Tradefora aims to enhance trade pricing transparency

As Tradefora goes live this week, we speak in detail to its developer, a senior FX industry executive, on why transparency between broker and client is a vital factor for sustainability in the retail sector

Ever since the influx of new, small to medium commercial enterprises entered the retail FX business in the middle of the last decade, a dynamic created by the melding of two business sectors previously unassociated with the financial and electronic trading business, those being third party platform development and affiliate marketing networks, there has been a lot of dialog about ‘transparency’ within retail OTC derivatives trading, and in many cases, the need for more of it.

Whilst some fourteen years have passed since MetaQuotes Software Corporation launched the now completely ubiquitous MetaTrader 4 platform, the FX business remains completely unique and an absolute enigma by comparison to other technology-dependent business sectors or e-commerce categories, mainly because absolutely no other industry in the world has relied on one particular software platform for two years, let alone almost a decade and a half.

To look at why transparency is needed and has become something of an elephant in the room, it is important to dissect the component structure of many small to medium FX brokerages, and the system upon which their entire business is dependent.

MetaTrader 4 was initially not designed as a trading platform that would provide access for retail traders to a live, global currency market. Its original structure was as an intended means for small and newly established companies with no former capital markets experience to operate customer acquisition and retention businesses based on lead buying and affiliate marketing, with trades executed in house on a dealing desk which was provided with the back end software as an integral part of the MetaTrader system.

Thus, it was the gateway to market for a vast number of former online gaming firms, lead conversion and customer acquisition businesses which had massive experience in making return on investment from customer deposit and digital campaigns, a means of one software firm owning the IP of 85% of the world’s retail brokerages and in the end, a need for specialist platform integration companies such as PrimeXM, oneZero and Gold-i to develop extremely sophisticated liquidity management systems and bridges which adapted the platform and its internal infrastructure to be able to connect to a live market.

In short, its original intention had as much to do with modern FinTech or electronic financial markets as the Harrier Jump Jet has to do with a horse.

The widespread adoption and reliance on MetaTrader, however, resulted in an over saturation and over familiarity with a single trading platform by users who had never traded any markets on a proprietary platform with any of the large, established retail FX companies of New York or London. This meant that in some respects, brokerages had ‘educated’ an entire generation of new traders who had previously had no exposure to electronic markets, to use one platform type.

Thus, with trades now able to be sent directly to liquidity providers, in some cases non-bank and prime of prime, and in some cases direct to Tier 1 interbank dealing desks, the MetaTrader platform will continue to dominate, however with the lack of will to invest in developing a proprietary trading system in order for brokerages to own their own intellectual property and develop detailed relationships with loyal traders, the similarity between the 85% of the market that is offering MetaTrader platforms has resulted in a very stiff competition from every corner of the world, and an easy on and offloading of clients to other MetaTrader brokerages.

The concentration has been on client acquisition costs, rapid replacement of clients with a low lifetime value and in some cases churning. This has taken the focus away from transparency and analytics, which are vital in order to develop longstanding loyalty among customers.

Now is the time for the FX industry itself to enter the age of price and execution enlightenment

Over the past few months, some specialists in the retail FX industry have begun thinking very carefully about the type of analytical tools and trade verification solutions that are needed by brokers and clients, and they are now coming to fruition.

This week, FinanceFeeds spoke to FX industry veteran and highly experienced senior executive Pavel Khiznhyak at his office in New York, where a new system for traders and brokerages to check every aspect of their trades from execution method to execution quality, to price accuracy and slippage, on a real time, millisecond-precise basis.

“We need to make every aspect of the trading experience and trading cycle accessible to end clients as much as possible” said Mr Khiznhyak as his new venture, Tradefora, went live this week.

“Currently, Tradefora has a patent pending in US, and we would like to expand its remit from its current function as an industry standard suite of complete analytics for the retail OTC FX business and its clients, into other markets and asset classes too” he explained.

Tradefora is an enterprise standard, stand-alone system which provides real time analytics to traders, who can compare spread, slippage, pricing and accuracy of all retail FX brokers in the market, as well as perform granular cross checks on their own trades that are executed on any account with any broker that they are clients of.

As far as functionality is concerned, FinanceFeeds took a brief initial look at the product.

Rather unusually, Tradefora has it own Expert Advisor (retail trading euphemism for automated trading robot) which can be connected to a retail trading account with any broker. This is very much not the norm among analytics software, and Mr Khizhnyak considers it an important component as it “picks up unnecessary ‘hidden’ costs from IBs and brokers.”

“For example, when developing Tradefora, one of the main considerations was that there needs to be a solution for brokers and traders to measure the differences among market participants. We have the technology for brokers to enter price feeds to test their latencies compared to other brokers. Brokers often lose a lot of money via latency that gets picked up by scalpers” – Pavel Khiznhyak, co-Founder, Tradefora.com

Mr Khizhnyak understands that aspect of the market well. Whilst embarking on the development of Tradefora in 2015, to bring it to market three years later, he was a Board Member of Global Market Index for two years, and had spent a significant amount of time at senior level at Forex Club, where he was Greater China Country Manager and VP of Institutional Sales as well as being on the Management Board, marking out his 10 year tenure at the company.

“The system monitors slippage and spread on a real time basis between all MT4 brokerages, and we believe that this is the very first Expert Advisor (EA) system that monitors execution” said Mr Khizhnyak

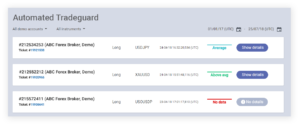

“One of the important features that I would like to emphasize at this stage is Auto TradeGuard. Once the EA is downloaded and running, all trades get real time analytics. All trades from all accounts at all brokers connected to it are listed. You can see execution quality and click “details” and it shows the execution details and over fifteen metrics that relate to the execution of a trade” said Mr Khizhnyak.

Market Comparison

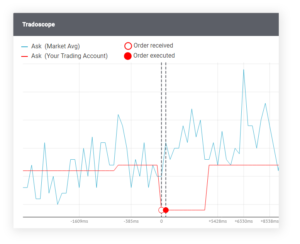

Within the Tradefora system, there is a Market Comparison section. This shows the dollar value of every trade executed. “There are three charts used to break down every trade” said Mr Khizhnyak. “The first two are market prices vs broker ask price. This is how traders can tell if brokers are manipulating the price, or adding extra spread, or even worse, making their own prices internally” he explained.

“When the comparison’s time indicator shows zero milliseconds, that relates to time stamp of when your trade was executed. We then go back in time to see how the price was behaving before that” said Mr Khizhnyak. “The market average price is taken from our composite index. There are more than 100 brokers that we get the pricing from and there is no limit as to how many brokers we can support” he said.

“The second chart is more visual. In this section, we can see where the trade was placed, and full metrics of all execution details are there.”

“Tradeoscope is the final chart, and this has been developed for a specific reason. In my opinion, it is the most interesting chart in the product right now. We can see how the broker was quoting whilst the trde was pending. Some brokers that are still using a manual dealing desk can see the price, and when a price goes against the client, order gets executed and you can see if a broker increases spread to make the trade go in their favor. Brokers will no longer be abe to do this as it will show up and a client can see how long a broker waits (broker delay time) before executing the trade” – Pavel Khiznhyak, Founder, Tradefora.com

“This particular facility, whilst helping traders identify disingenuous behavior from a broker, is also of great value to brokerages. This is largely because quite often, if a trade gets executed and a trader does not believe in the outcome, often the trader will blame the broker. I worked for brokers for 13 years so I saw both sides of the spectrum. We have a tool called “Trade Timeline View” with which can show factors such as delays in execution due to internet access/network latency, and can measure connection speed.”

“This way we can see the network speed in milliseconds, the client now knows that out of the overall time to execute, the delay was only, for example 79ms on his own internet connection, and 250ms on the broker side. In a situation such as this, a broker can be taken to task for latency with granular figures to back up such a claim. On the contrary, with the same tool a client may discover that the major part of the execution latency is attributed to his/her own network delays and has very little to do with the broker.” said Mr Khizhnyak.

Mr Khizhnyak then showed the “Automated Trade Guard” function. This shows real time execution and gathers data that can be used as historical information for traders that have used Tradefora over a period of time. It will go over all historical data which is pulled into Automated TradeGuard” said Mr Khizhnyak.

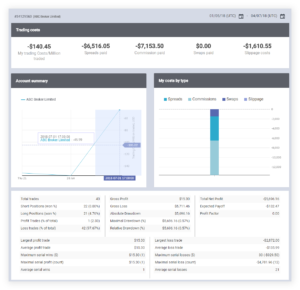

“In this section, traders can view every transaction per category, and also an aggregated view of all accounts, or individually on a per-account basis. Traders can see spreads, and positive and negative slippage on a totally impartial basis, with the cost of trading being displayed by type, such as spread, commission, swapps and slippage” he explained.

Some IBs are trading around 90,000 lots per month on behalf of clients, especially in South East Asia. This system will allow clients of those IBs who are trading their accounts often automatically, to see if they are being charged a higher commission than agreed.

Currently the account summary that Tradefora provides is mainly based on MT4 analytics but charts it in a user friendly manner. The Tradefora system automatically measures the connectivity speed from the trader’s PC to the broker’s server, and can check average execution speed of broker on aggregated and on individual trader’s levels. Many brokers advertsieadvertise “lightning speed execution”, and other such unsubstantiated claims. However, even with the fastest and trained human eye (a professional goalkeeper, for example) you can only catch events greater than 200 milliseconds. So anything faster than 200 ms is simply humanly impossible to track without specialized tool. And as we know, 200 ms can be an eternity during fast moving markets. , Now with Tradefora’s TradeGuard you can actually measure down to the nearest millisecond exactly how fast that so-called “lightening speed” actually is.” Pavel Khizhnyak, Founder, Tradefora.com

“FX brokers with institutional price feeds get price updates 5 – 10 times per second, or at approximately 100 millisecond intervals” said Mr Khizhnyak. “Thus, many traders cannot see or imagine millisecond precision, and the market can move 10 ticks in that time. Without millisecond precision, its not really a good measuring practice” he explained.

“We syncronize our server to the client server and then offer millisecond measurements” he said.

Execution Metrics

Many brokers are still hesitant to publish genuine execution data and there is no way of knowing what that true data really is” said Mr Khizhnyak.

“This makes traders often come back to the same question. When different clients from the same broker get totally different execution, and pricing, we want to personalize it so that we can see what your broker is giving you. Traders can now see the ratio between positive and negative slippage. The truth is – slippage in itself is not smth bad, it’s an integral part of any market execution.”

“What’s bad is when the brokers are unable to offer asymmetrical slippage and traders end up seeing much more negative vs. positive slippage. Positive slippage is also hard to measure, because for most traders greed wins over fear, cause them to use stop loss orders much more so than the take profit ones, so the trader sees the negative slippage for the most part as a byproduct” he said.

Brokers and traders can check, leading to longevity

“Our Manual TradeGuard is the same thing as the Automated TradeGuard in principle, however it differs in the respect that it allows users to experiment with different trades that they may have made in the past even prior to installing Tradefora EA and see if they are executed within an acceptable market price range or not” said Mr Khizhnyak. “Traders can select any broker. They can see in this function exactly where the market average price was at the time and where the trade was executed in respect to that market average” he said.

“There are some ancillary tools including ‘Spreads’, Swaps’ and ‘Commissions’ sections for clients to be able to easily cross reference svisible trading costs between different brokers. We currently support 1540+ instruments but and will be adding more going forward. and the brokers and their spreads are All of this data is being listed in real time” he said.

“For brokers, we try to separate brokers by account type, as many brokers, depending on which market they operate in, have different account types. For example, it would not be relevant to compare institutional account types to others as they have different terms hence we know that any comparison has to be kin to comparing apples to apples” said Mr Khizhnyak.

“With regard to swaps, our system makes it much easier to collect swaps in the denomination that traders want them to be shown in thanks to our built-in swap converter. Traders can see which broker has the best positive swap, or has the highest negative swap on the long trade on EURUSD, for example. In our Commissions section, we are constantly updating this and spending more time on it. There is currently a broker cost section, where we can compare brokers’ average, min and max spreads and cross-reference that with Tradefora Average Market Spread by instrument. We can also see the spread adjust to take into account commissions. A lot of retail clients don’t understand that when they see raw spreads quoted by a broker, that doesn’t necessarily mean the trade is raw at all, as additional costs may well have been packaged in. Tradefora now allows traders to be able to see all types of hidden commissions this way – Pavel Khizhnyak, Co-Founder, Tradefora.com

“A lot of retail clients also don’t always see that it is normal for spreads to widen during market opening and closing hours. Watching these movements, however, is a good measure of whether a broker is giving proper market prices, and it allows traders to compare the market too” he said.

“Overall, the system helps brokers to explain those situations to clients, and it helps traders to avoid trading during opening/closing hours due to lower liquidity and high spreads” explained Mr Khizhnyak.

“Our Instrument Quotes chart helps to evaluate the quality of the price vs the composite index” said Mr Khizhnyak. Traders can see the price ticks right on top of each other, this is a sign of no deviation and a solid price feed. If there are visible discrepancies, then there is something wrong with the price feed and maybe it’s a good idea to have a conversation with your broker about it before you embark on live trading on that feed” he said.

“Traders can compare bids vs asks. Many traders do not understand why a trade was not executed at the price that was not indicated on the chart provided by a broker inside the trading platform, for example, and there can be many reasons for this. For example, sometimes a broker shows ask price only, thus Tradefora will display exactly what the real price is” said Mr Khizhnyak.

“To conclude, I would say that just like in any other market there are dishonest brokers and also dishonest clients and we have plenty honest market participants as well. It is not really genuine for a broker to say “we offer best prices or execution” for example, as that cannot be substantiated, hence Tradefora is a method of bringing total transparency to the OTC space and letting everyone including brokers and clients enjoy it much more with much less trade related disputes” he said.

“This is the first step in the product’s evolution. We have many more features in store and a lot of traders will be able to take advantage of that. Currently, we offer the service in English, Russian, and Chinese languages and are focusing on those markets as we get through the BETA stage and then open the service for everyone we will add more languages and more great new features” he said.

“It is invite only access for now, however eventually we will open up the big data and machine learning system for everyone once we are certain of absolutely reliable operation” said Mr Khizhnyak.