UK regulator confirms administrators appointed at Glint Pay Services

Unfortunately, Glint safeguarded funds are not protected by the UK Financial Services Compensation Scheme.

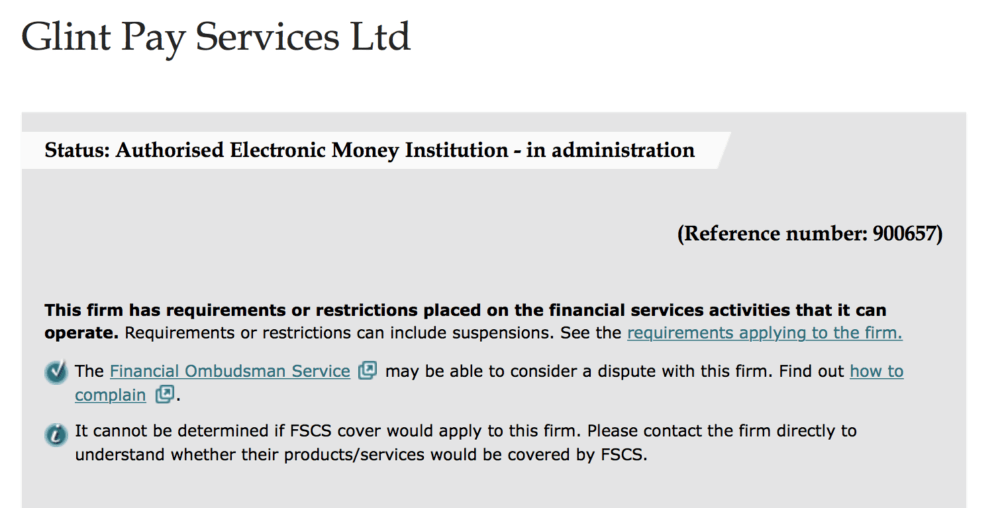

The UK Financial Conduct Authority (FCA) has earlier today provided information for customers of Glint Pay Services Ltd.

Glint Pay Services Ltd (FRN 900657) is authorised and supervised by the FCA to issue e-money and provide payment services under the Electronic Money Regulations 2011 (the EMRs).

The regulator confirms that, on September 18, 2019, Jason Daniel Baker and Geoffrey Paul Rowley of FRP Advisory LLP were appointed as joint administrators of Glint.

Customers who have money with Glint are advised to contact the joint administrators if they are concerned, have any questions or for any updates:

- Email: [email protected]

- Address: c/o FRP Advisory LLP, 110 Cannon Street, London EC4N 6EU

Source: FCA register.

Glint holds funds on behalf of its customers. Safeguarding is a key consumer protection measure within the EMRs and Payments Services Regulations (PSRs). The purpose of safeguarding is to protect customer money if a firm fails in a disorderly way.

Safeguarding requirements apply to Glint and are a condition of Glint’s authorisation that the firm must comply with at all times.

According to the FCA register, requirements are imposed on the firm. In particular, the firm must comply with the requirements in regulation 78A(2)(b)of the Electronic Money Regulations 2011 to refrain from providing account information services or payment initiation services for an indefinite period.

Unfortunately, Glint safeguarded funds are not protected by the UK Financial Services Compensation Scheme (FSCS). The regulator explains that FSCS only applies to certain types of activity. This does not include issuing electronic money or payment services.