TradingView integrates market data from German Tradegate exchange

TradingView announced that it has increased data coverage to allow its users to receive information from and get free access to the intra-day and tick data from Tradegate Exchange.

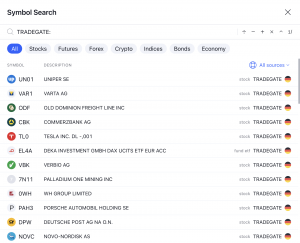

Per the company’s statement, the latest batch of changes allows market participants to garner information and screen stocks for the exchange that provides over 20,000 securities from around the world.

According to the web-based charting provider, registered users will have access to the data of the newly added exchanges delayed by 15 minutes but with an option to upgrade their subscription to include real-time data. In addition, users will be able to scan the new marketplaces with its Stock Screener product and also have access to hotlists such as top gainers, losers, most active and more.

The practice of paid real-time access is common as you usually have to pay for a market data feed, which includes the fee to the consolidated market data provider and certain exchange fees.

Tradegate is a fully regulated exchange and 60% owned by Deutsche Börse AG, one of Europe’s largest exchanges. The bourse offers a wide array of products, including British, European and US stocks with a flat fee of €3.90 per transaction.

“This stock exchange specializes in the execution of private investor orders, and judging by their transaction volume, private investors really appreciate it — since the first trading day in January 2010, transaction volumes on this exchange have grown from €3.2 million to a whopping €62 million. Today, the exchange offers around 20,000 securities including equities, bonds and investment funds, available to trade from 8am to 10pm — as a cherry on top, all this comes with complete order execution and no transaction fees,” the statement reads.

TradingView is a data-driven investor community, which is ranked among the top 300 websites in the world, powering over 40,000 other websites and providing social networks. The company’s approach differs from other social trading networks because it is chart-based with an emphasis on visuals to support investing and provide communal space to view and share trading ideas.

The data-driven investor community has hit over 30 million monthly active users and is expanding globally with paying customers in over 180 countries worldwide. That compares to 2,000 visitors per day when TradingView first launched in 2011.

Furthermore, TradingView has a webstore where users can purchase access to third-party tools. The company’s solution had already been rising in popularity in recent years as it has successfully marketed itself as a provider of smooth HTML5 charts that encompass a diverse set of asset classes.