Trading.com Markets Inc gets NFA registration as Forex firm

The brokerage, formerly known as Trading Point US Inc, has been approved as Forex Dealer Member of the United States National Futures Association.

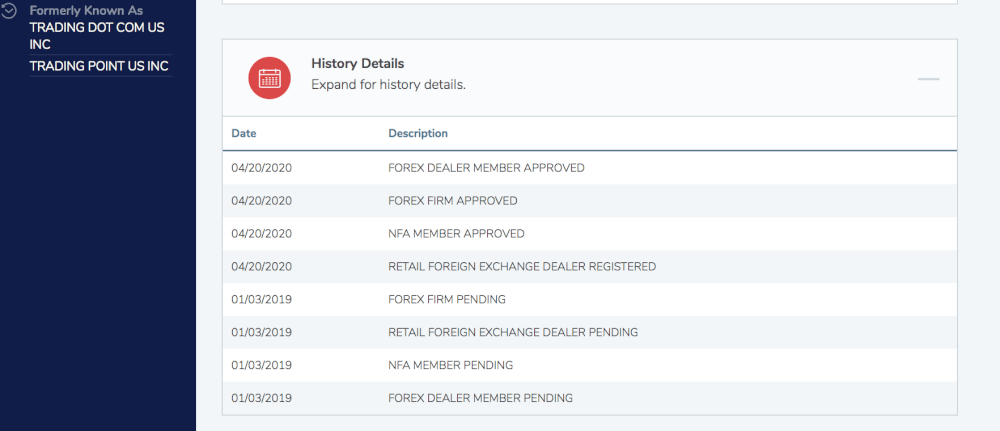

It has been more than a year since FinanceFeeds reported that Trading.com Markets Inc, formerly known as Trading Point US Inc, was heading back to the United States. There has been some development on this topic. FinanceFeeds’ research shows that the firm has secured a raft of NFA registrations, dated April 20, 2020.

As per the BASIC system of the National Futures Association (NFA), Trading.com Markets Inc has been registered as Retail Foreign Exchange Dealer. The firm has been approved as NFA Member, Forex Dealer Member, and Forex Firm.

The business address of the firm is:

85 Broad Street

18th Floor

Room 054

New York, NY 10004

United States.

There are nine listed principals, including CEO Charalambos Panayiotou, a name familiar from Cypriot FX broker XM.com.

This marks some interesting development in the US retail FX market. Let’s recall that, in February 2019, online trading major IG Group Holdings plc (LON:IGG) announced the launch of IG US, its US-based subsidiary offering foreign exchange trading.

“At IG we pride ourselves on championing the client, I am excited to bring that same focus to serve the United States market,” said June Felix, IG Group CEO. “We see this initiative as a significant growth opportunity and we’re excited about IG’s future in the US.”