US Dollar Surges on Inflation Data, Stock Market Uncertain

The expected US inflation rate, the Pound falls in reaction to lower inflation, and the Federal Reserve’s response fuels fear and volatility.

This week was always going to be about inflation and the consequences of the monetary policy. Inflation in the US was as expected but still caused plenty of volatility and concern about the Federal Reserve’s reaction. In response to the latest US Consumer Price Index, investors were mainly experiencing a decline in US stocks and a stronger US Dollar. The US Dollar increased to 103.60 and has increased by 0.36% during this morning’s Asian Session.

However, the main shock came from this morning’s UK inflation rate. The UK’s yearly CPI was expected to decline from 10.5% to 10.3%. The yearly CPI figure declines modestly to 10.1%, the lowest since October 2022. The news is positive for the UK economy and FTSE100 as it may allow a softer monetary policy to proceed. The announcement was specifically positive for the economy as they may decline experienced amongst food products, transportation, and fuel.

On the other hand, the Pound has come down tumbling as the weaker inflation rate may trigger a halt in interest rate hikes. The Bank of England, over the past 6 months, has been the most dovish central bank out of the main 3 global regulators. Out of the board’s 9 members, 3 have voted to stop hikes at the past 2 meetings.

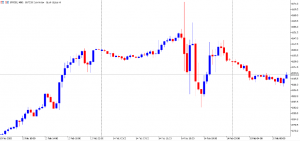

SNP500 – US Stock Market turns Uncertain

The US Dollar saw a clear trend after yesterday’s inflation rate. However, the price movement of US Indices was less certain as investors were uncertain about the true value of the S&P 500, NASDAQ, and Dow Jones. After yesterday’s announcement, the NASDAQ was the only higher index to end the day but still experienced strong bearish spikes. The Dow Jones saw the worst performance, and the SNP500 saw a slight decline.

The price of the SNP500 saw both up and down price movements but mainly saw sellers in control. The lowest daily price was $4,093, which may form a support level over the next week. During this morning’s futures session, the price is declining and is currently hovering at 0.80% lower than the pre-CPI announcement price.

After yesterday’s decline, technical analysis looks very different on smaller timeframes. The price on the 15-minute and 30-minute timeframe is now trading below the Ichimoku Cloud, and the RSI has dropped to 34.00. Both are an indication of a potential decline, and moving averages are also providing a similar indication. However, on larger timeframes, such as the 4-Hour, indications are trading at neutral and are providing no clear up or down direction.

From the fundamental side, the asset is influenced by positive and negative aspects. In general, the SNP500 and the stock market have been supported by recent earnings reports. For example, Coca-Cola has recently released its earnings confirming a higher Revenue and Earnings Per Share. Investors were specifically impressed by the Revenue, which came in 3% higher than expected at $10.20 Billion. Additionally, Airbnb has also confirmed 45% higher earnings per share.

The negative influences are mainly related to the monetary policy. Previously market participants expected a 0.25% hike at the next meeting and then a break. However, due to strong inflation data in January, investors are now contemplating whether the Fed will hike 0.50% and continue hiking to 6%. A Federal Fund Rate of 6% will take the monetary policy to its highest in 22 years and can significantly pressure the stock market. Investors are awaiting commentary from members of the Federal Open Market Committee.

Crude Oil – Dollar Surges on Inflation Data, but Oil Declines

Crude Oil’s price declined during this morning’s 2 sessions as investors remain concerned about yesterday’s inflation data. An expensive US Dollar and high-interest rates are known to pressure the price of Crude Oil. High-interest rates are known to slow economic growth, which tends to result in lower demand for fuel. An expensive US Dollar is also known to pressure prices as foreign buyers have to pay more for the same product. Will this trigger lower demand?

Well, it is also important that traders consider the effect supply can have on the pricing. The US President is preparing to bring 26 million barrels of oil to the market from the strategic reserve. This would bring the reserve to its lowest level since 1983.

Regarding technical analysis, analysts note that speculators should be cautious about the price rejection level. The rejection level formed at $77.67 after the CPI announcement.

Summary:

- The US Dollar increases in value due to high inflation for January 2022. The US Dollar increased to 103.60 and has increased by 0.36%.

- US inflation is down from 6.5% to 6.4% but is unlikely to satisfy the Federal Reserve.

- UK Inflation drops more than expected reaching a 4-month low. UK inflation reads 10.1%.

- Crude oil declines are the US Dollar increases in value and investors expect a stronger hike from the Fed.