Undercapitalized Tier 1 banks which restrict credit to the FX industry are a law unto themselves, crackdown on CEO salaries begins

RBS and Barclays, two very large FX dealers, are undercapitalized according to the Bank of England. If that’s the case, why doesn’t the regulator put a stop to them holding prime of primes to task on capital requirements when they don’t adhere to their own stipulated capital bases, and instead of shaving the remuneration packages of CEOs, make them responsible for putting this right?

RBS, formerly known by its traditional moniker The Royal Bank of Scotland before the propensity toward three letter acronyms began to make its presence felt even at Tier 1 bank level in the quest for attempts at a modicum of ‘trendiness’ which is at odds with a genuine financial institution whose roots date back to the pre-industrial revolution period, 10th largest interbank FX dealer by volume, with 3.38% of the global market share.

Its head office in London’s Canary Wharf represents the pinnacle of plate-glass interbank modernity in terms of electronic trading, and is one of the towers that dominates the skyline among its peers which between them handle 49% of the world’s FX volume.

Such is the clamor these days with regard to capitalization and counterparty risk among global regulators and the banks themselves which distribute FX liquidity to prime brokerages, that one would expect these top level institutions to be a bastion of lead-by-example uprightness, with gigantic capital bases that could never expose them or their corporate customers – ie prime brokerages – to a fiscal precipice should adverse market conditions occur or should a large client suddenly make a rash decision.

Perish the thought that banks such as RBS and Barclays would stipulate extreme restrictions on counterparty credit extension to their lifeblood and core business activities – OTC electronic trading – on the grounds of risk, if their own books are not up to scratch.

That would never happen, would it?

Unfortunately it would, and is doing.

Thankfully banks are subject to a different type of regulatory scrutiny in Britain, whose practice is unlike the passive Financial Conduct Authority (FCA) which never conducts compliance inspections on the non-bank entities that it regulates, instead preferring to take a reactive approach by sending a letter should a complaint arise giving two options, those being to either pay a settlment minus 30% and the book would be closed, or have an inspection.

Between 2010 and 2014, 97% of all cases filed with the FCA were closed by a small penalty being paid and the book closed, hence no inspections at all took place.

Furthermore, it is commonly considered that the FCA can be lobbied by giants to be able to serve specific agendas, as is thought to be the case with regard to the recent new proposals on how CFDs can be provided, targeting a core business activity of Britain’s giants, which would give rise to the thought that the large venues are able to flex their muscles to lobby the regulator with the agenda of migrating OTC FX to exchanges.

This is not the case with the banking regulator, the Prudential Regulatory Authority, which is a division of the Bank of England that took back the control of overseeing banks when the FSA was disbanded in 2013.

RBS is the latest bank to fail the PRA’s stress test, which is part of the banking regulator’s proactive approach to regulation.

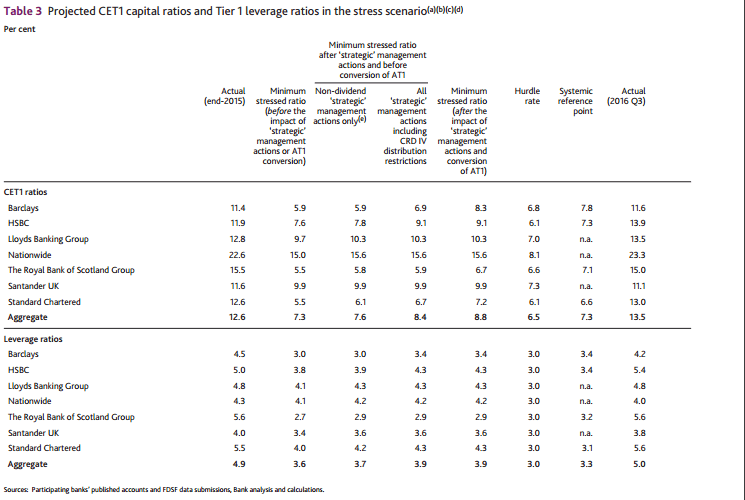

The Royal Bank of Scotland Group did not meet its common equity Tier 1 (CET1) capital or Tier 1 leverage hurdle rates before

additional Tier 1 (AT1) conversion in this scenario.

After AT1 conversion, it did not meet its CET1 systemic reference point or Tier 1 leverage ratio hurdle rate. Based on RBS’s own assessment of its resilience identified during the stress-testing process, RBS has already updated its capital plan to incorporate further capital strengthening actions and this revised plan has been accepted by the PRA Board.

The PRA will continue to monitor RBS’s progress against its revised capital plan.

What would that exact same bank do if it considered a prime brokerage with which it had until now had a first class relationship, to have less than its own stipulated capital base, which in the case of extending credit to OTC counterparties is the bank’s continually changing criteria, not a set of concrete rules set in place by a regulator?

The answer is that the bank would terminate the prime brokerage relationship. Five years ago, it was possible to maintain a prime relationship with $5 million capital, now it is approximately $50 to $100 million just to maintain an existing one, let alone forge a new one, yet the bank that stipulates this is under its required capital adequacy stipulations, which are part of its regulatory obligation.

RBS is one of two banks in this situation, the other being Barclays, which is the third largest FX dealer by global market share, and has recently been terminating prime brokerage agreements with firms that do not put up larger than previous capital on their balance sheets, and continues to pick and choose orders on its BARX platform by operating a last look execution model.

Barclays did not meet its CET1 systemic reference point before AT1 conversion in the Bank of England’s stress tests. In light of the steps that Barclays had already announced to strengthen its capital position, the PRA Board did not require Barclays to submit a revised capital plan. While these steps are being executed, its AT1 capital provides some additional resilience to very severe shocks.

Even so, this is still a severe case of double standards. It is like a police officer, whose livelihood depends on doing his job properly in a public community, therefore being reliant on the citizens he serves, fining someone for jaywalking, and then jaywalking back to his car after issuing the ticket.

Today, Royal Bank of Scotland may well take a token action by shaving £1.25 million from CEO Ross McEwan’s remuneration package.

Mr. McEwan’s long term bonus plan is under review, and is likely to be cut substantially.

Shareholders are currently considering a proposal that would reduce Mr. McEwan’s remuneration under his incentive plan to £1.75 million instead of the current £3 million.

These proposals are part of a series of reforms which are designed to avoid a contretemps with the British government, which is currently taking a long look at the pay packages of senior executives, bearing in mind that RBS is 70% owned by the British taxpayer, a matter that came about as a result of the collapse of the bank in 2008 under Sir Fred Goodwin’s leadership, which was also a time of reckless management.

Fred Goodwin’s strategy of aggressive expansion primarily through acquisition, including the takeover of ABN Amro, eventually proved disastrous and led to the near-collapse of RBS in the October 2008 liquidity crisis.

The €71 billion (£55 billion) ABN Amro deal (of which RBS’s share was £10 billion) in particular stretched the bank’s capital position – £16.8 billion of RBS’s record £24.1 billion loss is attributed to writedowns relating to the takeover of ABN Amro.

It was not, however, the sole source of RBS’s problems, as RBS was exposed to the liquidity crisis in a number of ways, particularly through US subsidiaries including RBS Greenwich Capital. Although the takeover of NatWest launched RBS’s meteoric rise, it came with an investment bank subsidiary, Greenwich NatWest.

RBS was unable to dispose of it as planned as a result of the involvement of the NatWest Three with the collapsed energy trader Enron. However the business (now RBS Greenwich Capital) started making money, and under pressure of comparison with rapidly growing competitors such as Barclays Capital, saw major expansion in 2005 to 2007.

Last week it was revealed the bank was being fined £9.7 million by the Swiss competition regulator over its role in rate rigging. And last month it was ordered to raise £2 billion after failing the capital requirements section of the stress test set by the Bank of England.

New Zealander Mr McEwan was appointed chief executive of the bank, which includes Natwest, in 2013.

Last year he was paid £3.785 million, consisting of his base salary of £1million, a £1 million fixed share allowance, a £1.347 million share award from 2013 as well as smaller amounts for pensions and benefits.

Currently, he is entitled to earn up to 300% of his basic pay of £1 million every year if he hits long-term targets, however now his maximum award could be reduced from 300 per cent to an upper limit of 175% which is subject to a shareholder vote in the spring of 2017.

Fred Goodwin left the bank in 2008 with a full pension and no impact on his remuneration post-collapse, leading to a belief that being paid for failure was acceptable at institutional level.

This raised a tremendous furore and is now being looked at, however the beef here is that good quality prime brokerages are being made to adhere to capitalization rules imposed by banks when the very same banks cannot adhere to their own capitalization rules set by regulators, which, whichever way this is looked at, is very naughty indeed, and quite simply not gentlemanly business practice.