UK Finance report reveals £50.1m lost due to investment scams in 2018

UK Finance members reported 84,624 incidents of authorised push payment scams with gross losses of £354.3 million in 2018.

The UK finance industry prevented £1.66 billion of unauthorised fraud during 2018, according to the latest report, Fraud the Facts 2019 published today from UK Finance.

A total of £1.20 billion was stolen by criminals committing fraud last year. This is comprised of:

- £354 million in authorised fraud;

- £845 million in unauthorised fraud.

In 2018, UK Finance members reported 84,624 incidents of authorised push payment (APP) scams with gross losses of £354.3 million.

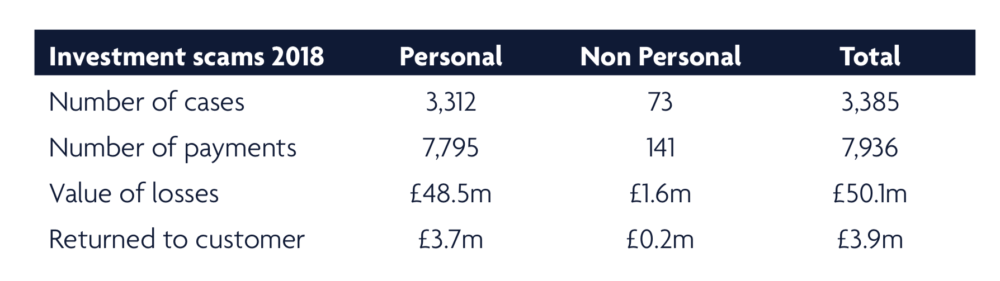

A total of £50.1 million was lost to investment scams in 2018, with payment services providers subsequently able to return £3.9 million.

In an investment scam, a criminal convinces their victim to move their money to a fictitious fund or to pay for a fake investment. The criminal will usual promise a high return in order to entice their victim into making the transfer. These scams include investments in items such as gold, property, carbon credits, cryptocurrencies, land banks and wine. Cold calling, email, social media and letters are also used in investment scams, with criminals seeking to take advantage of recent pension reforms.

The nature of the scams means that the sums involved in individual cases can be higher, so while investment scams accounted for only 4% of the total number of APP scam cases, they accounted for 14% of the total value.

Earlier this month, the UK Financial Conduct Authority (FCA) published two pieces of research looking at UK consumer attitudes to cryptoassets.

The qualitative research indicated some potential harm, including that many consumers may not fully understand what they are purchasing. Findings from the survey show 73% of UK consumers surveyed do not know what a ‘cryptocurrency’ is or are unable to define it. Despite this lack of understanding, the cryptoasset owners interviewed were often looking for ways to ‘get rich quick’, citing friends, acquaintances and social media influencers as key motivations for buying cryptoassets.