TP ICAP registers rise in revenues in 2019 as Institutional Services business has good momentum

The Institutional Services business had good momentum with full year revenues of £75 million, up 23% on a reported basis compared to 2018.

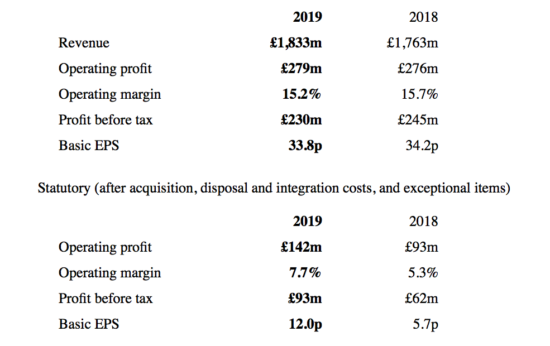

TP ICAP PLC (LON:TCAP) has earlier today posted its results for the year ended December 31, 2019. The Group says it improved its underlying and reported operating profitability, despite the mixed geopolitical environment, whilst completing successfully the ICAP integration program.

Group revenue amounted to £1,833 million in 2019, up 4% on a reported basis (1% at constant currency).

Global Broking revenues fell 1% on a reported basis (-3% on a constant currency basis) with Rates division growing by 3% on reported basis (+1% on constant currency basis). Conditions in credit markets continue to remain challenging, with a number of new competitors, lack of new issuance as well as restrictions on clients’ balance sheets, resulting in a reduction in Credit revenue of -7% on a reported basis (-10% on a constant currency basis).

Equities and FX & Money Markets both saw revenue declines of -5% (-7% on a constant currency basis) and -3% (-5% on constant currency basis) respectively compared with prior year due to subdued client activity on lower volume and volatility

Energy & Commodities revenue grew 15% on a reported basis (+11% on a constant currency basis) compared to 2018 on a reported basis due to a combination of positive markets, strategic hires and the acquisition of Axiom at the end of 2018.

Institutional Services revenue has grown by 23% (+21% on a constant currency basis) compared to 2018 at reported basis. The business performed well in its core products with higher client appetite in relative value execution, FX, listed derivatives, and cleared interest rate swaps. This was led by client demand resulting from changing market dynamics as investment banks reorganise their sales coverage teams.

Data & Analytics revenue was 15% higher than 2018 at reported basis (11% at constant currency basis) with the business executing a number of targeted organic growth opportunities during the year that have enabled it to monetise more proprietary data by releasing a higher number of new products with a larger salesforce. In addition, the division continued to win a number of new clients across hedge funds, sovereign wealth funds, market data vendors and independent software vendors.

Regarding operating profits, Global Broking reported a fall in underlying operating profit to £221 million. This reflects higher front-office costs reflecting higher compensation ratio as a result of increased retention efforts, as well as increased clearing and settlement costs due to vendor cost increases. Moreover, other costs rose due to ongoing legal costs in the US, IT consultancy investments, Cyber and Risk & Compliance costs. Operating profit margin decreased 2.4 percentage points to 17.5%.

For Energy & Commodities, the underlying operating profit increased to £46 million. This was primarily driven by higher revenues, only partially offset by higher support costs. The underlying operating profit margin improved 2.4 percentage points to 12.0%.

Institutional Services improved its underlying operating profit to £3 million. The business has generated necessary scale to improve its profitability, with solid revenue growth. The underlying operating profit margin improved to 4%, 2.4 percentage point higher year-on-year.

Data & Analytics reported underlying operating profit of £59 million, up 20% from 2018 levels. The results were supported by strong revenue growth and positive operational leverage. As such, the underlying operating profit margin improved to 43.7%, 1.8 percentage points higher year-on-year.

The Board declared an interim dividend of 5.6 pence per share paid on November 8, 2019 and is recommending a final dividend of 11.25 pence per share to be paid on May 19, 2020 (with a record date of April 3, 2020).