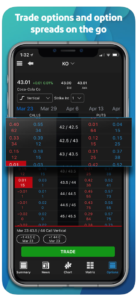

TradeStation mobile app shows Open Interest in Options chain

Traders can also access Probability ITM, OTM, BE & Theoretical value directly from the Options chain.

Online trading services provider TradeStation has been pretty active in updating its mobile solutions. A couple of days ago, the latest version (4.2) of TradeStation’s mobile app for iOS devices was released, with the improvements targeted at options traders.

Open Interest is now available on the Options chain. Users can also access Probability ITM (in the money), OTM (out of the money), BE & Theoretical value, which are all available directly from the Options chain.

In addition, TradeStation’s newly updated symbol search tool now incorporates volume into the search results, which will help users quickly identify the most active stocks directly from their search. It is also more predictive and will make life easier when traders are looking for their favorite company ticker. The enhancements to the symbol search tool were released about a week earlier in TradeStation’s mobile application for Android devices.

In addition, TradeStation’s newly updated symbol search tool now incorporates volume into the search results, which will help users quickly identify the most active stocks directly from their search. It is also more predictive and will make life easier when traders are looking for their favorite company ticker. The enhancements to the symbol search tool were released about a week earlier in TradeStation’s mobile application for Android devices.

Earlier this month, the iOS app got equipped with extra five popular chart studies that provide more detailed analysis on charts. The company has added the following studies: VWAP, Momentum, Price Channels, Time Series Forecast, and Moving Average Weighted.

The preceding couple of updates to the solution have been focused on the positions page. In late April, the broker added multi-selection on positions to the app. This enables users to close option spreads directly from the positions view. The preceding version of the application grouped Options and Futures with the underlying/root symbols. In addition, Open P/L is streaming, and the traders’ total profits are summed to show how their overall portfolio is doing.

The frequent updates that TradeStation makes to its mobile applications can be easily explained by the type of clientele the broker is targeting. In a recent FinanceFeeds’ interview, John Bartleman, President of TradeStation, said that in order to expand to a retail audience, web was important. That is why the broker added Matrix, trading news and its Trader Concierge to actively push data to customers.