UK-backed Millicent tests the world’s first full-reserve digital currency

Innovate UK, part of UK Research and Innovation, has audited the world’s first test of a Full-Reserve Digital Currency (FRDC) developed by blockchain startup Millicent.

Essentially, Millicent has been developing the technology that synchronizes the benefits of privately-issued stablecoins and CBDCs. However, the company prefers the term Full-Reserve Digital Currency to differentiate its offering from central bank issued digital currencies, as well as other types of ‘stablecoins’ that have proven to be anything but stable.

Acting as a sort of safe haven where consumers can park their assets in volatile markets, Millicent’s FRDC are privately-issued digital currencies pegged to a traditional fiat currency. The company taps a regulated third party to ensure its coins are always 100% backed by liquid ‘cash’ deposits held in banking accounts, directly at the central bank.

Millicent’s FRDC seeks to break down the existing barriers in the global financial system. Ultimately, the aim is to enhance efficiency by reducing the cost of transactions and increasing transaction speed.

For instance, Millicent’s network will be capable of facilitating upwards of 10,000 transactions per second—5x VISA’s network average—with sub-second settlement and negligible energy use. With transaction fees from one one-thousandth of a penny, cross-border compliance, and accessible user services with on and off-chain utility, Millicent says it paves the way for true financial inclusion.

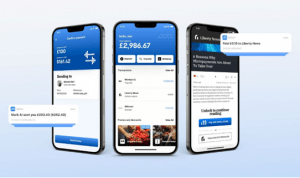

“[Millicent] addresses the major shortcomings of the payments industry, both traditional and crypto.” said assessors from Innovate UK, adding “Delivering a digital wallet and payment application accessible via iOS/Android apps, with an API for integration with existing web/mobile platforms within this project is courageous and ambitious.”

“We are extremely proud to have presented this world-first solution to Innovate UK—especially during such a turbulent time for the crypto markets. Recent troubles with popular cryptocurrency platforms highlight the importance of projects like Millicent, that focus on safety, stability, and real-world benefits.” said Millicent’s CEO, Stella Dyer.

Millicent’s new coin demonstrated various use cases, including micropayments such as a £0.15 to access a paywalled newspaper article, the use of a QR code to tip a busker £1, as well as higher-value peer-to-peer payments.

Co-funded by the UK government, Millicent is a regulator-friendly distributed network built to ignite the global mass adoption of digital finance. Its CEO and co-founder, Stella Dyer, is a Wall Street veteran with years of experience spanning senior roles with Morgan Stanley, JP Morgan, and managing Goldman Sachs’ global high tech investment banking unit.

Millicent also bridges enterprise and public blockchains, as well as traditional financial systems, supporting CBDCs and stablecoins, institutional access to DeFi, fiat on & off-ramping, tokenized assets, etc.

Earlier in March, the company secured government funding in the form of a UK Research, and Innovation (UKRI) Innovate UK Smart Award. The grant is intended to fuel the development of blockchains-based solutions for a number of use cases and also assist in the nation’s strives to launch a central bank digital currency.