UK research on EMIR shows there is case for exempting smaller FCs from clearing obligations

Analysis of a UK data sample indicates that there is a case for exempting smaller FCs from clearing without compromising the objectives of EMIR.

A research note quoted by the UK Financial Conduct Authority (FCA) provides insight into the objectives of EMIR and their potential consequences for the OTC derivatives market. The research, entitled “EMIR data and derivatives market policies. How EMIR data help regulators better understand the impact of policies” has Anne-Laure Condat, Alessandro Puce and Carsten Nommels listed as its authors.

The analysis is based on a sample of UK financial reporting counterparties’ outstanding OTC derivative trades on 10 April 2018 as reported under EMIR. Based on a sample of UK derivatives data, the research has found that a clearing exemption calibrated to minimise the number of counterparties that will be subject to the clearing obligation while maximising the amount of activity that is captured could significantly reduce burdens on those counterparties without hampering the achievement of EMIR’s overall objectives.

In 2012, the European Union (EU) adopted EMIR. EMIR introduced new requirements on market participants with the aim of improving transparency and reducing counterparty credit risk and operational risk in the derivatives market. On top of new reporting obligations, EMIR also introduced mandatory central clearing requirements for standardised over-the-counter (OTC) derivative contracts.

Under EMIR, all financial counterparties are subject to the clearing obligation, regardless of the size of their derivatives activity. The clearing obligation also applies to certain non- financial counterparties (NFCs), but only if their derivatives activity is above any of the asset class specific clearing thresholds.

To secure a gradual and orderly implementation of the clearing obligation, EMIR splits financial firms into three categories. These are based on the size of their derivatives activity and whether they are already a clearing member of a Central Counterparty (CCP). The clearing obligation applies in phases to the first, then the second and finally the third category of financial firms. Non-financial firms are in a fourth category. To date, only the first two categories of financials firms are subject to the clearing obligation.

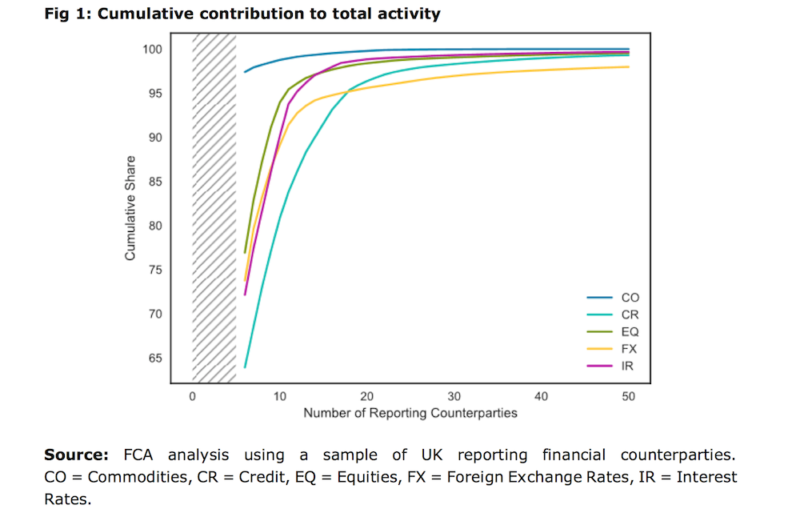

Based on the data sample, the research concludes that the UK OTC derivatives market remains characterised by a high level of concentration, with a small number of large financial counterparties accounting for the vast majority of market activity. Conversely, a relatively modest contribution is made to overall activity by a large number of smaller financial counterparties.

Against this background, in May 2017 the Commission published a proposal for a targeted review of EMIR to simplify the rules and make them more proportionate, without compromising the objectives of the legislation.

Inter alia, this proposal introduces an exemption from clearing for small financial counterparties (FCs), where ‘small’ means that a financial counterparty’s derivatives activity is below each of the asset class specific clearing thresholds currently applicable to non-financials under EMIR. The relevant thresholds are € 1bn in gross notional for credit and equity derivatives, and € 3bn for interest rate, Forex and commodity derivatives. And, vice versa, if a financial counterparty were to be above any one of the asset class specific thresholds, it would not benefit from the exemption and all its derivatives would have to be cleared.

Using the data sample, the researchers looked at how the number of FCs subject to the clearing obligation would vary in the context of the Commission’s proposal.

Based on the UK data sample, the Commission’s proposal would result in:

- 13.8% of FCs active in the interest rate asset class being subject to the clearing obligation, and just above 99.8% of the aggregate interest rate activity entered into by FCs active in the interest rate asset class being potentially subject to clearing if all interest rate derivatives were subject to the clearing obligation;

- 17% of FCs active in the credit asset class being subject to the clearing obligation, and 99.3% of the aggregate credit activity entered into by FCs active in the credit asset class being potentially subject to clearing if all credit derivatives were subject to the clearing obligation.

The analysis of the UK data sample clearly shows that there is a case for exempting smaller FCs from clearing without compromising the objectives of EMIR, as the Commission has proposed.

However, only analysis of the entire EU-level dataset would enable a comprehensive understanding of the impact of the proposed thresholds on the number of FCs that would be subject to clearing and the corresponding market activity that would be subject to the clearing mandate.