Is it time to get your broker listed in London? We investigate IPO slowdown and why it will end in autumn

If this year has been a year of organic expansion and diversification of services among technology providers and brokerages, then the previous three years had masked such developments in the shadow of large initiatives by many companies across all sectors of this industry to become listed on public exchanges – mainly London Stock Exchange’s alternative […]

If this year has been a year of organic expansion and diversification of services among technology providers and brokerages, then the previous three years had masked such developments in the shadow of large initiatives by many companies across all sectors of this industry to become listed on public exchanges – mainly London Stock Exchange’s alternative investment market (AIM).

Companies including SafeCharge, the specialist payment solutions provider owned by Teddy Sagi which has many customers in the FX industry made the headlines after listing itself on the AIM in April 2014, raising $125 million.

Ultra-efficient retail FX firm Plus500 raised $75 million in its London stock offering in July 2013, shortly afterwards becoming a company with a low-touch, digital marketing-orientated approach to client acquisition with a market capitalization of $1 billion.

Since 2015, however, London’s stock exchange has fallen somewhat out of favor not with just the promient FX companies and service providers with high aspirations toward expansion by being listed on one of the world’s most prestigious and long standing venues, but with pretty much every industry sector.

At the beginning of 2016, FinanceFeeds predicted that this year would not be a year in which any IPOs would take place in the FX industry, instead mergers and aquisitions, along with diversification and concentration on improving relationships with banks and liquidity providers as well as ensuring the cost of operations can be lowered via use of technology and reform of execution models taking precedence.

It is beginning to appear, however, that the lull in IPO activity may come to an end as early as this autumn.

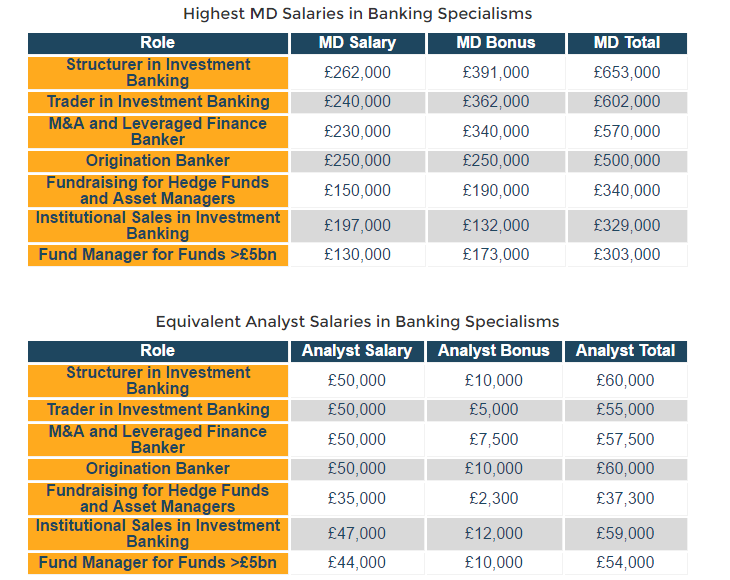

Whilst the interest in making such a move has not been displayed by any company in this industry at anywhere near the level that it was (pretty much at the top of many boardroom agendas) two years ago, research in London shows that mergers and acquisitions specialists, and private equity executives are being paid the very highest among all banking industry professionals, and certain companies are quietly positioning themselves very close to the banking experts.

CFH elected Dipak Rastogi on the board

During a meeting in London with CFH CEO Christian Frahm, FinanceFeeds learned that the recent appointment to the board of Dipak Rastogi, one of the world’s most prominent private equity and venture capital experts – Mr. Rastogi is CEO of Citigroup Ventures – was a strategic move as CFH is looking to buy specialist firms. This strengthening, along with its alignment with such a top level professional, could pave the way for further expansion and as the company is very prominent in London, places it very well for a future public listing.

Whether the company will go down that route or not is yet unknown but certainly it is strengthening its position.

London is the place for M&A executives within the largest FX dealers in the world

Supply and demand is very much a part of London’s salary landscape, and among the highest paid these days are not traders, but compliance officers and private equity specialists, further hinting at the requirement for such services as firms now look once again to expand.

Ensuring that compliance and regulatory changes are adhered to is a challenge in itself these days, as compliance executives need to understand the technological topography of today’s brokerages and reporting systems in order to ensure that they toe the correct line, and toeing the correct line is one of the most important criteria for those wishing to list on the London Stock Exchange.

Crowdsourced pay data resource Emolument shows this interesting dynamic in recent research.

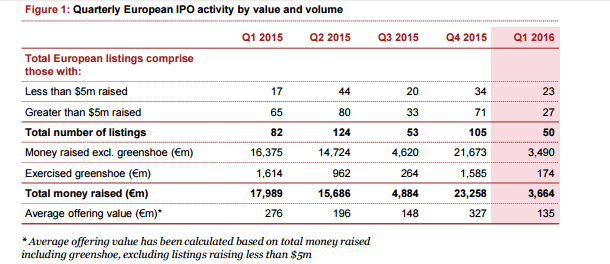

PriceWaterhouseCoopers published an IPO report for the first quarter of this year, showing a massive decrease in the number of IPOs across all sectors, 3.5 billion in IPO proceeds having been raized in the first quarter of the year, a dramatic 79% drop from the first quarter of last year, where it stood at 16.4 billion.

Only 50 IPOs took place across all industry sectors in the first quarter of the year, compared to 82 in the first quarter of 2015, however it is clear that the increase in requirement by firms for specialists in orchestrating corporate growth, plus the fact that with regard to the slowdown in IPOs, London has been affected far less than mainland Europe, a recovery will likely take place in the third quarter of this year.

The only caveat is the outcome of the forthcoming referendum on Britain’s position as a member of the European Union, not for any political or economic reason in this particular case, but because Deutsche Boerse is currently engaged in a merger with London Stock Exchange, the terms of which have been the subject of some degree of wrangling with regard to where the newly created entity would be headquartered, and if Frankfurt will take the reins.

With one month to go before the referendum, a clearer picture will emerge before the beginning of the third quarter of the year, however it is apparent that an upturn will occur during that period.

Photograph: London’s prestigious Square Mile once again looks toward IPO activity. (Royal Exchange buildings, copyright FinanceFeeds)