This day in history – October 21, 1907: Jesse Lauriston Livermore rockets to fame. We look at his illustrious trading career

Heading into the stock exchanges with incredible calculations at the age of 15, amassing huge profits, then losing them all, then mastering two massive crises and coming out the other side whilst following his own rules made Jesse Lauriston Livermore one of the most successful traders of all time. He beat the bucket shops, mastered the bank crises and prospered. We chronicle his career

Jesse Lauriston Livermore was one of the very first traders to have become famous for his incredible risk taking, his gregarious method of reading the potential moves in the North American stock, commodities and derivatives markets, and for rising to fortune as well as sustaining vast losses.

Some 99 years ago this day, Jesse Lauriston Livermore turned a massive corner in his career, which actually led to his fame and earned him the accolade of being a man with tremendous tenacity, as well as cementing his nickname “The Great bear of Wall Street.”

Born in 1877 in Shrewsbury Massachusetts, Jesse Lauriston Livermore began his career at the age of just 14 having run away from home to escape a life of farming that his father had intended for him, instead choosing city life and finding work posting stock quotes at brokerage Paine Webber in Boston.

Whilst at Paine Webber, Jesse Lauriston Livermore made written notes of specific calculations that he had worked out relating to future market prices, and then when such events occurred, he would then refer back to his predictions and work out how accurate they were.

Just one year after arriving in Boston as a young teenager with absolutely nothing, he had made profits which amounted to $1,000 which was a fortune in those days – approximately $26,000 in today’s terms.

The next step in Jesse Lauriston Livermore’s career was something that would be extremely frowned upon today, and the very word that describes these institutions has become an industry taboo. Indeed, one of his friends convinced him to start trading his own money on the markets, effectively becoming a proprietary trader some 105 years ago, however he did not do so at reputable firms, instead betting on stock at bucket shops, which were gambling establishments that took bets on stock prices but did not process them in the live market at all.

For six more years, Jesse Lauriston Livermore continued betting on false stock prices at bucket shops but was eventually banned by them for making too much money from them – a practice that unbelievably still prevailed at disreputable retail FX firms until as recently as the end of the last decade.

Having taken his profits and been turned away from all of Boston’s bucket shops, Jesse Lauriston Livermore packed his bags and moved to New York City, turning his attention to legitimate firms, and making his entry into Wall Street.

It was in New York that he rose to prosperity, and where he personally designed an entirely new set of rules for trading the market.

Some fifteen years went by and Jesse Lauriston Livermore’s success went from strength to strength.

On October 21, 1907, however, his rise to national fame took its first turn.

During the Panic of 1907, which at the time was known as “The Knickerbocker Crisis”, Jesse Lauriston Livermore saw a means of capitalizing on the fear and panic that had set in at the banks of New York instead of going under because of it.

Jesse Lauriston Livermore sold the market short just at the same time as it crashed. He noticed conditions where a lack of capital existed to buy stock.

As this took place, he predicted that there would be a sharp drop in prices when many speculators were simultaneously forced to sell by margin calls and a lack of credit.

With the lack of capital, there would be no buyers in sight to absorb the sold stock, further driving down prices, and he continued to trade on this basis. After the crash and its aftermath, he was worth $3 million – in 1907!

Liquidity shortages and lack of credit extension to counterparties is a phenomenon that has raised its head once again these days in the electronic markets, however today, there are technological ways around it and an ecosystem comprising of ECNs and prime of primes that can smooth out liquidity distribution, whereas 99 years ago, you were completely on your own!

The 1907 Panic that sealed Livermore’s fame took place over a three-week period starting in mid-October 1907, when the New York Stock Exchange fell almost 50% from its peak the previous year, which generated massive amounts of panic at institutional level.

This was during a time of economic recession, and there were numerous runs on banks and trust companies. The 1907 panic eventually spread throughout the nation when many state and local banks and businesses entered bankruptcy. Primary causes of the run included a retraction of market liquidity by a number of New York City banks and a loss of confidence among depositors, exacerbated, rather ironically, by unregulated side bets at the very bucket shops at which Jesse Lauriston Livermore used to trade, often to his own success.

Unfortunately, after marking himself out as one of the greatest and most astute traders of all time having made national headlines for mastering a market at times when even the institutions could not, Jesse Lauriston Livermore went on to lose 90% of his $3 million – equivalent to a lofty $77 million today – by placing it on a cotton trade which did not close in his favor.

Although Jesse Lauriston Livermore rewrote the rulebook by calculating potential outcomes and then referencing them afterwards to see if his methods were reliable, then religiously executing according to his own methodologies, what happened during his losing trade was a prime example of how even those with strict rules and proven strategies can be tempted to work outside their comfort zone and get carried away.

He broke all of his own key rules by listening to another person’s advice – he always made his own decisions previously – and added capital to a losing position, something he never did before, always choosing to get out of a position quickly if it was losing.

His losses continued and in 1912 Jesse Lauriston Livermore declared himself bankrupt with all of his $3 million capital gone, and a debt of $1 million.

Unbelievably, he did not give up and began trading again during the bull market between 1914 and 1918 as the First World War created a massive stock market rally, which Livermore mastered once again. He repaid all of his creditors in full and began to purchase luxury mansions all over the world which had an entire staff of servants. He also purchased a fleet of limousines and a yacht for trips to Europe.

Even after sustaining losses in the Wall Street Crash of 1929, which saw off many massive industrialists in America including General Motors co-founder Louis Chevrolet who lost every single penny and concluded his career working at a ten pin bowling alley in Detroit, Jesse Lauriston Livermore continued to go from strength to strength.

Livermore short sold during the crash and came out of it with a personal fortune of $100 million – an equivalent of $1.5 billion today.

Unfortunately, it did not take long before he lost his money again.

In 1934, Jesse Lauriston Livermore was once again declared bankrupt and was suspended as a member of the Chicago Board of Trade (known as CBOT today).

No record exists of what happened to the $100 million he made during the 1929 crash, but it was clear from his own personal records that it had all completely gone.

On November 28, 1940, Jesse Lauriston Livermore shot himself in the head at the Sherry Netherland Hotel in Manhattan, leaving a suicide note of eight pages in his personal leatherbound notebook.

After his death, liquidators valued his estate at over $5 million, which in today’s terms is approximately $86 million.

In 2013, Richard Smitten wrote a book which detailed Jesse Lauriston Livermore’s 45 year trading career, heralding him as one of the greatest traders that has ever lived.

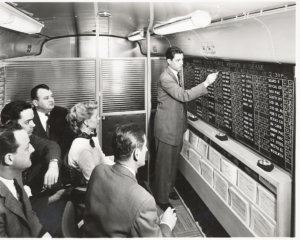

Featured image: Chicago Board of Trade, 1940. Courtesy of Thomson Reuters