Trustlessly purchasing an NFT on Flare using the token of a different blockchain.

The layer-1 for data, Flare, just completed a live demonstration of new interoperability functionality now available in beta on the network.

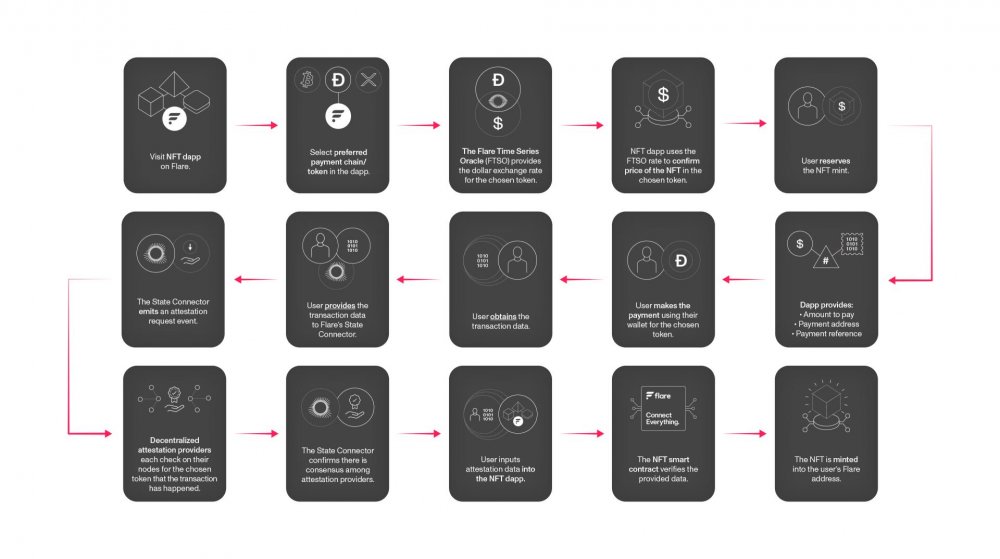

Using two core interoperability protocols, State Connector and Flare Time Series Oracle (FTSO), an NFT was trustlessly purchased with the transaction taking place on a different chain using a different token. The demo was performed on Flare’s canary network, Songbird, with the purchase made using DOGE and XRP tokens.

Flare’s State Connector protocols enable information, both from other blockchains and the internet to be used securely, scalably and trustlessly with EVM-based smart contracts on Flare chains. In this case, it has been used to prove that a transaction has been confirmed on a non-Flare chain and simultaneously verify the correct payment reference was included.

The Flare Time Series Oracle delivers highly decentralized price and data feeds to dapps on Flare, without relying on a centralized provider to bring the data on-chain. For the demonstration, it provides the live updating price of the NFT in the currency of the other chain.

As Flare is an EVM-based blockchain, everything that can be achieved on Ethereum and other EVM chains can also be performed on Flare. The NFTs minted in the demo are therefore standard ERC721 contracts written in Solidity and deployed on the network. The only changes required were the addition of methods to integrate with the FTSO and State Connector.

Hugo Philion, Flare CEO & Co-founder, said, “This demo highlights Flare’s ability to provide more types of secure, decentralized data on-chain in order to power new functionality and potential use cases for the industry. The NFT demo is one example of the web3 utility Flare can unlock for legacy tokens, enabling them to be used trustlessly in dapps on the network. We are excited to see what other applications engineers can develop, harnessing the capabilities of Flare’s native interoperability protocols.”

Demo Video: https://www.youtube.com/watch?v=g0qxxm2EZjw

About Flare

Flare is an EVM-based Layer 1 blockchain that gives developers decentralized access to high-integrity data from other chains and the internet. This enables new use cases and monetization models, while allowing apps to serve multiple chains through a single deployment.

Flare’s State Connector protocols enable information, both from other blockchains and the internet to be used securely, scalably and trustlessly with smart contracts on Flare.

The Flare Time Series Oracle delivers highly-decentralized price and data feeds to dapps on Flare, without relying on centralized providers.

Build on Flare with more data than ever before or build with Flare to serve multiple ecosystems.

Website | Twitter | Telegram | Discord

Contact

Nadav

[email protected]