tZero Expands Cryptocurrency Offering With Five New Altcoins

Overstock.com’s blockchain subsidiary tZero today announced in a corporate statement that it added more popular cryptocurrencies/tokens to its proprietary platform. Effective October 4, tZero will support Bitcoin Cash (BCH), Stellar Lumen (XLM), Cardano (ADA), Compound (COMP), and Uniswap (UNI).

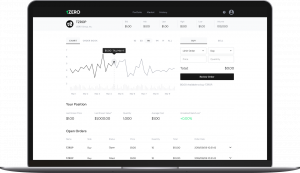

This brings its total available cryptocurrency suite to 15 different coins and coincides with recent updates to the tZERO crypto app.

The additional cryptocurrencies will complement tZERO’s existing product range of digital assets, which includes the already installed Bitcoin, Ethereum, Litecoin, Chainlink, Dogecoin, USDC, 0x, Bitcoin SV, Basic Attention Token, and Ravencoin.

The company’s client base will be able to trade in the most popular altcoins directly on its own trading platform, making it easier for them to access a wider variety of crypto assets, in the sense that they are not just constrained to the big two or three.

tZERO has been quickly shoring up its offerings with more altcoins. While 2020 marked the launch of its platform and a gradual embrace of crypto products, the latest expansions have been fueled by consistent demand for more diverse options.

The move comes on the heels of tZERO launching major updates to its crypto app, which introduced faster settlement times and higher buy limits: The app now supports $25,000 per day deposit limits as part of its standard offering.

tZERO Crypto has also partnered with a third-party custodian to custody investors’ assets in a regulated hosted wallet environment.

tZERO Interim CEO and Chief Legal Officer Alan Konevsky stated, “Our critical priority is to increase the number and range of attractive and compliant assets on our platform and adjacent products. Today’s announcement illustrates our ability to execute against our strategic priorities. We plan to continue to grow our product offerings in the near future and add more coins as we create a unified user experience across a range of our securities and cryptocurrency products, including NFTs and other digital assets classes.”

tZERO’s broker-dealer subsidiary, tZERO Markets, offers crypto sales, trading, electronic execution, and portfolio execution for buy- and sell-side clients. tZero’s retail brokerage service, which is also registered with the Securities and Exchange Commission (SEC), allows the firm to grab the capacity to serve individual traders instead of only accredited investors. Additionally, it provides token issuers with investment banking and placement agent services in connection with capital raising activities.

tZERO anticipates trading more digital assets, but says the addition of new coins have to carefully work through legal and financial due diligence, as well as regulatory matters to ensure that only high-quality assets trade on the tZERO platforms.