The issues facing FX rating sites and how investfox can be a potential solution

Rating sites have become a popular resource for those looking to buy products or find services worth using, and it wasn’t long before Forex brokers found themselves in the consumer review spotlight.

Traders of all levels soon flocked to these new FX broker reviews and rating sites looking to evaluate trading platforms and get a clear idea of which brokers are worth using, and what using them might cost.

As with everything online, the cracks in this newfound approach quickly began to appear as traders began to raise concerns about the credibility and motives of those running this show.

The first question that people began to ask was regarding the accuracy of these FX rating sites.

So what are the main issues that traders face when dealing with FX review sites?

Data and methodology

It can be quite difficult for traders to determine which sites are trustworthy and provide accurate information. Some sites are obviously using questionable data sources and outdated or inaccurate analytical methods, which leads to biased or inaccurate ratings. This generally goes hand-in-hand with a lack of transparency, as many sites make it difficult, or even impossible to find any clear information that would help traders evaluate the credibility of ratings.

Affiliate marketing

The next issue that was set to plague this industry stems from the impact that affiliate marketing has on any form of a rating system. With so many sites generating revenue through affiliate links, the conflicts of interest are obvious as the influence that these platforms hold over the lowly review pages is significant. The Go-to-Market Security (GTMSec) company CHEQ estimated the global value of affiliate marketing at $15 billion globally in 2020, according to a study conducted by them in collaboration with the University of Baltimore. The study also found that around $1.4 billion of this total would be lost to affiliate fraud.

With the motto of “no sign-ups, no money” companies that employ affiliate marketing can quickly squeeze even the most trustworthy of FX review sites into punting a poor-performing broker.

User reviews

More often than not rating sites allow users to leave consumer reviews. However, this has led to such an increase in the amount of fake or biased reviews that companies such as Trustpilot spend a lot of time and energy trying to curb this problem. Just in 2021, the aforementioned platform removed over 2.7 million fake reviews, pointing to a clear issue with customer reviews. This is especially bad when dealing with financial institutions such as an FX broker that simply paid a company to push up its public image through fake reviews. On the other hand, some reviews may be subject to moderation or filtering, which could also potentially bias the ratings.

The solution

With fake reviews and amateur ratings being so prevalent in the investment review space, a 2022 startup called investfox has stepped to the plate providing unbiased and expert reviews, educational resources, and a platform for trustworthy user feedback.

investfox might be a relatively new player in this market, but it has already made a name for itself with a dedication to providing accurate and detailed reviews and information to anyone looking for investment companies and opportunities worth their while.

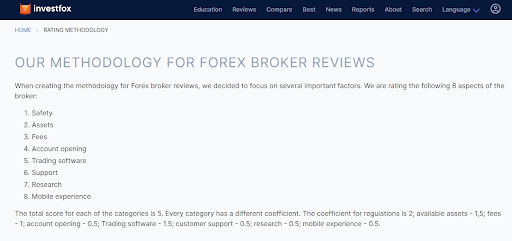

To start off with, they employ a strict methodology that is followed to the letter by their research and analysis team, thus ensuring each review is as honest and unbiased as humanly possible.

The methodology is extensive and covers every aspect that should be considered when deciding on an investment company to use. investfox is open about it and makes it easy to find out exactly what they look at when conducting research while compiling their reviews.

Along with this comes a vast amount of educational resources that can provide value to beginners and experts alike. If knowledge is power, then they have set out to make sure that anyone interested in this field will be able to muster the right voltage, by providing all their reviews and educational information in multiple languages.

The final part of the puzzle is dealing with user reviews. While moderation is not something that everyone likes to consider as a solution to the problem of fake reviews, the investfox team keeps a close eye on all consumer reviews and ratings that appear on their site, to make sure that no company is able to pay their way into a better ranking.