How trading platforms help brokers onboard and retain traders – Guest Editorial

Devexperts explains how the DXtrade trading platform re-defines marketing tactics for FX brokers

By Evgeny Sorokin, SVP of Software Engineering at Devexperts

In this day and age, a viable and creative marketing strategy is a must for Forex brokers. With competition on the FX market being sky-high, it’s vital to set your firm apart and offer your traders a more targeted and enjoyable trading experience.

Using advertisements and social media to hard sell and hype your brand may have been a lucrative tactic five to ten years ago. That’s no longer the case. These days traders trust their peers more than ads. In this respect, brokers have to rely on their product speaking for itself.

Here is how the DXtrade trading platform helps you retain traders and differentiate your brokerage.

Onboarding right at registration

Your chances of losing future traders are always highest at the registration stage. When visitors face a seemingly endless list of KYC questions immediately after hitting “Sign Up”, it may discourage them from completing their registration altogether. While KYC procedures are mandatory regulations, it doesn’t mean brokers can’t make this process more engaging for their future traders.

With DXtrade, brokers can configure a registration form to open in a pop-up window over the actual working platform. Being just one step from trading, traders will feel encouraged to complete their registration. They’ll also be more motivated to open an account when the trading tools they’ll use are right in front of their eyes.

Brokers often use KYC to segment their client base and understand how skilled and experienced their new traders are. And brokers almost never use this information to their benefit. A great solution is to show traders predefined layouts based on their experience level.

The Platform that Suits Each Trader

For FX brokers, the best marketing strategy originates from their product. With DXtrade, brokers get a sleek and a highly customizable platform interface that allows them to offer their traders multiple personalized layouts.

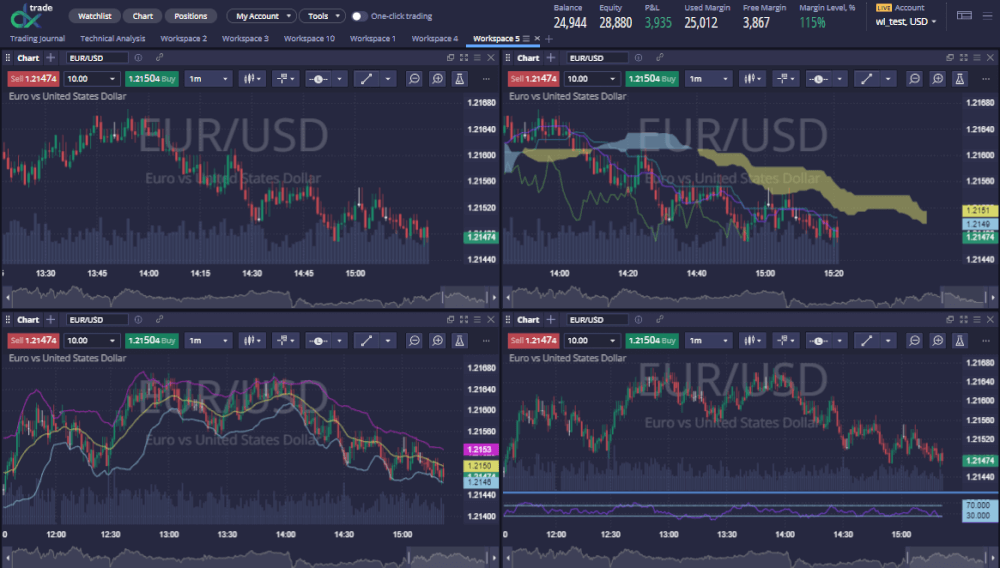

For example, you can set up a simple layout for newly registered or beginner traders. At login, this layout might contain just 3 basic widgets (Charts, Watchlist, and Positions) to help ease them into trading. To play it safe, you can even freeze the beginner layout, so traders won’t accidentally change it. You can also gradually introduce new widgets when your rookie traders become skilled enough to explore the full platform. Conversely, you can offer experienced traders another preset layout with additional widgets to set up their workspaces how they like.

If you have a group of traders heavily into technical analysis, you can offer them a layout just for that. Set up 2 or 3 workspaces with a focus on charts.

User Attrition Mitigation

Retaining traders is one of the trickiest challenges for brokers running their own trading platforms. A personalized approach can be the key to mitigating user attrition. The needs of beginner traders are not the same as those of large-scale traders, traders who dabble in analytics, traders who specialize in particular instruments, and so on. With DXtrade, you can offer each trader group a customized layout to suit their particular needs.

DXtrade also has useful tools that get traders more attached to the trading terminal and make them think twice before they consider switching brokers. Let’s have a closer look at the user retention tools.

Trading Experience Improvement with Performance-Enhancing Tools

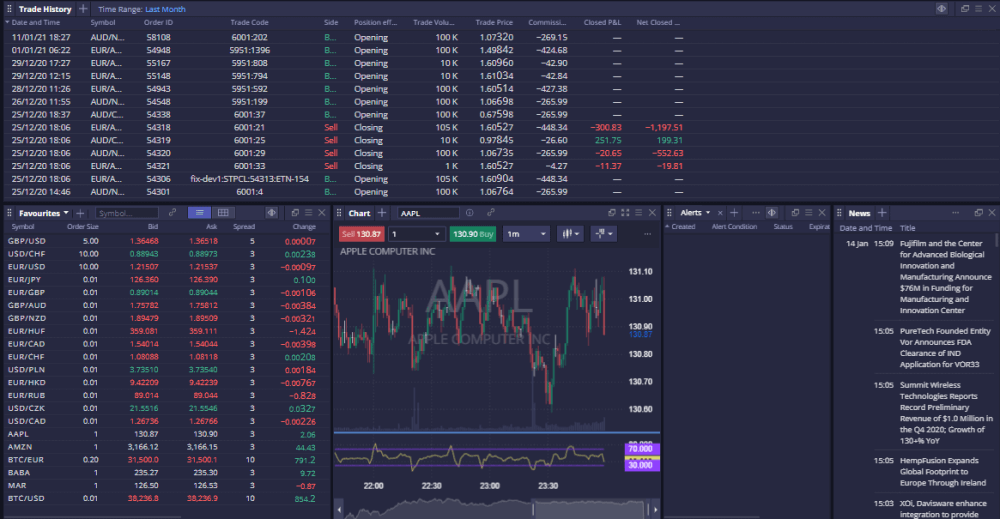

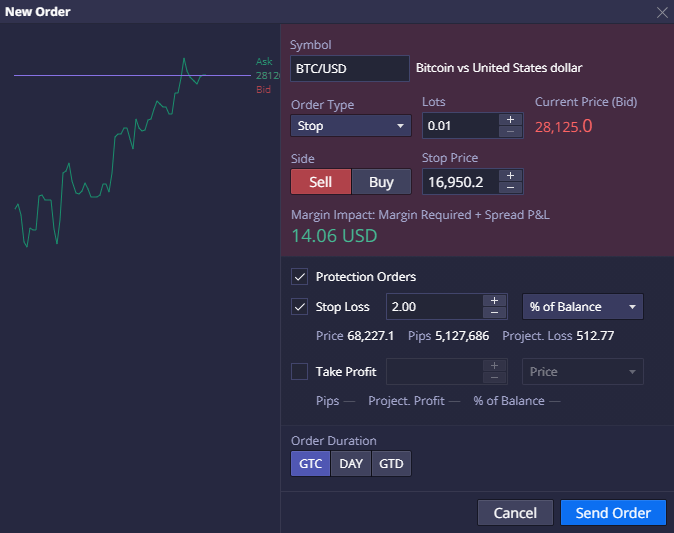

The DXtrade platform contains a suite of tools to improve brokers’ interaction with their client base and make their trading experience more enjoyable. The front-end tools available to traders include a charting engine with 90+ indicators, a Trading Dashboard to analyze trading performance, and versatile risk management tools. With DXtrade, users can trade from anywhere: for instance, by clicking on the market depth ladder to issue an order.

Traders are advised to risk no more than 2% of their account balance. DXtrade allows them to do just that. Traders can hedge their risks by setting Stops at 2%.

Trading Journal

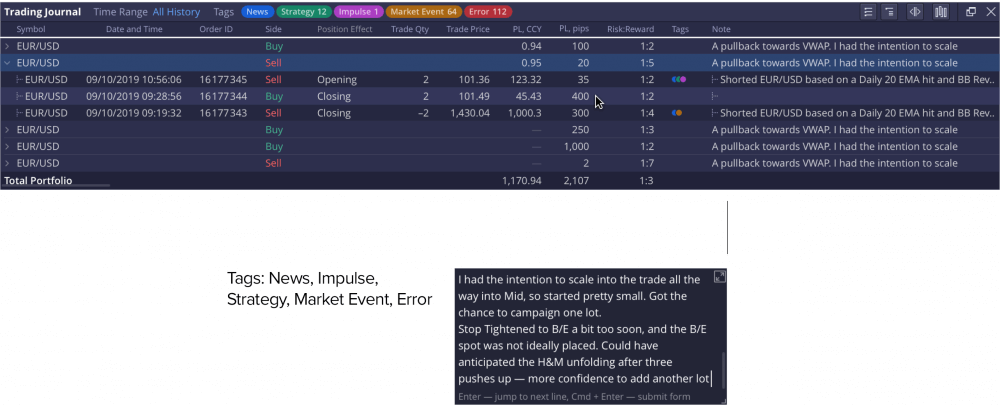

Many traders still track their performance in Excel spreadsheets (though it’s 2021 already!). Brokers often integrate a trading journal or a trading diary with their platforms. But these extensions are almost never part of the platform. They require traders to switch between apps and leave the platform.

The DXtrade Trading Journal is a seamless part of the platform. The trader’s actions are logged in the journal automatically. The only thing traders need to do is tag their trades. With Trading Journal, traders can tag their trades to remind themselves why they entered or exited a position, or to make personal notes. Traders no longer have to copy & paste every trade into a spreadsheet. This frees up time for actual trading!

Active Trader Rewards with Rebates

Rebates are a specialized DXtrade feature configurable with the broker’s back-end tool. Its purpose is to reward active traders. Rebates are paid out monthly for trades that took place in the preceding month. Brokers can set up rebates as tiers: the higher the trading volume, the higher the rebates. Tiered rebates encourage your clients to increase trading volumes and introduce new traders to the platform.

It is challenging for a broker working with legacy software to apply new settings to specific accounts. They have to create a new trader group from scratch. The DXtrade trading platform makes segmenting users much easier. If you think applying rewards to a select group of traders will be a pain, don’t worry. It’s never been easier.

Trading Experience Personalization with Account Groups

Account Groups is another back-end setting that can help brokers tailor the platform to the needs of newcomers and experienced sharks. On the back-end, brokers will be able to assign their trader accounts to multiple groups and apply different settings to each group.

For example, a group of newbie traders may be assigned settings that limit certain risky transactions (such as Swaps) or only offer those transactions in tutorial mode. By contrast, an account group of experienced traders may have more advanced trading settings enabled. In addition, paid third-party subscription services can be activated for one group and disabled for others.

Trader Education and Community Development

Every broker understands that educating traders is a requisite for expanding their brokerage. Educated traders are incentivized to trade more and trade better. They might also want to share their knowledge and build a tight-knit (and ultimately loyal) community around your platform.

With DXtrade, distributing educational content for traders becomes much easier. DXtrade is modular and has a smoother learning curve for new traders than legacy platforms.

You can produce interactive tutorials using screenshots of the platform or videos with step-by-step instructions for platform setup. With additional customization tools, tutorials can be integrated right into the trading interface. For example, you can create sample trading strategies and encourage beginner users to apply them to their demo accounts.

Onboarding traders (and keeping them) can be challenging, but it is extremely important and ultimately highly rewarding. DXtrade makes it easier for brokers to attract and retain customers while giving them an edge over brokers who use other trading platforms.