U-Turn as GKFX leaves UK

Last month, when FinanceFeeds probed GKFX UK’s imminent closure, the firm denied it, however on May 24 this year, all accounts will either be transferred to Malta or closed

“Should I stay or should I go?” was the famous question sung by Mick Jones in 1981.

Today in May 2019, however, this adage could be applied a long established retail FX brokerage and its decision to close its FCA regulated operations.

Turkish-owned GKFX has had presence in London for several years, its FCA regulated operations at the prestigious Bevis Marks House having been a mainstay during the company’s expansion of its partners network across mainland China, however this week, according to many of its clients, signals the end of an era for the company.

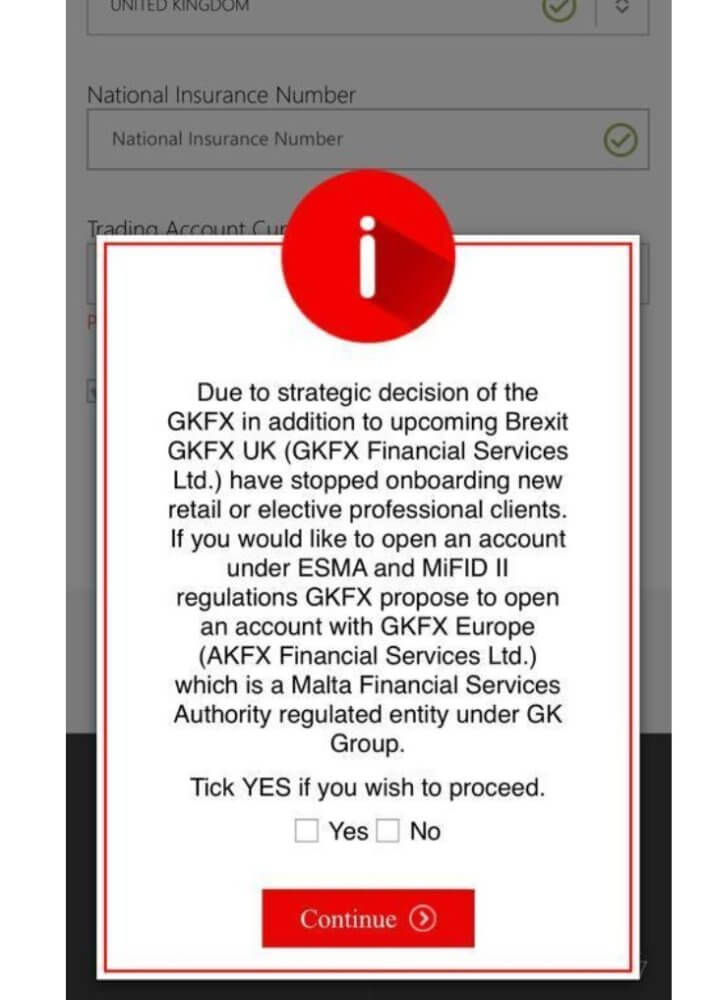

On Friday last week, several clients of the firm received an official notification that GKFX is in the process of closing its UK operations, and is no longer accepting new customers.

FinanceFeeds was approached by a software engineer based in Scandinavia who has a longstanding retail FX and CFD trading account with GKFX’s London office, as he received a notification by email that clients of GKFX’s London office would be offered a choice of either closing their account, or having it transferred to a subsidiary in Malta.

The email to clients reads as follows:

Dear Client

Re: Account Closure and Transfer NoticeFollowing a review of GKFX Financial Services Limited (GKFX UK) business strategy considering Brexit and other recent regulatory developments, GKFX UK have decided to focus its business on the wholesale and professional market. As a result, we regret to inform you that GKFX UK will no longer be providing its trading services to retail and elective professional customers and are hereby giving you notice of intention to close your account by Friday 24th May 2019 as per section 38 of our terms of business.

We appreciate that this may cause disruption and inconvenience for you and therefore GKFX UK has taken considerable steps to minimise any disruption and inconvenience as much as possible. GKFX UK has entered into an agreement with AKFX Financial Services Ltd (AKFX), an affiliate of GKFX UK and member of the Global Capital Group which will allow you to transfer your active positions to AKFX and keep your active positions open if you choose to do so.

AKFX is a Financial Brokerage Firm registered in Malta and regulated by Maltese regulator, the Malta Financial Services Authority (MFSA). AKFX holds regulatory permissions that will enable it to provide substantially similar services to retail and elective professional customers (as compared to GKFX). We have prepared a comparison table below to illustrate any material differences in the services offered by GKFX UK and AKFX.

This corporate decision by GKFX has been one of interest to FinanceFeeds for some time, largely due to our discovery of a notice that had appeared temporarily on the company’s UK website in mid-April, stating that GKFX was no longer accepting new customers to its British division.

This message remained on the company’s website for a very short time before being removed.

At that time, FinanceFeeds contacted UK CEO Rob Woolfe for clarification, to which Mr Woolfe replied “” As part of GKFX’s Brexit strategy, we are considering a number of options and this message that prematurely appeared on our website is one of several under consideration. The message was immediately removed from our websites and no clients were or are affected.”

Therefore, it was the company’s official line at the time that the firm was indeed accepting new clients to its British entity and that it is operating absolutely as normal, thus no British clients need to open their accounts via the firm’s Malta entity, as had been stated on the temporarily displayed message.

On April 15, 2019, FinanceFeeds published that Mr Woolfe had further explained that the UK entity was absolutely operating as normal, and that GKFX had indicated that most certainly companies in the electronic trading business are indeed looking at their options with regard to rationalizing their operations post-Brexit, however there is nothing to be too concerned about, and interestingly that the company had set the message live on its UK website in error.

Now, one month on, the firm has issued official notices via email to clients of its UK office, demonstrating that it had intended to close its UK operations.

One particular point to bear in mind is that since the original message was displayed and then swiftly removed from GKFX UK website in April, when attempting to open a demo account from a UK IP address without a VPN (I am in the UK – ed) the site does has not allowed a demo or live account to be established, instead going in a loop which was not addressed by the firm during our conversation this last month. FinanceFeeds at the time stated an intention to provide further clarity when that point has been covered, hence now it is clear.

The company had denied its imminent closure of its UK division, however GKFX is a massive market participant in China, and has been for several years. Many of my visits to the offices of medium sized introducing brokers (IBs) in second tier development cities across China has revealed longstanding and unshakable relationships with GKFX which was (until China began asking some of the bigger firms like FXCM to leave) the fourth largest international FX representative in China.

As that market becomes less friendly toward non-Chinese brokerages, the UK division (Chinese IBs often stipulate the existence of a British or Australian base as a must for doing business with an overseas broker) may be superfluous to its main operations.

Many institutional providers of liquidity in London have speculated on this subject for some time, and there are regulatory ramblings to the tune that the firm has come under some degree of scrutiny by the FCA, an activity that it has been suggested commenced at the end of last year.

FinanceFeeds asked GKFX UK’s senior management for a comment on the matter, particularly as to why it was explained a month ago that the firm had no intention of leaving the UK, however no comment was provided.

GKFX’s official rationale cites Brexit as the main factor, however this is very unlikely to be the actual reason for exiting the UK.

Indeed, it is our opinion that more brokerages will flock to the UK once it exits from the European Union, some of which are already in the process of establishing operations in London.