Tough break for the SEC with NYSE outage

By Jeffrey O’Connor, Head of Market Structure, Americas, at Liquidnet.

Two weeks ago, we saw somewhat ironic timing with the NYSE opening process interruption in conjunction with the start of the winter Securities Trader Association events circuit. There were two high profile events for the cooperative — one in Chicago and one in Baltimore — each with plenty to discuss. The focus, however, quickly turned to exchange stability, particularly in light of pending market structure change proposals that would equate to the biggest shift since Regulation NMS was implemented in 2005. Not the least of these proposals would be the Order Competition Rule, or the proposal to move retail orders to the exchange for execution rather than through the current PFOF structure routing to the wholesaler internalizers. This could perhaps lead to a closer look into the type of messaging this will entail and the operational load that will have to be consumed.

There hasn’t been much out there as we still largely reside in the digestion period, which might be akin to a python taking down an antelope and many would point to the typical comment period of 60-90 days not being applicable or sufficient here. We’ve had some commentary and questions from the STA, a group of senators, and some professorial opines but largely it has been quiet, particularly from the wholesalers who are arming up in a whole host of ways at the moment. We can expect this to heat up late February and into March.

The timing of the NYSE outage is particularly interesting as the crux of investor confidence revolves around reliability, particularly operational capability. So while the timing of the NYSE interruption last week is unfortunate for the exchanges as they and the regulators work to move flow back to their venues, the messaging load of proposed initiatives is worth highlighting.

The STA pointed out in December that FINRA CAT reported having processed an average of 296 billion records per day across U.S. equity and options markets. Details seem opaque in regards to the upgrade in capacity load that may be needed but it is safe to say that introducing auction, auction alerting, order entry, and execution messaging will be FINRA CAT reportable events. These will be complicated relative to the current structure of Broker A sending order to Broker B and receiving a price back. Ports and networks that traffic the messaging have finite capabilities and a stress here can bring concern — not the least of which is conversation fodder for a group of industry participants with nametags huddled around a makeshift hotel bar.

The roots of the NYSE disruption appear to have been at a Chicago data center and possibly even a simplistic, Homer Simpson-esque human error. The episode caused the cancel of thousands of trades and erroneous prints where the opening auction process failed and the imbalance caused a print outside of the confines of an orderly market. This had the tertiary effect of reducing overall volumes and volatility significantly relative to the recent patterns. In general, not a good look in the midst of major market structure proposals, particularly where an exchange’s response and economic responsibility can be scrutinized. Even the smallest of outages damages confidence to an extent that is tough to measure.

With this in mind, it’s a good time to discuss the SEC proposals again and map out the points and counter points:

- Enhance Order Competition (exchange auction proposal). This is easily the most controversial and simultaneously the least likely to see adoption. The aforementioned NYSE outage highlights a few arguments here:

- The retail wholesalers currently agree to take “held” order types from the brokers, i.e., guaranteed execution. What happens to liquidity when the liquidity isn’t there at auction and the wholesaler no longer is in agreement to guarantee execution?

- How burdensome of an implementation process will arrive (considering technology and compliance costs)?

- How prepared are the exchanges to take financial responsibility for errors? Can the system handle the messaging load?

- The 1% ADV Threshold actually reduces the list of eligible venues and exchanges capable of offering a market once going to auction

- If an auction were to exist, wouldn’t best execution dictate which venue is better rather than forced venue participation?

- Tick Size and Access Fees. Not an easy pass through itself but this measure has shown early bi-partisan support although it would still constitute a dramatic change and difficult implementation. The wholesaler response here will most certainly be an extended litigation exercise once the official comment period ends. Three notable efforts here:

- Adopt minimum variable pricing increments (MPIs)/tick sizes for quoting and trading NMS stocks, adjusted by name quarterly based on typical or average trading metrics).

- Reduce access fee caps from 30mils to 10mils (lower in some circumstances).

- Introduce new odd-lot best bid/offer benchmark.

Again, this is largely an effort to move retail executions to on-exchange from off. In theory, harmonization — an STA even key buzzword — tick sizes, and quoting across all venues should increase competitive forces on that execution and including the odd/lot transparency can add to the liquidity picture. There are several drawbacks, however, including:

- The wholesale marker will be forced to trade at these tighter levels and will see a margin/profitability dent both in the spread opportunity and the exchange rebate to offset a take fee (typically 30mils take, 28mils rebate), sparking the question: Will less profitability for the wholesaler alter the PFOF structure and ultimate lead to a re-snap of retail broker commissions?

- Will the liquidity disincentive actually work to widen spreads and eliminate liquidity providers?

- As previously stated, current structure guarantees automatic execution — will new structure eliminate the liquidity wholesalers provide?

- By ultimately providing less liquidity at a price point, what relevance does the NBBO provide for institutions looking to execute sizeable orders?

- Is added volatility at price levels, less size, complexity in MPI adjustments, and added messaging load going to be too disruptive to a system which already enjoys significant efficiencies?

- Best Execution. While this would seem to make sense to maintain a fair market and best customer execution, FINRA already laid out best execution policy. Therefore, this can be viewed as the SEC’s first official recognition. Do multiple regulatory bodies addressing the same issue cause confusion or lack of cohesion as they set policy on essentially the same rule? Who enforces? Since the SEC addressed this in practice with 2005’s Reg NMS, is it worth $700mm (as estimated by the SEC) to implement and run? Likely highly debatable and offering enough legal counter to implementation. To understand the SEC’s perspective here, it’s worth looking back at Reg NMS, in particular, where there are outdated rules as it applies to retail order flow on page 72:

“Moreover, the Commission has not interpreted a broker’s duty of best execution for retail orders as requiring that a separate best execution analysis be made on an order-by-order basis.149 Nevertheless, retail investors generally expect that their small orders will be executed at the best displayed prices. They may have difficulty monitoring whether their individual orders miss the best displayed prices at the time they are executed and evaluating the quality of service provided by their brokers.150 Given the large number of trades that fail to obtain the best displayed prices (e.g., approximately 1 in 40 trades for both Nasdaq and NYSE stocks), the Commission is concerned that many of the investors that ultimately received the inferior price in these trades may not be aware that their orders did not, in fact, obtain the best price. The Order Protection Rule will backstop a broker’s duty of best execution on an order-by order basis by prohibiting the practice of executing orders at inferior prices, absent an applicable exception.” (Source: Excerpt from page 72 of 2005’s Reg NMS)

While FINRA already officially outlines Best Execution, the SEC’s standard is maintained through the trading rule itself. The Order Protection rule specifically and seemingly satisfies concerns on a broker/dealer not executing an order at the most optimal price for a customer. While the details of Reg NMS point to a retail customer expecting the best displayed price, the reality is, in the structure of PFOF, the retail customer is typically getting better prices than an institution would. The transparency of Rules 605/606 raises the competitiveness for these executing broker/dealers — if your performance is not there you will not get the flow.

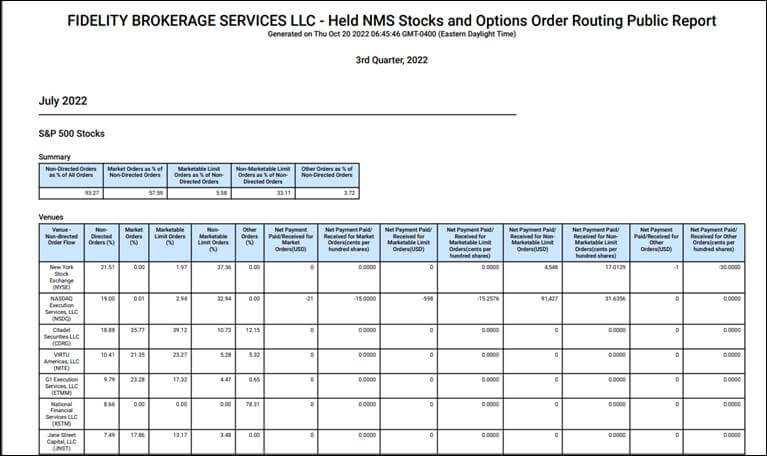

Below is Fidelity’s most recent Rule 606 filing. All retail brokers, like Fidelity, are required to provide their breakdown and the “held” orders sent to their wholesalers are included. Citadel Securities received 18% of the flows in this time study, Virtu received 10%, in addition to some of the smaller players listed below. Pure economics dictates who is receiving — who can price improve the best? If Citadel Securities is price improving the best, they likely have the best mark outs in Fidelity’s studies of execution quality, then Citadel Securities wins the order flow and it is their order to handle however they please.

Source: https://clearingcustody.fidelity.com/app/item/RD_13569_21696/sec-rule-606.html

- Execution Transparency Disclosures. The SEC’s proposal to refine the aforementioned rule 605. Likely offering the least controversy — and potential success for implementation — as it offers modernization of reporting and the ultimate goal of improved transparency. As alluded to above, the natural competition can get enhanced through this as broker/dealers further prove their worth. This would seem to be a logical step and so far there have been few rebuttals.

About Liquidnet

Liquidnet is a leading technology-driven, agency execution specialist that intelligently connects the world’s investors to the world’s investments. Since our founding in 1999, our network has grown to include more than 1,000 institutional investors that collectively manage $33 trillion in equity and fixed income assets. Our network spans 46 markets across six continents. We built Liquidnet to make global capital markets more efficient and continue to do so by adding additional participants, enabling trusted access to trading and investment opportunities, and delivering the actionable intelligence and insight that our customers need. For more information, visit www.liquidnet.com and follow us on Twitter @Liquidnet.