Are you using social media to its full potential?

Using social media to its full potential means actively engaging with customers to create a sense of ownership and enhance a stronger relationship. But how exactly do you do that? Leverate’s Adinah Brown gives several pictorial and explanatory examples

Studies conducted by KPMG in 2011 showed that 88% of people aged under 35 connect to their financial institution through social media. More recently, studies have shown that not only has that percentage increased, but so has the number of people beyond that age group who interact through social media.

As almost all financial institutions maintain a presence on social media, the critical question is not if you should have a presence (undoubtedly you already do), but whether you are utilizing social media, be it Facebook, Twitter or YouTube, to its full potential?

Thus, I would like to present five benefits for maximizing the use of your brokerage’s social media profiles and for reasons that go beyond marketing and increasing public awareness of your brand.

1. Resolving customer issues

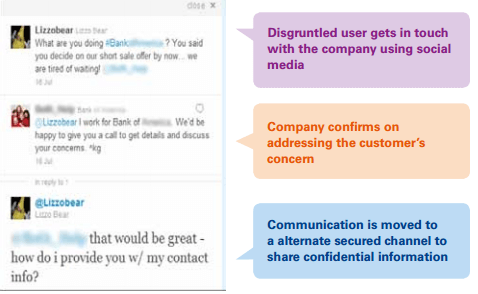

Social media is an effective tool for addressing customer queries and complaints. Although, once the complaints have been posted on the social media page, it’s imperative that a representative address it straight away.

This not only ensures a qualitative improvement in their customer experience, but will ensure that the company’s profile page continues to appear positive and professional.

The process of resolving a customer complaint inevitably requires an exchange of sensitive information, at this stage, the interaction needs to transfer to a more secure channel of communication.

In this case, social media becomes the first point for registering a complaint, the company then confirms the customer’s concern at which point the communication is moved to an alternative secure channel, be it phone or email.

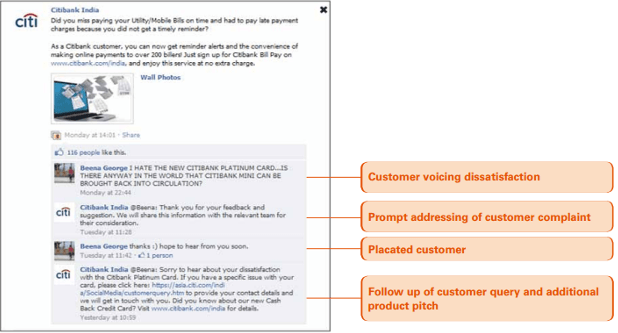

2. Identify and address public sentiment

As social media is multi-directional it allows customers to convey any sentiments they may hold regarding a brokerage firm, Therefore by having a social media presence, a broker is able to gauge the attitudes of customers towards their firm.

In the case where negative sentiments are aired, the social media representative becomes aware sooner and acts swiftly to contain the issue.

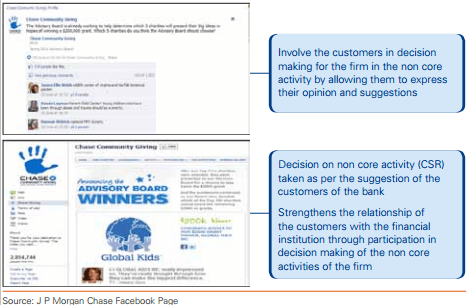

3. Crowd Sourcing

Using social media to its full potential means actively engaging with customers to create a sense of ownership and enhance a stronger relationship. But how exactly do you do that?

In short, by crowd sourcing. Financial brokerages of any stripe often engage in numerous non-banking activities, be it community projects, social or environmental initiatives.

These non-core activities that are typically planned and implemented internally, can and should, become part of the customer engagement strategy, where customers are invited to share in the decision making process.

This entails minimal risk to the company, whilst enabling customers to develop a strong sense of ownership and decision making through this more meaningful level of participation.

4. Engaging Brand Awareness

Okay, I know I said reason beyond brand awareness, but as social media’s most fundamental use, it’s a really hard point to omit.

The variety of engagement is really only limited by your own sense of creativity, display industry related news, conduct polls, create games, create a sense of exclusivity through offers that are only available to your social media fans and followers.

While your ideas may vary widely, the point is that they all result in an increase in brand awareness at a significantly lower cost than other media channels.

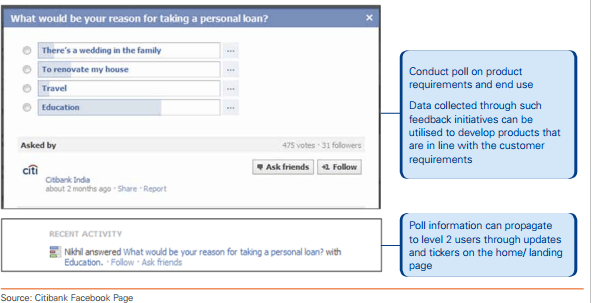

5. Customer Feedback

Customers who connect with their broker on social media are going to get regular updates on their social media page about their financial broker.

As a broker why not use this network feature of social media to ask traders about their opinion on various services that you’re considering to offer, thereby helping your company to prioritize projects. By leveraging your social media platforms, you can effectively determine the interests of your market and more accurately gauge their needs.

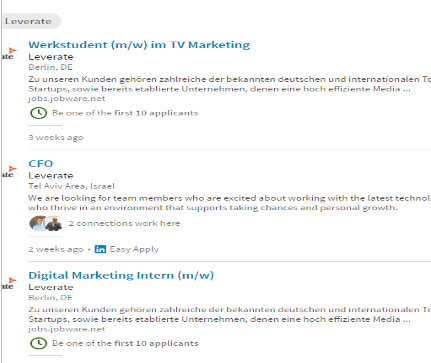

6. Find Employees

With the growth of social media, it’s becoming easier for financial brokers to find the niche talent that they require on professional social media websites like Linkedin.

Senior management who were traditionally recruited through expensive headhunters, can now be sought after through professional social media sites, significantly bringing down recruitment costs.

Despite all this, there are risks associated with sensitive information being leaked through social media, limitations of only targeting younger age cohorts and to a certain degree there is loss of control of your content that is placed on social media.

These are real concerns and in all these cases, your social media representative needs to know how these situations should be professionally addressed. In relation to sensitive customer information or certain internal documents.

Despite its benefits do not to limit your marketing approach to just social media as you seek to ensure that your are getting exposure amongst a wider demographic. Lastly, to avoid a loss of control, financial brokers should take a fair, balanced and neutral tone in the content that they place (i.e. stay away from politics and religion).

Additionally, you have the means to block spam and inappropriate content and address criticisms swiftly left by clients.

Ultimately, this is a direction that your traders are moving into, and in order to stay in the game, you need to maximize your full potential in this new arena of client enegagement.