “It is well-known that this US Federal Reserve FOMC statement today is highly likely to raise rates, and the focus will be on the wording of the accompanying statement as to the potential course of action of any future rate hikes” said Mr. Leahy.

“For those who want great analysis of the situation, please see this research piece from Marshall Gittler yesterday” advised Mr. Leahy.

“What will be interesting to me is the amount of market volatility in the immediate aftermath of the decision and statement. We expect lower liquidity in exotic currency pairs towards end of year” – Stephen Leahy, COO, FXPRIMUS.

“But we have been seeing massive inter-day moves in the major pairs lately. That means a combo of thin liquidity and/or huge year-end positioning by the largest of trading houses. With the retail FX industry so dependent on volatility, I am looking to see how volatile this event is as foreshadowing of the last few weeks of the year” concluded Mr. Leahy.

Ryan Nettles, Director at Swissquote explained to FinanceFeeds “The USD crosses are currently trading in a tight range ahead of the FOMC rate decision today. With the USD weakening about 4% after the ECB interest rate news two weeks ago, we are expecting a rate increase by the FOMC which should reverse the some of the weakness the USD had earlier.”

When the Federal Reserve released its third quarter GDP figures which recorded a rise of only 1.5%, Michael Hewson, Chief Market Strategist at CMC Markets said “I think the statement by the Federal Reserve was more about messaging than anything else. I think they wanted to keep the option of a December rate rise on the table even though the data currently suggests that they may not do anything.”

With regard to the October statement by the Federal Reserve, Mr. Hewson noted that the Federal Reserve implemented a timing cycle that would make it difficult for them to raise rates in December when that meeting comes around because there has been a significant sell off in the Euro and a tightening or raising in bond yields.”

Indeed, with this measured view at the beginning of the last quarter, the jury is most certainly still out.

Jansen Khoo, Head of Risk and Prime Services at Blackwell Global told FinanceFeeds today “Our desk view is that the rate hike tonight is certain and priced in. However, what will drive the dollar after the release would be the pace that Fed will hike in 2016.”

Let’s see what the multi-asset proponents make of this should the hike have significant effect on the currency markets as this comes at a time when a great many retail FX firms are rallying to go multi-asset, yet have not yet got the ability to price underlying assets or gain clearing facilities for CFDs or other futures contracts which do not involve FX and can be traded electronically via a retail platform.

Interesting times ahead….