V4 Markets appears on FXCM/Global Brokerage list of subsidiaries

Is there a sign of new business life in the otherwise gloomy FXCM annual report?

FXCM Inc, which has been renamed as Global Brokerage Inc (NASDAQ:GLBR), has earlier today submitted a filing with the US Securities and Exchange Commission (SEC), providing its annual report for the year to the end of December 2016. In our previous report, we briefly enlisted the risks that the company is facing as it has a a heavy debt to repay, business to restructure, reputation to mend and regulatory moves to handle.

Now, let’s take a look at the structure of FXCM’s business. According to the latest 10-K report, as of December 31, 2016, FXCM Inc (now renamed to Global Brokerage Inc) had 31 subsidiaries. This compares with 35 subsidiaries a year before that. More interesting to us for the purposes of this article is not which companies were sold or closed, but rather whether there is anything new on the list. Perhaps you would not expect that, but there are some new developments.

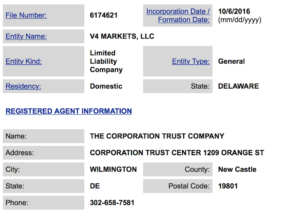

It turns out that there are two new entities right below V3 Markets which were not on the list a year ago. These two entities are V4 Markets, LLC (50.1% owned by Global Brokerage Inc) and V4 Operator LLC (50.1% owned by Global Brokerage Inc). Both companies are registered in Delaware – you can check the registration information obtained from State of Delaware, Department of State: Division of Corporations, below.

You can see that V4 Markets LLC was incorporated on October 6, 2016, whereas V4 Operator was incorporated on December 13, 2016.

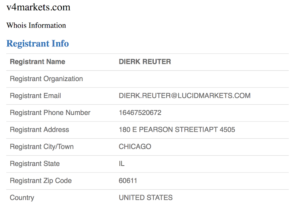

The website v4markets.com seems not to be active but domain information shows that the registrant name is Dierk Reuter (from Lucid Markets).

The NFA database shows that Mr Reuter was a principal of V3 Markets before the registration was withdrawn in January 2017.

V3 Markets is (was) a Chicago based proprietary trading firm. According to its website, the company’s business involves trading a diverse set of products on exchanges around the globe. V3 Markets got its National Futures Association registration as a floor trader firm in June 2014. The registration was withdrawn on January 6, 2017.

According to the 10-K report, that is, the annual report by FXCM Inc, or Global Brokerage Inc, V3 Markets is 50.1% owned by Global Brokerage Inc, as of December 31, 2016. FXCM’s holding in V3 is held for sale alike FXCM’s holdings in Lucid Markets and FastMatch, with the proceeds set to go for the repayment of the loan to Leucadia. As FinanceFeeds reported earlier, Global Brokerage has made some rather dismal predictions as to its abilities to meet its repayment obligations.

The appearance of the names of new companies is probably the sole positive sign in the report. Of course, we have yet to see whether these entities will commence operations and whether Mr Reuter is planning to continue the business line that V3 Markets was supposed to follow. Given the overall uncertain tone of the report, it is hard to make any rosy predictions about any of the subsidiaries.