Trading stocks for a living is possible but requires a lot of dedication

The stock market can be a great venue for day traders to earn a living but it requires a commitment to continuously learn.

By Jeff Broth. Jeff Broth is a financial writer and investor. With over 5 years of trading in the financial markets, Jeff contributes his knowledge and insights on market developments.

Trading stocks isn’t for everyone. Only a select few are able to consistently generate enough profit just to break even after monthly expenses. Even fewer people make a lot of money to obtain true financial freedom.

Traders are certainly up against the odds, but it is both possible and affordable for anyone to at least try day trading for a living to see if it is right for them. Many brokers require an initial deposit between $500 and $1,000.

What Is Day Trading

A day trader refers to an individual that buys and sells stocks throughout the day. Unlike traditional investors that hold a blue-chip stock for years or decades, traders very rarely hold a stock overnight.

Some day traders exit their position within seconds to capture minuscule gains. The logic behind this strategy is that many small profits over one trading session will add up to a large number.

Think about it: a two-cent profit (after fees) on a 2,000 share position doesn’t seem like much at $40. But a trader that is able to consistently make $40 ten times a day can end the year with a six-figure profit.

Other day traders look to enter one, two, or maybe three trades a day and sit on their position for a few hours. This strategy is based on the notion that a trader that waits patiently for an ideal trade setup will maximize return and minimize loss.

Some traders strictly limit themselves to one of the two trading time frames while others love both.

Trading Stocks For a Living Isn’t Easy

Is trading stocks for a living in 2021 that easy? Can new traders start making $40 a trade 10 times a day every day? No, of course not. Anyone that says otherwise shouldn’t be listened to.

But the same logic holds true for every career path.

Can an entrepreneur start a business and be guaranteed $1 million in sales in the first year just because they have a good business idea? Is a salesperson that works on commission entitled to close a deal that would net them a $20,000 bonus in the first month?

Even motivated and bright workers need to work up the corporate ladder before they can start making a lot of money. An engineer that graduates at the top of their class will need to put in many years before they catch the attention of upper management and earn that dream promotion.

Trading stocks is no different.

If you are lazy and/or have a sense of self-entitlement, trading stocks isn’t the right fit for you, and thinking otherwise will most likely result in a total loss.

However, if you want to dedicate time and effort to learning the market and strategies required to become successful, the upside potential is unlimited.

The best day traders, much like the best business leaders, all follow a similar pattern. They soak up as much knowledge as possible before applying it to their craft.

One would assume that multi-billionaire legendary investor Warren Buffett earned the right to spend his days relaxing or even daydreaming while his investments generate interest like clockwork.

Quite the opposite holds true as he strives to read 500 pages a week to make himself smarter. He explained:

“That’s how knowledge builds up, like compound interest.”

Buffett, Bill Gates, and many other billionaires acknowledge that despite their vast wealth, there is still much more for them to learn. So, what’s your excuse for not studying the market in great detail day and night?

But, Making A Living Is Possible

The COVID-19 pandemic ushered in record numbers of new traders who quickly discovered a large number of trading opportunities each day. This was especially true after the stock market rebounded in late Spring and the bullish momentum carried through to the end of the year with no prolonged hiccups along the way.

There is little reason to believe that 2021 will be any different.

On any given day, there will be a handful of stocks that make large moves. It isn’t unusual to see stocks gain 50% or more in just a few hours. If a trader captures just five of these large moves in a year, it will certainly make a major difference.

Even mega-cap companies like Apple, Amazon, Tesla, and Facebook moved enough on a daily basis for traders to earn living trading stocks in 2020.

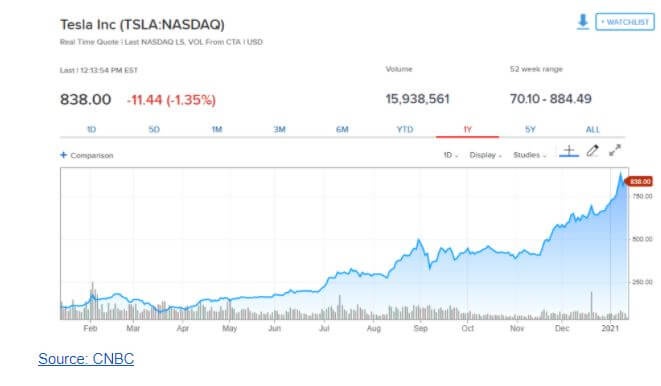

Tesla, as an example, gained around 700% in 2020. The math behind this exponential growth implies shares moved higher on average nearly 3% each day. This one stock alone made it possible for many people to earn a living trading stocks.

So Now What?

The question many people are now asking is how can a new trader identify trading opportunities so they too can make a living trading stocks. It will take time and dedication to become an expert, but the process could be as simple as learning from the pros.

YouTube hosts an endless supply of professional traders sharing their knowledge. Some offer excellent content, others not so much. So the key is to find someone you are comfortable learning from.

Many YouTubers upload free videos to the streaming platform to promote their website that offers more content for a fee. If you find value in content that doesn’t cost anything, chances are likely you would benefit from the knowledge you can gain from a paid subscription.

Most, if not all day trading content creators, offer a free trial to their website. So the downside potential is zero.

Bottom Line: Learn, Practice, Study, Repeat

Reading, learning, and studying from experts is the first and most important step towards success. Before opening a trading account and risking money, it would be great to get a feel for the market through a free paper trading account.

A paper account lets traders practice their strategy in a platform that mirrors the real market in every way but all the trades are simulated so no money is made or lost.

New traders are recommended to take notes of their paper trading performance in a trading journal. Write down anything everything you feel is important to keep track of, especially what strategies are working and what aren’t.

New traders that best understand where they can improve their knowledge are much more likely to succeed. And should you become successful and make a great living, never forget the market requires constant learning and adoption to change.

Trading stocks for a living can be a lifeline journey. Don’t forget to have fun along the way.

The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff. Main Image courtesy of Pixabay.