UK Financial Ombudsman receives more than 195,000 enquiries between Oct and Dec 2019

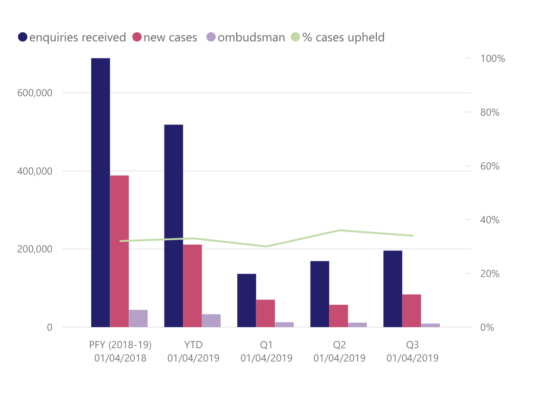

In the quarter to end-December 2019, the body received 195,851 new enquiries and 83,754 new complaints.

Today, the UK Financial Ombudsman Service published data showing the number of complaints it received between October and December 2019.

Between October 1, 2019 and December 31, 2019, the ombudsman received 195,851 new enquiries and 83,754 new complaints – with 9,160 complaints passed to an ombudsman for final decision. On average, the body upheld 34% of the complaints it resolved.

PPI continued to be the most complained-about product, with 45,510 complaints. It made up around half of all complaints received. The Ombudsman continues to receive a significant amount of complaints about consumer credit, in particular about payday and installment loans. The body continues to uphold a large proportion of complaints about high-cost credit products.

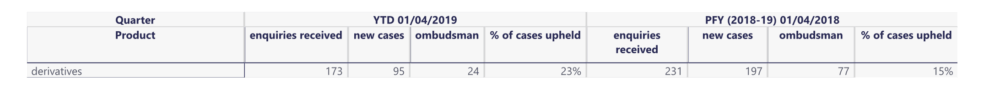

Regarding derivatives, the body reports receiving 173 enquiries about these products during the three quarters to December 31, 2019. The number of cases referred to the ombudsman is 24, with the proportion of cases upheld being 23%, which is somewhat higher than the 15% rate seen in the year-ago period.

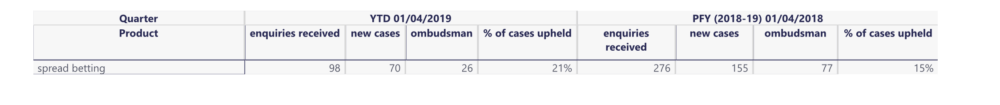

Regarding spread betting, the ombudsman said it received 98 enquiries about such products in the first three quarters of FY19/20. The number of cases referred to the ombudsman is 26, with the proportion of upheld cases being 21%, which is higher than the 15% rate for the year-ago period.

The FOS can look at complaints from customers or potential customers of financial businesses – which generally covers individual customers and some small businesses. The body can also look at complaints about claims management companies (CMCs).