TP ICAP registers 17% Y/Y rise in revenues in Q3 2019

Institutional Services revenue grew by 38% in the quarter to end-September 2019, on the back of new hires and expansion of client base.

TP ICAP PLC (LON:TCAP) has earlier today provided a trading update for the quarter to September 30, 2019, with revenues registering a rise from a year earlier thanks to favourable market conditions.

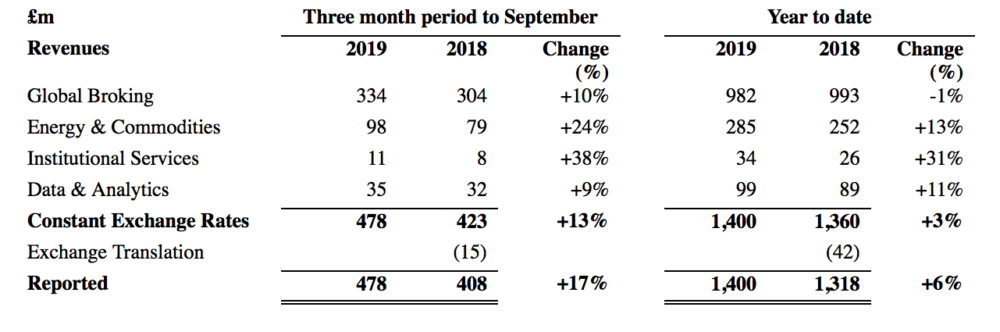

Revenue in the three months to end-September 2019 amounted to o£478 million, up 17% from the £408 million in revenues reported for the equivalent period a year earlier and 13% higher on a constant currency basis.

During the January to September period revenue was £1,400 million, up 6% than the £1,318 million revenue reported for the equivalent period last year and 3% higher on a constant currency basis.

Global Broking revenue grew 10% in the third quarter of 2019 from the equivalent period last year and was 1% lower in the first nine months of 2019 with strong performance in Rates offsetting weaker performance in Credit and Equities.

Energy & Commodities performance was very strong and revenue grew 24% in the third quarter of 2019 relative to the equivalent period last year and 13% in the nine months to end-September 2019 as a result of selective hires and recent acquisitions, with encouraging macro conditions across the majority of our Energy & Commodities products, especially oil.

Institutional Services revenue grew by 38% in the third quarter relative to the equivalent period last year and 31% year to date as the segment continues to benefit from new hires and expansion of its client base.

Data & Analytics revenue rose 9% in the third quarter against a strong prior year comparative period and 11% year to date on the back of strategic initiatives to launch new products and deepening its client relationships.

In terms of outlook, TP ICAP reiterated its previous guidance. In the face of the robust performance in the third quarter, the full year guidance of low single-digit revenue growth on a constant currency basis for 2019 remains unchanged.

The company also highlighted current geopolitical uncertainties which may have an impact on transaction volumes in the fourth quarter.