Comprehensive Tickmill broker review

Tickmill is a global provider of financial services, offering CFDs on Forex, stock indices, commodities, bonds as well as Futures and Options (available under Tickmill UK Ltd).

Tickmill is a global provider of financial services, offering CFDs on Forex, stock indices, commodities, bonds as well as Futures and Options (available under Tickmill UK Ltd).

Regulated by the Financial Conduct Authority (FCA) of the United Kingdom, the Cyprus Securities and Exchange Commission (CySEC), the Seychelles Financial Services Authority (FSA), the Labuan Financial Services Authority (Labuan FSA) and the Financial Sector Conduct Authority (FSCA), Tickmill Group provides first-class products and services, catering to the needs of the most sophisticated retail and institutional clients around the world.

With vast experience in financial markets and strong industry knowledge, the company offers superior trading conditions such as spreads from 0.0 pips, ultra-fast execution and outstanding client support that enable traders to take their trading to the next level.

Tickmill Pros and Cons

Pros

- Multi-asset broker (Forex, CFDs, Futures and Options)

- Spreads from as low as 0.0 pips

- Ultra-fast trade execution averaging 0,20 seconds

- All trading strategies allowed (including EAs, hedging and scalping)

- Leading trading platforms available including MT4 & MT5 (for CFD trading) and CQG (for ETD trading)

- Mobile application

- Powerful trading tools and applications including Autochartist, Pelican Trading, Acuity Trading, VPS and more

- Variety of local and international deposit and withdrawal options with fast processing times

- Segregated accounts with top-tier banks

- Dedicated support in 15+ languages.

- Educational blog in multiple languages

Cons

US residents are not allowed

Tickmill Regulations

Tickmill Group’s companies are regulated in some of the world’s most reputable financial jurisdictions.

Tickmill Group consists of Tickmill UK Ltd (a company registered in England and Wales under number 09592225) authorised and regulated by the UK Financial Conduct Authority (FCA), Register Number: 717270, Tickmill Europe Ltd, licensed and regulated by the Cyprus Securities and Exchange Commission (CySEC), Licence Number: 278/15, Tickmill Ltd regulated as a Securities Dealer by the Financial Services Authority of Seychelles (FSA), Licence Number: SD 008, Tickmill Asia Ltd authorised and regulated by the Labuan Financial Services Authority, Licence number: MB/18/0028 and Tickmill South Africa (Pty) Ltd, authorised and regulated by the Financial Sector Conduct Authority (FSCA), Licence number: FSP 49464.

Tickmill Trading Account Types

The broker offers a variety of account types, providing Retail and Professional Clients with a broad range of options while allowing all trading strategies. Interestingly, an Islamic account is also available which is 100% compliant with Sharia law. All Muslim clients can benefit from Tickmill’s best trading conditions by opening Classic or Raw account and converting it to an Islamic type.

Classic Account

The Classic account is suitable for both novice and experienced traders and offers optimal trading conditions, ultra-fast order execution while enabling traders to use virtually any trading strategy. Traders can trade CFDs on a range of popular currency pairs, major stock indices, oil, precious metals, bonds and Cryptocurrencies on the Classic account, with variable spreads starting from 1.6 pips and no commissions.

Raw Account

The Raw account gives traders access to CFDs on 62 currency pairs, major stock indices, oil, precious metals, bonds and Cryptocurrencies, with fluctuating spreads starting from 0.0 pips. Traders pay a commission of only $3 per lot per side for FX & Metals only. Other asset classes/instruments are commission free.. Tickmill’s standard commission is one of the lowest in the world.

The broker charges no commission on CFDs on Stock Indices, Cryptocurrencies, Oil and Bonds.

Futures Account

Tickmill’s Futures account provides clients with the opportunity to trade real exchange-traded derivatives across 6 globally regulated Futures exchanges on the powerful CQG platform. The broker’s Futures and Options traders benefit from competitive commissions and dedicated client support.

Demo Account

Tickmill’s MT4/MT5 Demo account allows traders to experience the broker’s unique trading conditions, practice trading in real-time, test tools and strategies and sharpen their trading skills in a completely risk-free environment.

Tickmill Trading Platforms

MetaTrader Platforms

MT4 and MT5 are the world’s most popular CFD trading platforms, designed to give traders an edge in the market. Both are available under Tickmill’s suite of trading platforms and give traders full customizability and efficiency when trading CFD asset classes on their desktop, mobile device or the web.

- Advanced charting functionality

- Sophisticated order management tools

- Automated trading – Expert Advisors

- Real-time quotes in the Market Watch

- WebTrader works on any web browser

- Market tab to Buy/Sell trading algorithms

MetaTrader WebTrader

Trading is more accessible than ever with Tickmill’s MetaTrader Web Trader platform. It’s the same MetaTrader platform that you’re used to but is now available directly on your browser without the need to download additional software.

Key Features:

- Real-time quotes in the Market Watch

- Customizable price charts

- 9 different time frames

- Direct access through all modern browser

- 30+ Indicators

- Complete trading history

- Securely encrypted data transmission

Tickmill Trading Instruments

- Forex: Trade 62 currency pairs, including the majors, minors and exotics, with ultra-low spreads and fast execution.

- Stock Indices & Oil: Get access to major international stock indices and Oil with no commissions or requotes and no hidden mark-ups.

- Metals: Speculate on the price movements of Gold and Silver against the US dollar and diversify your trading portfolio.

- Bonds: Take advantage of the inverse relationship between interest rates and bond prices and leverage the stability of government treasuries.

- Cryptocurrencies: Get direct exposure to the world’s leading cryptocurrencies including Bitcoin, Ethereum and Litecoin.

- Futures and Options: Complement your portfolio with futures contracts to buy or sell an asset on a specific date at a specific price, through a variety of real exchange-traded products.

Tickmill Commission & Spreads

The broker offers probably some of the most competitive spreads in the industry. Here are some indicative spreads:

- Typical spread on EURUSD is 0.1 pips.

- WTI (XTIUSD) and Brent crude oil with typical spread of 4 pts.

- Futures and Options: Commissions from as low as $0.85 on micro contracts and $1.30 on standard contracts.

Tickmill Leverage

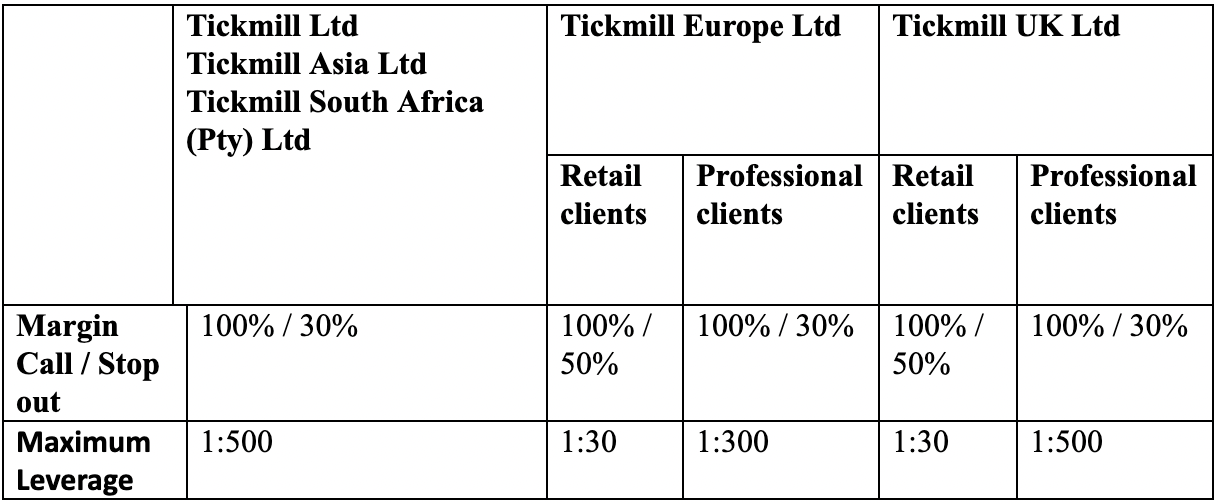

The broker offers separate leverage to retail and professional clients and this differs according to the entity they are registered with.

The below table outlines the margin requirements and maximum leverage allowances for each entity:

Tickmill Deposit and Withdrawal

The initial deposit is 100 (USD, EUR, GBP, PLN) to start trading with Tickmill. Traders can make payments through various credit/debit cards, bank wire transfers through popular online systems such as Skrill, Neteller. SticPay, FasaPay, UnionPay, PayPal and WebMoney.

All transactions (deposits, withdrawals, transfer of funds) take place via Wallets. Tickmill does not charge any transfer fees for using their deposit and withdrawal methods, but intermediary banks or eWallets may do so, which is beyond the broker’s control.

Tickmill Education and Research

The broker offers a comprehensive Forex blog with daily market insights, fundamental and technical analysis and expert articles in 10 languages. Tickmill’s range of educational material includes multilingual webinars, multi-themed video tutorials, eBooks and infographics.

Tickmill Customer Support

Tickmill support staff can be contacted through the live chat feature at the official site, by email or by telephone. Interestingly, the broker offers support in 16 languages (English, Arabic, Chinese, German, Indonesian, Italian, Korean, Polish, Portuguese, Spanish, Thai, Turkish, Vietnamese, Malay, Russian, Filipino) Monday-Friday 07:00 – 16:00 GMT during Daylight Saving Time.