The UTIP Desktop advantages over mobile and web versions of the trading terminal

The UTIP platform is an off-the-shelf software package to launch brokerage business in over-the-counter markets. All the types of recent and easy-to-use trading terminals are in traders’ disposal.

The UTIP Desktop with its advanced Algotrading functionality is installed on a PC.

The UTIP WebTrader — is available in all browsers, and no installation is required on the device.

The UTIP Mobile is a terminal for Android and iOS mobile devices.

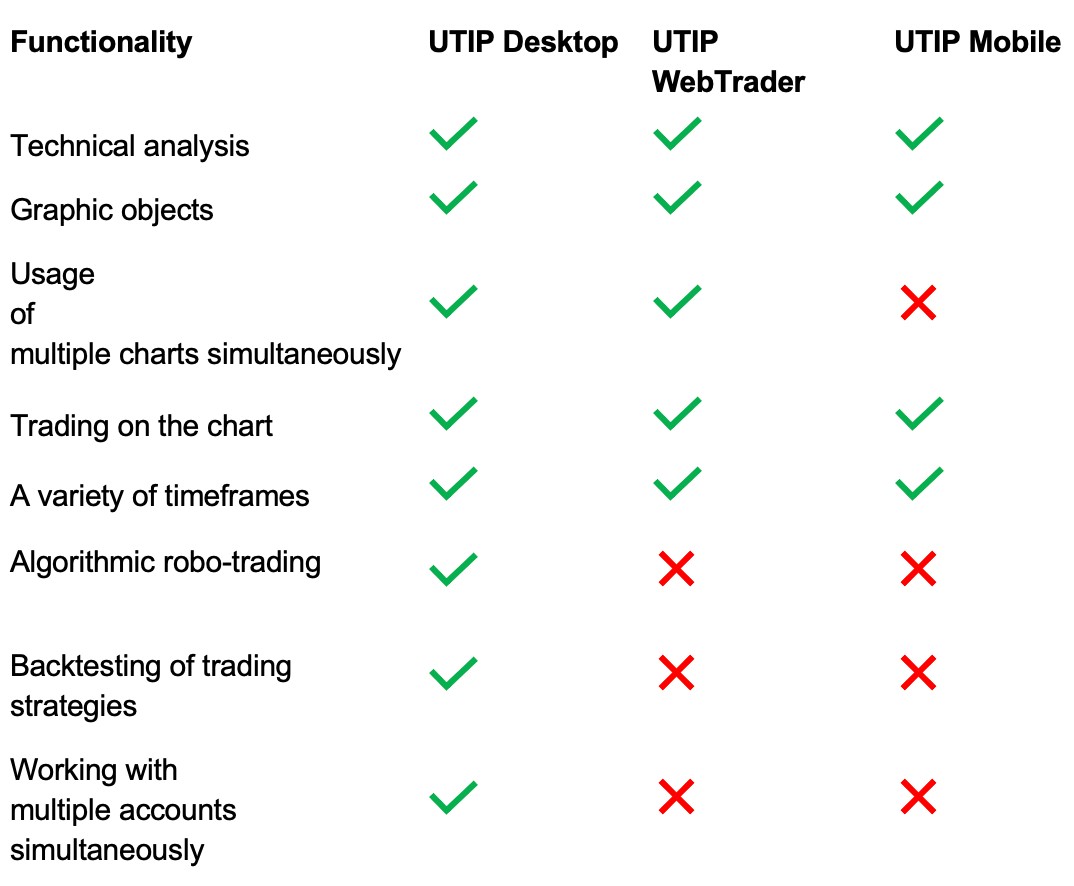

The UTIP trading terminals have analogous functionality, but only in the desktop version are available algorithmic robo-trading and historical data-type-testing strategies, as well as simultaneous work with multiple accounts.

Features of desktop, web and mobile versions

Robot Editor in C#

In the UTIP Desktop robo-trading development framework has been integrated in the Objective-C, a main programming language. Our solution includes a simple, reliable and scalable programming language, large community and multifunctional libraries. The UTIP Desktop ensure traders with the feature to create their own robots. This option is also available to brokers to offer developed robots to traders afterwards.

Backtesting

Your clients are given with the opportunity to do historical data-type-testing of the created robots for different symbols and timeframes. Additionally, a turnkey version of the “Algotrading” solution has been available since December, 2022

In what ways are different versions suitable for

Web and mobile versions are available on all the devices whereon the apps are being installed and the browser is opened. Therefore, it’s convenient to use them being on a route: for example, when going for a stroll or driving.

The Desktop version is suitable for traders who are eager to have their trading strategies tested for efficiency and further automate them. Plus, provided option to develop trading robots and launch them.

The usage of the trading terminal desktop version is targeted to well-experienced traders so that broker is able to boost profit at the expense of trading volumes resulted from the automated strategies. Thus, the UTIP Desktop with its in-built Algotrading functionality is mutually beneficial for brokers and traders.

You can try the UTIP Desktop with its Algotrading functionality by following the link and refer to the information about other solutions on the UTIP website.