Thomson Reuters FX volumes outperform rival EBS in December by $17 billion per day

The battle for supremacy between the two benchmark institutional ECN FX platforms Thomson Reuters and ICAP’s EBS electronic brokerage division has been a very close one during the course of the past year. The gap is widening between the two arch rivals, however, and in December 2015, EBS recorded an average daily spot FX volume […]

The battle for supremacy between the two benchmark institutional ECN FX platforms Thomson Reuters and ICAP’s EBS electronic brokerage division has been a very close one during the course of the past year.

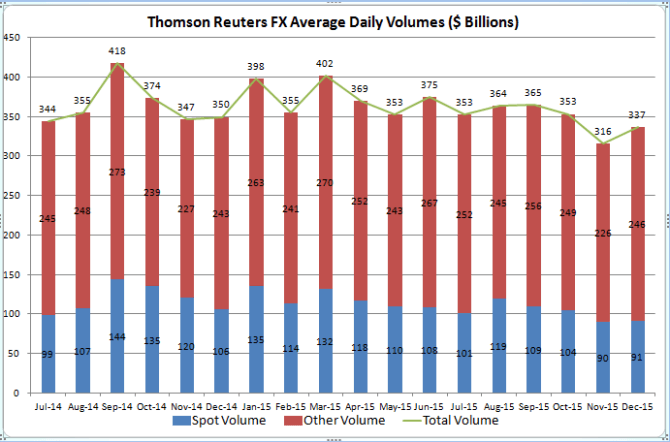

The gap is widening between the two arch rivals, however, and in December 2015, EBS recorded an average daily spot FX volume of $74 billion for the month, whereas Thomson Reuters figure for December weighed in at $91 billion on average per day, standing the firm considerably higher at the end of the year.

The results for both plaforms were a shadow of those achieved during the previous year, with December 2014 having been a month in which EBS achieved a monthly spot FX volume of $104.8 billion on average per day.

Average daily volume for the six monthly period between July and December 2015 was $6.528 trillion at Thomson Reuters, with September’s high of $418 billion being a reflection of the value of the acquisition of FXall by Thomson Reuters three years ago for $625 million.

Chart courtesy of Thomson Reuters.