A trip to India, then to Nepal, followed by a flutter on FX futures at the DGCX. Would you?

India’s government banned 500 and 1000 INR notes. There are giant reserves in the hands of citizens of Nepal who could sell them on to ease transfers, and the rupee is on the floor, however the exchange traded Indian rupee contracts at the DGCX – home to 31% of all rupee trading – presents a massive opportunity

There is a very good reason why the major reserve currencies of the world are evergreen, why they never change or lose their status, and why they are a mainstay of the world’s 5.5 trillion dollar notional volume per day FX trading business.

The major reserve currencies, despite their volatile nature compared to illiquid assets such as raw materials, property or commodity futures contracts, have enough stability to form a giant borderless market which the major banks of the world generate the majority of their core business by trading one against the other, yet enough price movement to create the type of market excitement that stimulates entire economies.

To be able to sustain that status quo long term requires geopolitical stability, solid, sensible fiscal policy, top quality leadership, a diversified industrial base and most of all, that predictions by analysts cannot envisage any nasty surprises that could change the entire dynamic of an entire national currency without recourse…..

……which is why the Indian rupee, despite its massive circulation as the national currency of a country with over 1.3 billion people and a huge industrial base that varies from agriculture to management consultancy to computer science, will never cut it as a desirable unit by which to trade the electronic financial markets.

India, whilst its total GDP is the third in the entire world at $8.72 trillion, is an unstable mess as far as economic policy is concerned.

The question is, would now be a good time to trade the Indian rupee?

On November 8 this year, the Indian government suddenly canceled its two largest rupee notes, the 500 rupee and 1000 rupee notes, in what it described as an anti-corruption measure, announced on national television by Prime Minister Narendra Modi.

Whilst the decision, which was unexpected by the population, was aimed at fighting corruption and money laundering – both absolutely rife in India – this created absolute havoc and rendered large quantities of currency completely worthnless overnight.

The Reserve Bank of India (RBI) estimates that there are 16.5 billion 500 rupee notes and 6.7 billion 1000 rupee notes currently in circulation. ATMs were shut on November 9 and 10 to help implement the change, however vast lines of people amassed in many areas outside ATMs, and physical fights broke out between people scrambling to extract money from ATMs whilst battling massive crowds.

What a mess.

Further problems ensued because more than half of India’s 200,000 ATMs had not been reconfigured to dispense the new 2,000-rupee ($40) notes introduced by the government, according to Finance Minister Arun Jaitely. He said it would take two to three weeks for all the ATMs in the country to be recalibrated to handle the new notes.

The value of the rupee absolutely collapsed immediately after the government canceled the 500 and 1000 rupee notes. When comparing it to the very stable US dollar, it is clear that confidence is not the only problem, as shortages of currency, suddenly worthless centrally issued bank notes and a devaluing of the entire economy have decimated the value of the rupee.

Another example of extreme instability and bungling which leads to absolute mistrust and lack of faith came just two weeks before the government canceled the two denominations.

In mid-October, a $10 billion position was left unhedged within the FX deposit redemptions section of India’s banking system which analysts considered to be the potential cause of a possible depreciation in value of the rupee over the next few months.

Whilst some analysts were bearish, some actually did consider this to be a potential liability, as such a drop would act as a booster for exports and possibly narrow the trade deficit although imports of oil and other commodities would become costlier, said experts, some of whom suggested the gap may have deliberately been left uncovered. Not anymore it won’t!

Three years after the Reserve Bank of India sought to shore up the rupee through foreign currency non resident-bank (FCNR-B) deposits, the country is bracing for an outflow as these are redeemed.

Whilst all of this unfolds, there are nations around India’s periphery which have open borders with India, and whose populations are flush with 1000 and 500 rupee notes.

Yesterday, private sector firms in Nepal began lobbying the Nepal Rastra Bank to initiate FX intervention to bring 500 and 1000 rupee notes which are in the possession of the Nepalese public and traders near the border within the banking channel to provide an effective exchange facility.

This has created an unofficial street value of higher than the nominal value of what are now illegal tender. Beyond comprehension!

Due to Nepal’s open border with India and regular flow of people to and from the southern neighbour, many Nepalese people have some stock of INR 500 and INR 1,000 notes for daily transactions, which could amount to billions.

This volatility has been caused by extremely alarming circumstances that would never take place in an organized economy – India has, despite its vast industrial base and blue-chip commerical interaction with Western telecoms, technology and consultancy firms, a completely disorganized economy.

Only 2% of India’s population pay tax, owing to the enormous unofficial economy that operates with every small business from taxi drivers to shop owners tranacting everything in cash and never reporting it, hence the government’s draconian crackdown.

What if FX traders could turn this to their favor?

Take a country with the third largest GDP in the world, and a volatile currency. Clearly the country’s productivity is very high and the need for global businesses to transact from USD to INR is huge in order to sustain this.

The low value of the rupee may only be temporary, however anyone wishing to make spot FX transactions would have to have nerves of steel.

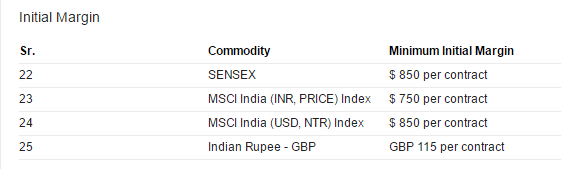

Bearing all of this in mind, the Dubai Gold and Commodities Exchange (DGCX) has emerged as a prominent new exchange over the last five years, largely due to its Indian rupee futures contract.

Indeed, the Indian rupee futures contract traded on DGCX accounts for over 31% of all global exchange traded Indian Rupee market share.

In other regions of the world, the discussions relating to potential moves onto exchanges by FX firms has largely died out, even in North America, which leads the world in exchange-traded products from the derivatives and exchange technology powerhouses of Chicago.

It is easy to see why. In Chicago, clearing and membership fees of a vast, long established electronic derivatives marketplace would be prohibitive, and the OTC market is buoyant and stable. In India and certain parts of the Arabian peninsuala, however, things are very different indeed.

DGCX membership and clearing fees are a fraction of those of the giants of the MidWest, and the Indian rupee futures contract is a roaring success as a futures contract.

Now, with low rupee values and a very uncertain fiscal policy in a disorganized country which has a massively productive economic structure, this could be the actual dawn of the Indian rupee’s rush to popularity as an exchange traded asset.

Placing a futures bid on a currency such as the rupee on a long position, whilst it is in disarray, on a venue which is highly energized in rupee trading, based in an economically (by Middle East standards!) stable location could appear to be quite interesting, especially when taking the instantaneous nature away from the transaction, and matching it against indices and commodities.